What are Tax Credits? CPA Explains How Tax Credits Work (With Examples)

TLDRSherman, a CPA at Life Accounting, explains the concept of tax credits and their importance in saving money on taxes. He clarifies that tax credits are different from tax deductions, with the former directly reducing the tax amount owed, making them more effective. Sherman shares personal experience saving over $100,000 using tax credits and outlines various types of credits available, such as the Work Opportunity Tax Credit for hiring underrepresented groups, the Opportunity Zone Tax Credit for locating businesses in developing areas, and the Research and Development Tax Credit for innovation. For individuals, credits like the American Opportunity Tax Credit for education, Earned Income Tax Credit for low-income workers, and Child Tax Credit for reducing child poverty are highlighted. Sherman emphasizes that tax credits are not just for corporations but are also available to individuals at federal, state, and local levels, encouraging viewers to explore these opportunities for financial savings.

Takeaways

- 💼 **Understanding Tax Credits**: Sherman, a CPA, emphasizes the importance of understanding tax credits as they can significantly increase one's savings on taxes.

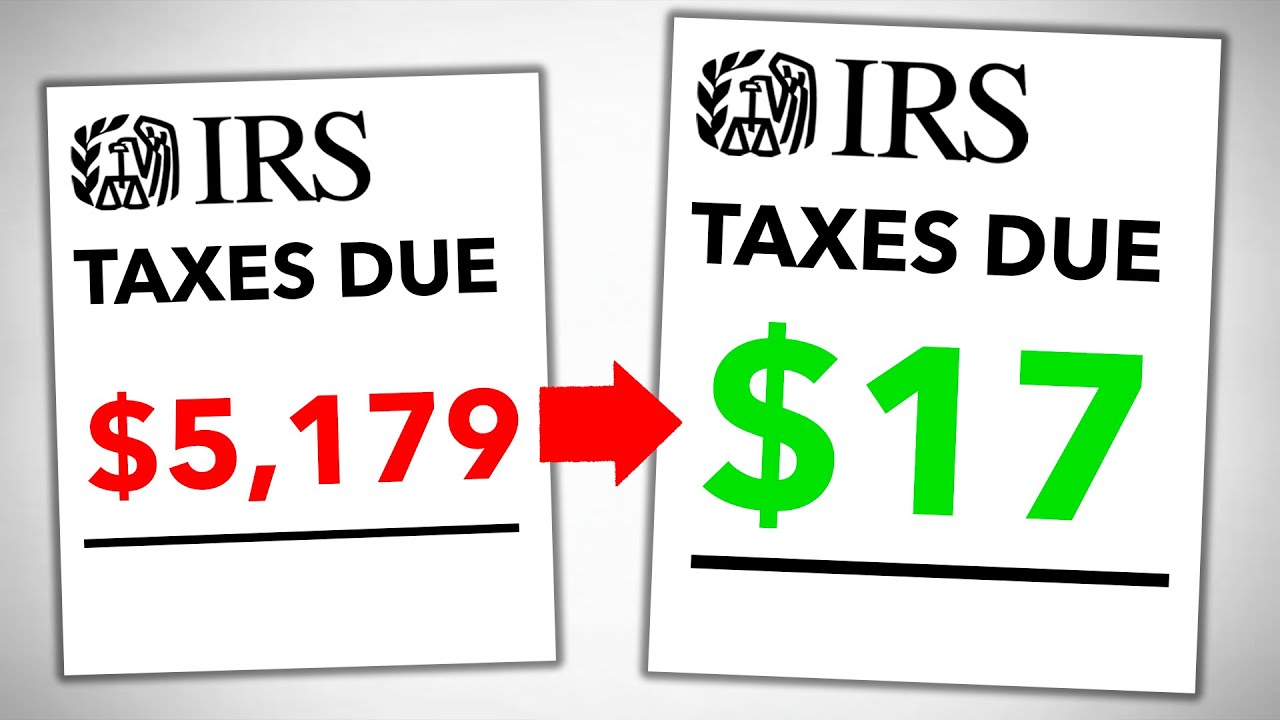

- 🚫 **Tax Credits vs. Deductions**: Tax credits are not the same as tax deductions. While deductions reduce taxable income, credits directly reduce the amount owed.

- 💰 **Effectiveness of Tax Credits**: Tax credits are three to four times more effective than tax deductions in saving money on tax bills.

- 🤑 **Personal Savings**: Sherman has saved over $100,000 in taxes by utilizing tax credits.

- 🏢 **Business Tax Credits**: There are various tax credits available for businesses, such as the Work Opportunity Tax Credit, Opportunity Zone Tax Credit, and Research and Development Tax Credit.

- 🌱 **Government Incentives**: Tax credits are used by the government to encourage certain behaviors, like hiring veterans or investing in developing areas.

- 📚 **Individual Tax Credits**: Individuals can benefit from credits like the American Opportunity Tax Credit for education, Earned Income Tax Credit for low-income workers, and Child Tax Credit for families.

- 🏠 **More Tax Credits**: There are additional tax credits for activities like home ownership, retirement account investments, and adoption.

- 📈 **State and Local Tax Credits**: Besides federal credits, there are state and local tax credits that can provide significant savings, as seen with companies like Amazon and Facebook.

- 🔍 **Finding Tax Credits**: Tax credits can be found on the IRS website for federal credits and through state or local economic development authorities.

- 📺 **Continued Learning**: Sherman encourages viewers to subscribe for more information on saving taxes and building wealth.

Q & A

What is the primary focus of the video?

-The video focuses on explaining what tax credits are, how they differ from tax deductions, and how they can be used to save money on taxes.

How does a tax credit differ from a tax deduction?

-A tax credit directly reduces the amount of taxes owed, while a tax deduction lowers the taxable income, thus reducing the tax liability indirectly.

Why are tax credits considered more effective than tax deductions?

-Tax credits are more effective because they provide a dollar-for-dollar reduction in tax liability, making them three to four times more potent than tax deductions.

What is an example of how tax credits can save money?

-If someone owes $100,000 in taxes and has $100,000 in tax credits, they would owe zero dollars in taxes, or if the credits are refundable, they could receive a refund.

What is the purpose of tax credits according to the government?

-Tax credits are used as incentives to accomplish political agendas, such as combating climate change, providing jobs, investing in developing areas, and increasing innovation.

What is the Work Opportunity Tax Credit?

-The Work Opportunity Tax Credit incentivizes business owners to hire individuals who have faced barriers to employment, such as veterans, people with disabilities, and ex-felons.

What is the Opportunity Zone Tax Credit?

-The Opportunity Zone Tax Credit encourages business owners to locate in developing areas, which can be beneficial for both the business and the community.

What is the Research and Development Tax Credit?

-The Research and Development Tax Credit is designed to help businesses increase innovation and efficiency by providing tax benefits for developing or improving business processes, techniques, formulas, or inventions.

What are some tax credits available for individuals?

-Individuals can benefit from tax credits such as the American Opportunity Tax Credit for higher education expenses, the Earned Income Tax Credit for low-income workers, and the Child Tax Credit for low to moderate-income families.

Where can one find more information on federal tax credits?

-Federal tax credits can be researched on the IRS's website, and state or local tax credits can be found through the economic development authority in one's state or city.

How has the speaker personally benefited from tax credits?

-The speaker has saved over one hundred thousand dollars in taxes over the years by utilizing tax credits, including the Opportunity Zone Tax Credit while working in downtown Atlanta.

What is the advice given for individuals looking to take advantage of tax credits?

-The advice is to look for tax credits that align with government initiatives, as there is likely at least one tax credit that an individual can leverage, and to check both federal, state, and local sources for available credits.

Outlines

💼 Understanding Tax Credits for Personal and Business Savings

Sherman, a CPA, introduces the concept of tax credits and emphasizes their importance in saving money on taxes. He shares his personal experience of saving over $100,000 using tax credits. Sherman clarifies the difference between tax credits and tax deductions, explaining that while both can save money, tax credits are more effective as they directly reduce the tax amount owed. He provides an example to illustrate the impact of tax deductions versus tax credits on one's tax liability. Sherman also discusses the rationale behind tax credits, which is to align with government initiatives, such as combating climate change through the electric vehicle tax credit.

🏢 Popular Tax Credits for Businesses and Individuals

The video continues with Sherman discussing various types of tax credits available for businesses and individuals. For businesses, he mentions the Work Opportunity Tax Credit, which encourages hiring individuals facing employment barriers, the Opportunity Zone Tax Credit for locating businesses in developing areas, and the Research and Development Tax Credit to foster innovation. Sherman shares his personal claim of the Opportunity Zone Tax Credit, which saved him over $100,000 in taxes. For individuals, he outlines credits like the American Opportunity Tax Credit for higher education expenses, the Earned Income Tax Credit for low-income workers, and the Child Tax Credit to reduce child poverty. Sherman highlights that these tax credits not only save taxpayers money but also serve to fulfill government objectives such as job creation and area development. He also mentions that there are additional tax credits available at the state and local levels, suggesting viewers check the IRS website and local economic development authorities for more information.

Mindmap

Keywords

💡Tax Credits

💡Tax Deductions

💡Work Opportunity Tax Credit

💡Opportunity Zone Tax Credit

💡Research and Development Tax Credit

💡American Opportunity Tax Credit

💡Earned Income Tax Credit

💡Child Tax Credit

💡Refundable Tax Credits

💡State and Local Tax Breaks

💡IRS

Highlights

Sherman, a CPA, explains how understanding tax credits can save you money on taxes.

Tax credits are different from tax deductions and are more effective at saving money on your tax bill.

Tax credits directly reduce the amount of taxes owed, unlike deductions which lower taxable income.

Sherman has personally saved over $100,000 in taxes using tax credits.

Tax credits are three to four times more effective than deductions for tax savings.

An example is given to illustrate the difference between tax deductions and credits in terms of tax savings.

The government uses tax credits as incentives to achieve political and social goals, such as combating climate change.

The electric vehicle tax credit is an example of a government initiative to reduce greenhouse gas emissions.

Different types of tax credits for businesses include the Work Opportunity Tax Credit, Opportunity Zone Tax Credit, and Research and Development Tax Credit.

Tax credits for individuals include the American Opportunity Tax Credit, Earned Income Tax Credit, and Child Tax Credit.

There are more tax credits available for activities like owning a home, investing in retirement accounts, or adopting a child.

State and local tax breaks are also available, with examples of Amazon and Facebook receiving substantial tax breaks.

Tax credits are not just for big corporations; individuals can also find and leverage tax credits to save on taxes.

Information on federal tax credits can be found on the IRS's website, and state or local tax credits through economic development authorities.

The importance of looking for and claiming tax credits to maximize savings on taxes is emphasized.

Sherman encourages viewers to subscribe for more tips on saving on taxes and building wealth.

Transcripts

Browse More Related Video

What are Tax Write-Offs? Tax Deductions Explained by a CPA!

9 HUGE Tax Write Offs for Individuals (EVERYONE can use these)

IRS Releases NEW Inflation Tax Brackets...What This Means For You in 2024!

How to AVOID Taxes... Legally (Do This Now)

The Basics of Tax Preparation

14 Biggest Tax Write Offs for Small Businesses! [What the Top 1% Write-Off]

5.0 / 5 (0 votes)

Thanks for rating: