What are Tax Write-Offs? Tax Deductions Explained by a CPA!

TLDRThe video script by Sherman, a CPA with Life Accounting, aims to educate viewers on the importance and mechanics of tax deductions. It emphasizes that over 2 million people overpay their income taxes annually due to a lack of understanding about deductions that could legally reduce their tax liability. Sherman explains that tax deductions are expenses considered ordinary and necessary for running a business, which can be subtracted from taxable income, thus lowering the adjusted gross income (AGI) and the tax liability. The script clarifies the difference between tax deductions and tax credits, noting that the former reduces taxable income while the latter directly reduces the tax owed. To maximize tax deductions, Sherman advises viewers to maintain a separate business bank account, keep accurate bookkeeping, and retain proper documentation for all expenses. The video also dispels the misconception that tax deductions directly reduce the amount owed to the IRS, instead of the taxable income. By following Sherman's advice, business owners can ensure they are taking full advantage of available tax deductions to save significantly on taxes.

Takeaways

- 💼 **Understanding Tax Deductions**: Tax deductions are eligible expenses that can be deducted from your income to lower your tax liability legally.

- 📊 **Standard Deduction**: Every taxpayer gets a standard deduction, which is a set amount that reduces taxable income, depending on filing status.

- 📋 **Separate Business and Personal Finances**: Use a business bank account to keep personal and business expenses separate, which is crucial for tax deductions and audits.

- 💡 **Bookkeeping**: Proper bookkeeping is essential to organize and categorize business expenses, making it easier to identify eligible tax deductions.

- 📝 **Documentation**: Retain all documentation for business expenses to provide proof in case of an IRS audit.

- 🚗 **Ordinary and Necessary Expenses**: The IRS allows deductions for business expenses that are both ordinary (common in the industry) and necessary (helpful and appropriate) for running the business.

- 🔍 **Taxable Income vs. Tax Liability**: Taxable income is the amount subject to tax, while tax liability is the amount of tax owed; deductions reduce taxable income, not the tax liability.

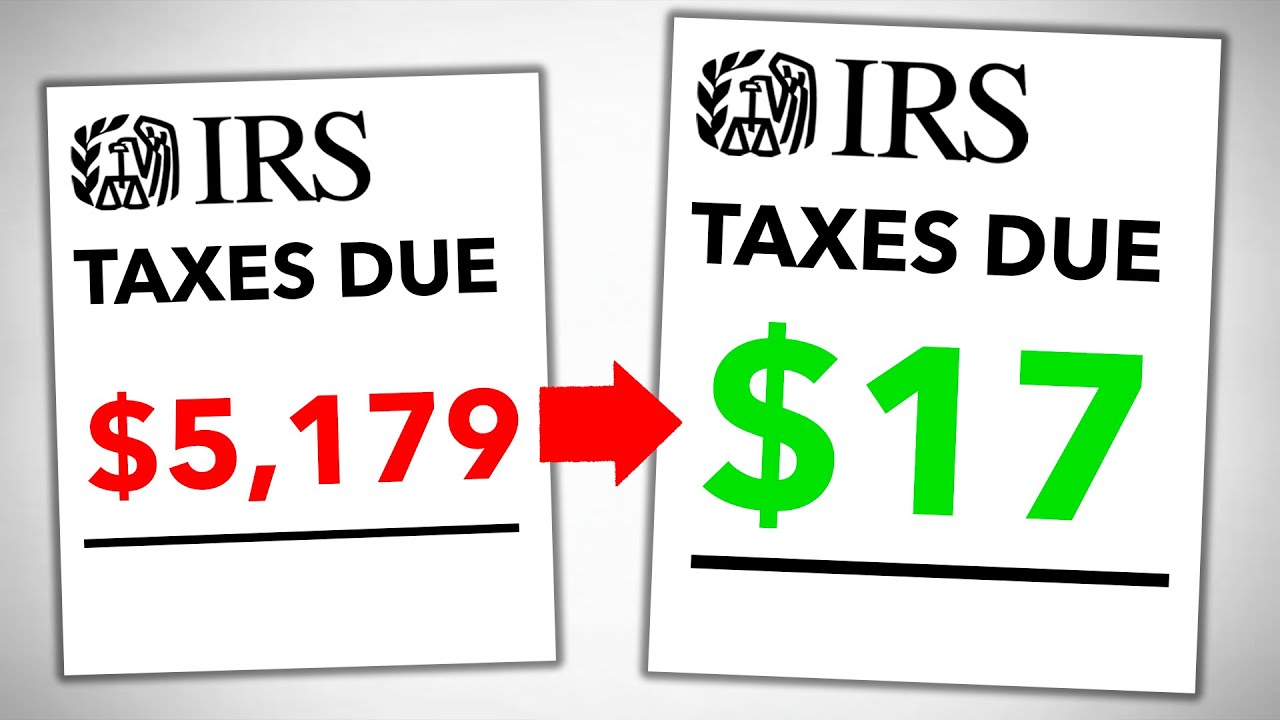

- 💰 **Tax Credits vs. Deductions**: Tax credits directly reduce the tax liability, unlike deductions which lower taxable income. Credits are dollar-for-dollar reductions.

- 🏠 **Home Office Deduction**: Business owners can write off expenses for a home office used exclusively for business purposes.

- 📱 **Technology and Equipment**: Expenses for technology, cell phones, and other business-related equipment are often deductible.

- 🚨 **Mileage and Interest**: Business mileage and interest expenses, such as those related to business loans, can also be deductible.

Q & A

Why do people often overpay on their income taxes?

-People often overpay on their income taxes because they are unaware of the tax deductions they are eligible for, which can legally lower their tax liability.

What is the purpose of the standard deduction in the tax system?

-The standard deduction is a fixed amount that every taxpayer can subtract from their income before it is taxed, reducing their taxable income and potentially their tax liability.

What are the two main characteristics of a deductible business expense?

-A deductible business expense must be both ordinary, meaning it is common and accepted in the industry, and necessary, meaning it is helpful and appropriate for running the business.

How do tax deductions work in relation to taxable income and tax liability?

-Tax deductions reduce taxable income by allowing eligible expenses to be subtracted from the total income. This adjusted gross income is then used to calculate tax liability, which is the amount of tax owed.

What is the difference between tax deductions and tax credits?

-Tax deductions reduce taxable income, which in turn may lower the overall tax liability. Tax credits, on the other hand, are dollar-for-dollar reductions in the amount of tax owed after the tax liability has been determined.

Why is it important to separate personal and business expenses?

-Separating personal and business expenses helps maintain clear records, simplifies the tax filing process, and provides an audit trail that can be presented during an IRS audit if necessary.

How can a business owner ensure they are taking advantage of all available tax deductions?

-A business owner can ensure they are taking advantage of all tax deductions by maintaining proper documentation, keeping business finances separate from personal finances, and organizing expenses in a way that makes them easy to categorize and identify as eligible deductions.

What is the role of an IRS audit in the context of tax deductions?

-An IRS audit is a review process to ensure taxpayers are complying with tax laws and regulations. It is not a reason to avoid claiming valid tax deductions, but rather an incentive to keep accurate records and documentation.

What are some common types of tax deductions that small businesses can claim?

-Small businesses can claim a variety of tax deductions, including expenses for a home office, technology, cell phones, business mileage, and interest expenses.

Why is it beneficial to have a business bank account for tax deductions?

-Having a business bank account allows for clear separation of business and personal transactions, which aids in accurate record-keeping and simplifies the process of identifying and claiming tax deductions.

What are the steps to properly write off business expenses as tax deductions?

-The steps include having a separate business bank account, maintaining proper bookkeeping with categorized expenses, and retaining proper documentation for all expenses to be written off.

What is the significance of the adjusted gross income (AGI) in the context of tax deductions?

-The AGI is the amount of income remaining after eligible tax deductions have been subtracted from the total income. It is the figure reported to the IRS and is used to calculate the final tax liability.

Outlines

📚 Understanding Tax Deductions for Small Business Owners

The first paragraph introduces the importance of tax deductions, emphasizing that many people overpay their income taxes due to a lack of knowledge about available deductions. The speaker, a CPA, explains that tax deductions can legally reduce tax liability and shares a personal example of a client who missed out on significant deductions. The video aims to educate viewers on tax deductions, starting with a basic explanation of the tax system, the standard deduction, and moving on to itemized and business tax deductions. The CPA also encourages viewers to subscribe for future tax-related content and to engage with the video by liking it.

🧮 How Tax Deductions Work and Their Impact on Your Tax Liability

The second paragraph delves into the mechanics of tax deductions, explaining that they are ordinary and necessary expenses that can be subtracted from taxable income. It clarifies that not all business expenses are deductible, only those accepted as ordinary and necessary by the IRS. The paragraph also distinguishes between tax deductions and tax credits, noting that deductions reduce taxable income while credits reduce the actual tax owed. The speaker outlines steps to take advantage of tax deductions, including maintaining a separate business bank account, keeping organized financial records, and retaining proper documentation for all expenses. The importance of compliance with IRS regulations is highlighted, and the speaker reassures viewers that audits are a normal part of ensuring compliance.

🏦 Maximizing Tax Deductions and Ensuring Compliance

The third paragraph recaps the key points of the video, focusing on the definition of tax deductions as eligible expenses that can be deducted from income for tax purposes. It reiterates that tax deductions are applied to taxable income, not the tax liability, and contrasts them with tax credits, which provide direct reductions in the amount of tax owed. The speaker encourages viewers to subscribe to the channel for more content on tax savings and to like the video if they found it helpful. The video concludes with a reminder of the potential for significant tax savings through deductions and an invitation to learn more about the topic.

Mindmap

Keywords

💡Tax Deductions

💡Tax Liability

💡Standard Deduction

💡Ordinary and Necessary

💡Taxable Income

💡Adjusted Gross Income (AGI)

💡Tax Credits

💡Business Bank Account

💡Bookkeeping

💡Documentation

💡Tax Audit

Highlights

Over 2 million people overpay on their income taxes annually due to missing out on tax deductions.

A client with over $500,000 in revenue paid taxes on the full amount without realizing they had missed out on $250,000 in eligible tax deductions.

Many business owners are unaware of what tax deductions are, often requiring a CPA license or a master's degree in accounting to understand.

The presenter, Sherman, is a CPA with Life Accounting, offering a full-service accounting firm for small businesses.

The standard deduction is a common tax deduction that everyone gets when filing their taxes, reducing taxable income.

Tax deductions are eligible expenses that can be deducted from income for tax purposes, specifically for businesses.

Ordinary and necessary expenses are the criteria set by the IRS for what can be deducted as a business expense.

Tax deductions lower tax liability by reducing taxable income, not the tax liability owed directly.

Tax credits are different from tax deductions; they are dollar-for-dollar reductions in the taxes owed after tax liability is determined.

Having a separate business bank account is crucial for distinguishing personal from business expenses.

Proper bookkeeping and categorization of expenses are essential for tax time and maximizing deductions.

Retaining proper documentation for all business expenses is vital for potential IRS audits.

Tax deductions can include a wide range of expenses such as home office, technology, cell phone, business mileage, and interest expenses.

The presenter encourages subscribing to the channel for future content on saving on taxes and the biggest tax write-offs for small businesses.

Tax deductions are applied to taxable income, not the tax liability, which is a common misconception.

The video provides a comprehensive explanation of tax deductions to help business owners avoid missing out on potential savings.

The presenter emphasizes the importance of understanding tax deductions to legally lower tax liability.

Transcripts

Browse More Related Video

14 Biggest Tax Write Offs for Small Businesses! [What the Top 1% Write-Off]

What are Tax Credits? CPA Explains How Tax Credits Work (With Examples)

Adjusted Gross Income, Explained in Four Minutes | WSJ

How to AVOID Taxes... Legally (Do This Now)

How to File Tax Returns as an international student | Tax Refund 2022

IRS Releases NEW Inflation Tax Brackets...What This Means For You in 2024!

5.0 / 5 (0 votes)

Thanks for rating: