Black Scholes Formula I

TLDRThis lecture concludes a course by introducing the world of finance, focusing on the Black-Scholes formula for option pricing. It explains the concept of options as financial derivatives and the importance of understanding Brownian motion. The lecture outlines the prerequisites for finance and discusses the risks and uses of options, emphasizing that they are primarily for cash-rich entities. It also introduces the idea of a complete market, free of arbitrage, and the use of Ito-Doeblin formula, setting the stage for deriving the Black-Scholes equation in the subsequent lecture.

Takeaways

- 🎓 The course is concluding with an introduction to the world of finance, emphasizing the importance of understanding concepts like Brownian motion for those interested in finance.

- 📚 The lectures are designed to be accessible, gradually building up to more complex topics such as the Black-Scholes formula, which is a keystone in financial mathematics.

- 📈 The script discusses the concept of financial derivatives, particularly options, which are secondary financial instruments whose value is derived from an underlying primary instrument, such as a stock.

- 🚫 A caution is given against the use of options by individuals without substantial financial resources, as most options traded are not realized and are tools used by large corporations and wealthy speculators.

- 🤔 The importance of understanding the Black-Scholes equation is highlighted, as it is fundamental for anyone involved in finance, especially for pricing options.

- 💰 The script explains the option contract, where an individual can agree to buy a stock at a fixed price (strike price) at a future time, without the obligation to do so, depending on the market price.

- 🔄 The concept of hedging is introduced, where the seller of an option uses the premium received to create a portfolio that can offset potential losses from the option contract.

- 💡 The idea of a 'complete market' is discussed, where one can always hedge their risk, and the market is free from arbitrage opportunities, which is an essential assumption for the Black-Scholes model.

- 🧩 The script touches on the complexity of financial markets and the simplifications made in the Black-Scholes model, such as assuming a constant interest rate and a market with no arbitrage.

- 📉 The role of risk-neutral pricing in the Black-Scholes formula is mentioned, which simplifies the pricing of options by assuming that the stock and bond grow at the same rate, ignoring the actual risks involved.

- 🔍 The final takeaway is an anticipation of the next lecture, where the derivation of the Black-Scholes differential equation will be discussed, providing a mathematical framework for option pricing.

Q & A

What is the main purpose of the last two lectures in the course?

-The main purpose of the last two lectures is to introduce the students to the world of finance and to serve as a stepping stone towards a more in-depth study of finance, particularly focusing on concepts like the Black-Scholes formula.

Why is Brownian motion important in the context of this course?

-Brownian motion is important because it is a fundamental concept in financial mathematics, particularly in the pricing of options and other financial derivatives, which is a key topic in the course.

What is the Black-Scholes equation and why is it significant?

-The Black-Scholes equation is a partial differential equation that describes the price of a financial derivative, such as an option, over time. It is significant because it provides a theoretical model for pricing options, which is a central theme in financial mathematics.

What is the basic concept of a financial derivative like an option?

-A financial derivative, like an option, is an instrument whose price depends on the price of an underlying primary instrument, such as a stock. The option gives the holder the right, but not the obligation, to buy or sell the stock at a predetermined price (the strike price) on or before a certain date.

Why should someone with not a great amount of money avoid using options?

-Options are complex financial instruments that carry a high level of risk. They are typically used by big companies and cash-rich speculators who can afford to take on that risk. Individuals with limited funds should avoid options due to the potential for significant financial loss.

What is the strike price in the context of an option contract?

-The strike price, denoted as 'K' in the script, is the predetermined price at which the holder of the option can buy or sell the underlying stock, according to the terms of the option contract.

What is the expiration time in an option contract?

-The expiration time, denoted as 'T' in the script, is the date by which the holder of the option can exercise their right to buy or sell the underlying stock, as per the terms of the option contract.

What is the option price, and why is it important?

-The option price is the premium paid by the buyer to the seller to enter into the option contract. It is important because it represents the upfront cost of acquiring the right to buy or sell the underlying asset at the strike price.

What is the concept of arbitrage in finance?

-Arbitrage is the practice of taking advantage of a price difference between two or more markets to make a profit without risk. It involves buying and selling the same asset in different markets to exploit the price discrepancy.

What does it mean for a market to be 'free of arbitrage'?

-A market is considered 'free of arbitrage' when there are no opportunities to make a risk-free profit by exploiting price differences of the same asset in different markets, implying that prices are in equilibrium and reflect fair value.

Outlines

📈 Introduction to Finance and the Course Overview

In this final lecture, the course transitions to the world of finance, particularly focusing on the foundational concepts and the significance of the Black-Scholes formula. The lecturer emphasizes the stepwise approach to learning finance, highlighting the necessity of understanding concepts like Brownian motion and the importance of financial derivatives such as options. The introduction also touches on the inherent risks of stock trading and the basic mechanics of option contracts.

💼 Detailed Explanation of Options and Contracts

This section delves into the specifics of option contracts, explaining the concept of strike prices and the nature of call options. The lecturer describes how options allow traders to speculate on stock prices without the obligation to execute the trade if conditions are unfavorable. The narrative includes scenarios where the buyer benefits or avoids loss, and the rationale behind the premium paid for entering an option contract.

🔍 Understanding the Valuation of Options

The focus here is on the valuation of options and the conditions under which options are exercised. The lecturer explains the calculation of the option's worth based on stock prices at expiration. The concept of a complete market, where traders can hedge their risks effectively, is introduced. The discussion also covers the role of arbitrage in maintaining market balance and the theoretical foundations of option pricing.

🏦 Theoretical Market Conditions for Option Pricing

This segment elaborates on the assumptions necessary for the Black-Scholes formula to work, such as the absence of arbitrage and the completeness of the market. The lecturer gives examples of arbitrage opportunities and how they quickly disappear in real markets. The idea of a complete market, where all risks can be hedged, is discussed in detail, along with the limitations of these theoretical models in practical scenarios.

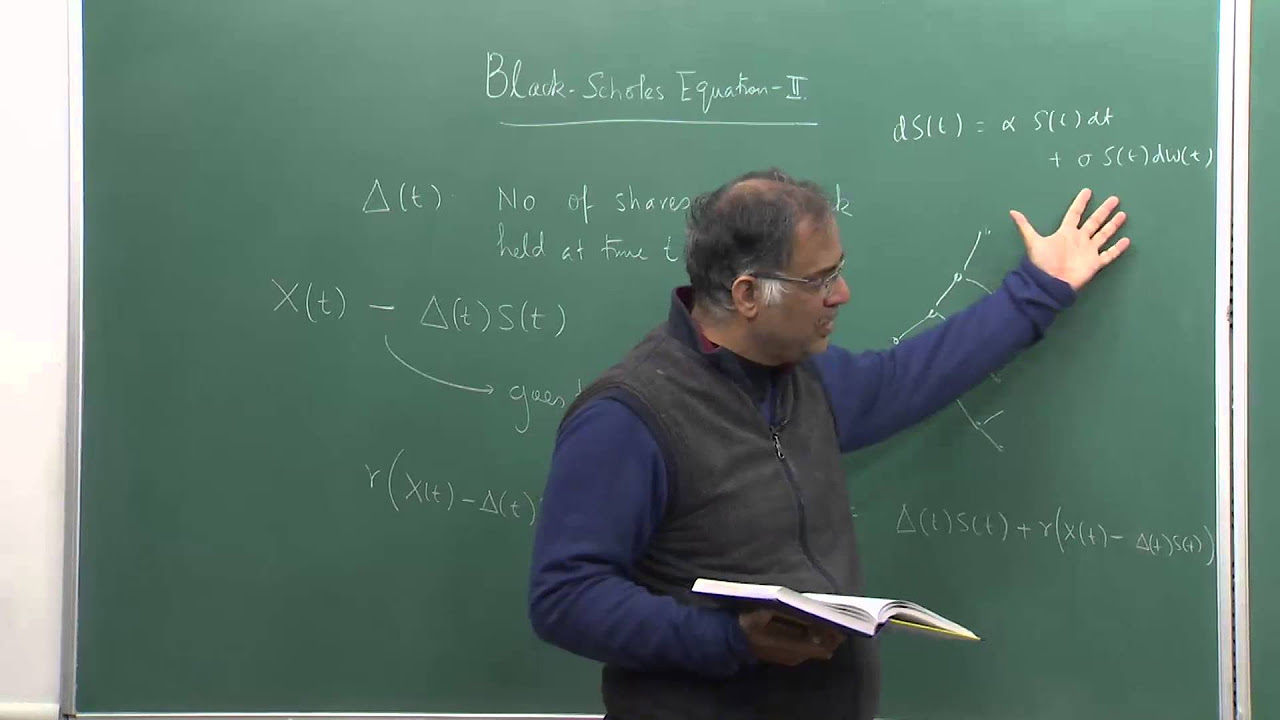

📉 The Black-Scholes Differential Equation

The lecturer outlines the differential equations that govern stock prices and the basic principles of the Black-Scholes model. Key terms like drift and volatility (sigma) are explained, and the process of using initial investments to trade in the market is described. The aim is to match the portfolio value to the option price, taking into account the fixed interest rates assumed in the model.

💹 Discounted Price and Risk Neutral Pricing

This part covers the concept of discounted prices for fixed deposits and stocks. The lecturer explains the exponential growth of investments over time and introduces the idea of risk-neutral pricing, where investments in stocks and bonds are treated with the same growth rate. The goal is to simplify the complex reality of market dynamics to make the pricing of options more understandable.

📊 Conclusion and Transition to Future Lectures

The final section hints at the next steps, including the derivation of the Black-Scholes differential equation and the actual computation of option prices. The lecturer emphasizes the importance of understanding the continuous nature of the option pricing function and previews the detailed finance course that will follow, which will delve deeper into both mathematical and financial aspects.

Mindmap

Keywords

💡Finance

💡Brownian Motion

💡Black-Scholes Formula

💡Option

💡Call Option

💡Strike Price

💡Premium

💡Arbitrage

💡Risk-Neutral Pricing

💡Hedging

💡Ito-Doeblin Formula

Highlights

Introduction to the world of finance through the last two lectures of the course.

The importance of understanding Brownian motion for those interested in finance.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: