The Trillion Dollar Equation

TLDRThe video script explores the impact of mathematical models on finance, particularly the use of physics and mathematics in understanding and predicting market behaviors. It highlights the success of Jim Simons' Medallion fund, which used complex algorithms to achieve extraordinary returns. The script also delves into the history of options trading and the development of the Black-Scholes-Merton model, which revolutionized the pricing of derivatives. The narrative contrasts the approaches of Isaac Newton and Louis Bachelier, illustrating the evolution of financial modeling and its profound influence on global markets.

Takeaways

- 📈 The development and application of mathematical models in finance, originating from physics, have led to the creation of multi-trillion dollar industries focused on derivatives and risk management.

- 🎲 The success of individuals like Jim Simons, who utilized mathematical and scientific principles to beat the stock market, highlights the importance of non-traditional approaches in finance.

- 📚 Louis Bachelier's work on option pricing and the random walk theory laid the foundation for modern financial mathematics, despite initially being overlooked by both the physics and finance communities.

- 🔄 The concept of the random walk, which models stock prices as unpredictable movements like a ball through a Galton board, is central to the efficient market hypothesis and the pricing of options.

- 💡 Einstein's explanation of Brownian motion as evidence of atomic and molecular existence is directly related to the mathematics of the random walk, which Bachelier had discovered five years earlier.

- 🎩 Ed Thorpe's application of card counting in blackjack and his later success in the stock market with dynamic hedging exemplify the transfer of skills from one domain to another.

- 📈 The Black-Scholes-Merton model revolutionized the finance industry by providing a precise formula for option pricing, leading to the rapid growth of options and derivatives markets.

- 🚀 The Chicago Board Options Exchange's establishment coincided with the publication of the Black-Scholes-Merton equation, facilitating the widespread adoption of options trading.

- 🌐 Derivatives markets, which include options, credit default swaps, and securitized debt, are estimated to be worth several hundred trillion dollars, significantly larger than the underlying assets they are based on.

- ⚖️ The impact of physicists and mathematicians on finance extends beyond personal wealth accumulation; their work has provided insights into risk management and market efficiency.

- 🔮 The pursuit of discovering patterns in the stock market could ultimately lead to a perfectly efficient market where all price movements are random, assuming all patterns are known and accounted for.

Q & A

What is the significance of the single equation mentioned in the transcript?

-The single equation mentioned is foundational to the understanding and pricing of derivatives, which has led to the creation of multi-trillion dollar industries and transformed the approach to managing risk.

How did Jim Simons contribute to the field of finance?

-Jim Simons set up the Medallion Investment Fund, which utilized mathematical models and data-driven strategies to deliver exceptionally high returns, making him the richest mathematician of all time and demonstrating the power of mathematical approaches in finance.

What was Isaac Newton's experience with the South Sea Company?

-Isaac Newton initially doubled his investment in the South Sea Company but lost about a third of his wealth after buying back in at the peak and continuing to buy as the price fell, illustrating the unpredictability of markets.

Who was Louis Bachelier and how did he contribute to finance?

-Louis Bachelier was a mathematician who pioneered the use of mathematics to model financial markets. He proposed the concept of the random walk to describe stock price movements and developed a method for pricing options, which was a significant advancement in financial theory.

What is the Efficient Market Hypothesis?

-The Efficient Market Hypothesis suggests that it is impossible to consistently achieve higher returns than the average market return on a risk-adjusted basis, as all available information is already reflected in asset prices.

How did Ed Thorpe revolutionize the stock market?

-Ed Thorpe revolutionized the stock market by applying his card counting skills to financial trading, pioneering a type of hedging known as dynamic hedging, which allowed him to make significant profits with minimal risk.

What is dynamic hedging and how does it work?

-Dynamic hedging is a strategy that involves adjusting the holdings of an investment portfolio in response to changes in the price of the underlying asset to minimize risk. It involves owning an asset to offset the risk of an option sold, thus allowing for profit with minimal risk from price fluctuations.

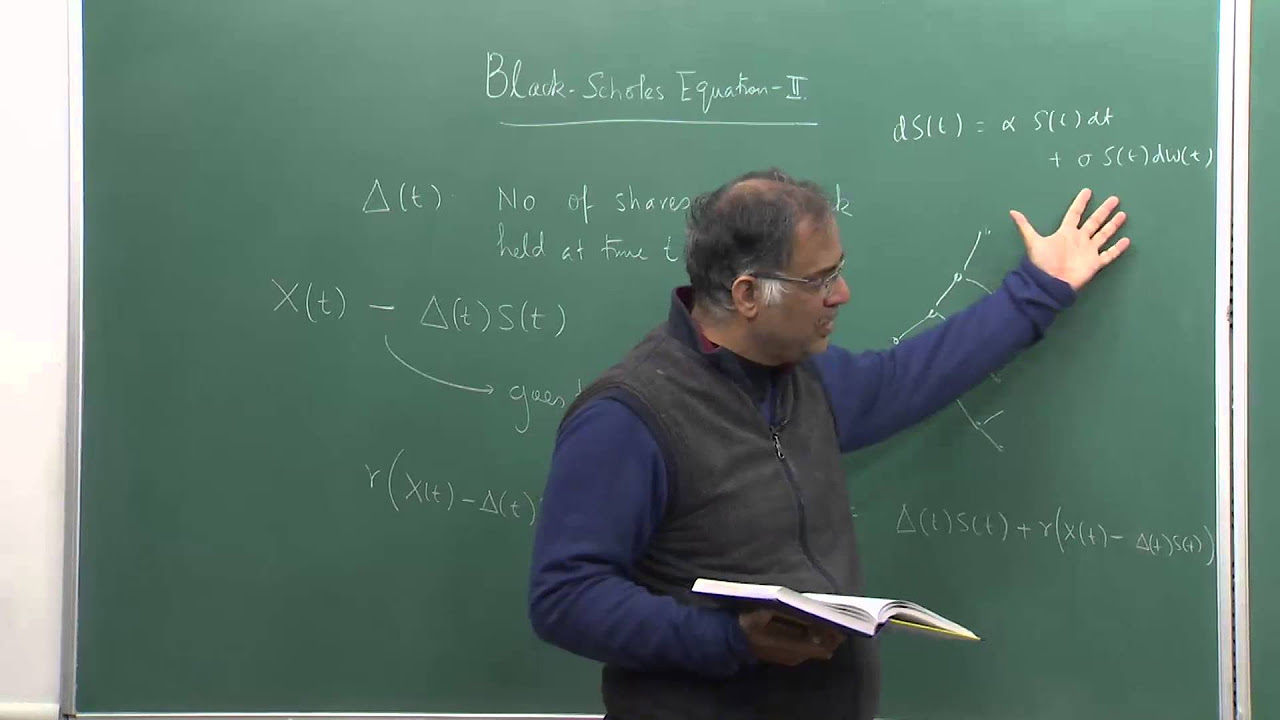

What was the Black-Scholes-Merton model and its impact on finance?

-The Black-Scholes-Merton model is a mathematical model used to price options and other derivatives. It introduced a formula that provides an explicit expression for the price of an option, which has been widely adopted in the finance industry and has led to the growth of multi-trillion dollar markets for derivatives.

How did the discovery of Brownian motion and the random walk theory contribute to finance?

-The discovery of Brownian motion and the random walk theory provided a mathematical framework for understanding the random movements of particles and, by extension, the fluctuations in stock prices. This insight underpinned the development of models like Bachelier's and the Black-Scholes-Merton model, which are crucial for pricing derivatives and understanding market behavior.

What is the Medallion fund's strategy?

-The Medallion fund, managed by Renaissance Technologies, uses sophisticated mathematical models and algorithms, including hidden Markov models, to find patterns and make predictions in the stock market, leading to exceptional returns.

How do physicists and mathematicians contribute to the field of finance?

-Physicists and mathematicians contribute to finance by applying their expertise in complex mathematical models and data analysis to understand market dynamics, identify inefficiencies, and develop strategies for trading and risk management, often leading to significant advancements in financial theory and practice.

Outlines

📈 The Impact of Physics on Finance

This paragraph discusses the profound influence of physics and mathematics on the financial industry, particularly in the realm of derivatives. It highlights the story of Jim Simons, a mathematician who founded the highly successful Medallion Investment Fund, which outperformed the market significantly for 30 years. The narrative contrasts Simons' success with Isaac Newton's financial misfortunes, emphasizing the importance of mathematical models in predicting market behavior. It also introduces Louis Bachelier, the pioneer in using mathematical models to understand and price financial options, drawing parallels between the random walk of stock prices and the random motion of particles, known as Brownian motion.

📊 Options Trading: Profits and Losses

This paragraph delves into the mechanics of options trading, explaining the concept of call and put options, and how they function as financial instruments. It outlines the profit and loss potential of options, highlighting the advantages of limited downside risk, leverage, and hedging capabilities. The paragraph also discusses the historical challenge of pricing options accurately and how Bachelier's random walk model provided a mathematical framework for option pricing, which was later improved upon by others like Ed Thorpe and the creators of the Black-Scholes-Merton model.

🔄 The Random Walk and Brownian Motion

This paragraph explores the concept of the random walk, which underpins the idea that stock prices move unpredictably, much like a ball through a Galton board. It connects this financial model to the physical phenomenon of Brownian motion, where particles move randomly in a fluid. The paragraph discusses how Einstein's work on Brownian motion provided evidence for the existence of atoms and molecules, and how Bachelier's application of the random walk to finance predated Einstein's work. It also touches on how these mathematical models have applications beyond finance, influencing various fields including physics.

💡 Innovations in Option Pricing

This paragraph focuses on the evolution of option pricing models, from Bachelier's initial model to the more sophisticated Black-Scholes-Merton model. It discusses how Ed Thorpe improved upon Bachelier's model by incorporating the drift of stock prices, which reflects the trend of a stock's upward or downward movement over time. The paragraph then describes the groundbreaking work of Fischer Black, Myron Scholes, and Robert Merton, who developed a formula that allows for the explicit calculation of option prices, leading to a revolution in financial markets and the creation of a multi-trillion-dollar industry.

🚀 The Expansion of Derivatives Markets

This paragraph examines the growth of the derivatives markets following the publication of the Black-Scholes-Merton model. It discusses the establishment of the Chicago Board Options Exchange and the rapid adoption of the new option pricing formula by Wall Street. The paragraph also explores the broader implications of the model for various financial instruments and markets, including credit default swaps, securitized debt, and the overall global economy. It highlights the ability of the Black-Scholes-Merton equation to hedge against risks and provide leverage, as well as its impact on market stability during periods of stress.

🌐 The Quest for Market Efficiency

The final paragraph discusses the quest for market efficiency and the role of mathematicians and physicists in this pursuit. It emphasizes the achievements of Jim Simons and his Renaissance Technologies in using advanced mathematical models and machine learning to find patterns in the stock market, leading to the creation of the highly successful Medallion Fund. The paragraph also touches on the debate around the efficient market hypothesis and the potential for a perfectly efficient market where all price movements are truly random, suggesting that the discovery of all market patterns could lead to such a scenario.

Mindmap

Keywords

💡Derivatives

💡Random Walk

💡Efficient Market Hypothesis

💡Option Pricing

💡Dynamic Hedging

💡Black-Scholes-Merton Model

💡Jim Simons

💡Hidden Markov Models

💡Risk Management

💡Market Inefficiencies

Highlights

A single equation from physics has led to the creation of four multi-trillion dollar industries and changed the approach to risk.

The equation originates from understanding atomic structure, heat transfer, and even strategies to win at blackjack.

Physicists, scientists, and mathematicians, not traditional traders, have been some of the most successful in beating the stock market.

Jim Simons, a mathematics professor, established the Medallion Investment Fund in 1988, which returned 66% per year for 30 years.

Isaac Newton, despite his mathematical prowess, lost a third of his wealth in the South Sea Company stock due to market unpredictability.

Louis Bachelier, a physicist, was the pioneer in using math to model financial markets, leading to significant advancements in option pricing.

Thales of Miletus is credited with the first known use of options in 600 BC to secure the right to rent olive presses for a future harvest.

Options provide three key benefits: limiting downside risk, providing leverage, and acting as a hedge against potential losses.

Bachelier proposed that stock prices follow a random walk, similar to a ball passing through a Galton board, leading to a normal distribution over time.

The Efficient Market Hypothesis suggests that it is impossible to make money by trading due to the rapid absorption of new information into prices.

Einstein's explanation of Brownian motion provided definitive evidence for the existence of atoms and molecules, unknowingly aligning with Bachelier's financial theories.

Bachelier's pricing model for options was overlooked by both the physics and finance communities, despite its groundbreaking nature.

Ed Thorpe's card counting strategy in blackjack and subsequent success in the stock market demonstrated the application of mathematical models to gambling and finance.

The Black-Scholes-Merton model introduced a new approach to pricing options, considering both the random walk and the drift of stock prices.

The Black-Scholes-Merton equation provided an explicit formula for option pricing, leading to rapid adoption by Wall Street and the expansion of the options market.

Derivatives markets, based on the principles of option pricing, are estimated to be worth several hundred trillion dollars globally.

The impact of physicists and mathematicians on finance extends beyond personal wealth, influencing risk management and market efficiency through their models.

Jim Simons' Medallion Fund utilized machine learning and data-driven strategies to achieve unprecedented returns, challenging the efficient market hypothesis.

The discovery and application of patterns in the stock market by mathematicians and physicists have led to the creation of new markets and improved pricing of financial instruments.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: