Ito Integrals in Higher Dimension

TLDRThis lecture delves into the applications of Ito's calculus in finance, focusing on modeling financial processes as Ito processes. It introduces the concept of geometric Brownian motion to represent stock prices, ensuring non-negativity through exponential functions. The instructor demonstrates how to apply Ito's formula to derive the stochastic differential equation for asset prices, showcasing the power of Ito calculus in finance. The lecture also touches on Ito integrals, martingales, and the concept of interest rates, setting the stage for further exploration of financial models.

Takeaways

- 📚 This lecture focuses on the applications of Ito's calculus in finance.

- 📈 Expressing financial processes as Ito processes is crucial for leveraging the power of Ito calculus.

- 🔍 Modeling stock prices as Ito processes involves stochastic differential equations (SDEs) with drift and volatility terms.

- 🔀 Brownian motion alone isn't suitable for modeling stock prices due to the need to keep prices non-negative, leading to the concept of geometric Brownian motion.

- ⚙️ Geometric Brownian motion ensures that stock prices remain non-negative by incorporating an exponential term.

- 🧩 The Ito process can be written in SDE form, with the coefficient of the dt term as the drift term and the coefficient of the dWt term as the volatility term.

- 💡 The quadratic variation of an Ito process is crucial in understanding the behavior of financial processes.

- 🔢 By applying Ito’s formula, we can derive that geometric Brownian motion satisfies a specific SDE used for modeling stock prices.

- 📊 The stochastic differential equation followed by a price process involves both drift and volatility terms, showcasing the utility of Ito calculus in finance.

- 🔄 Future lectures will cover more applications, including the derivation of the Black-Scholes equation for pricing European call options and modeling interest rates as Ito processes.

Q & A

What is the primary focus of the last week of the course?

-The primary focus of the last week of the course is on the applications of Ito's calculus, particularly in the context of financial processes.

Why is it important to express financial processes as Ito processes?

-Expressing financial processes as Ito processes allows for the application of Ito calculus to draw conclusions and make predictions in finance, leveraging the mathematical properties of stochastic differential equations.

How does Ito calculus differ from standard calculus?

-Ito calculus differs from standard calculus by incorporating stochastic processes, which allows it to handle random variables and their distributions over time.

Outlines

📚 Introduction to Ito's Calculus Applications

The script begins by introducing the final week of a course focused on the applications of Ito's calculus in finance. It emphasizes the importance of expressing financial processes as Ito processes, which involves stochastic differential equations (SDEs) with drift and volatility terms. The concept of geometric Brownian motion is introduced as a model for stock price movements, ensuring non-negativity of prices. The lecturer aims to demonstrate that stock prices can be modeled as an Ito process, which is a prerequisite for applying Ito calculus in financial analysis.

📈 Constructing the Ito Process for Stock Prices

This paragraph delves into the construction of an Ito process to model stock prices. The lecturer defines an Ito process with constant volatility (σ) and drift (α), and then translates this into a stochastic differential equation (SDE) form. The quadratic variation of the process is discussed, highlighting the path independence and the guarantee that stock prices remain non-negative due to the exponential function. The asset price is defined in terms of this Ito process, with the aim of showing that it satisfies the geometric Brownian motion, an essential step in applying Ito calculus to finance.

🧑🏫 Applying Ito's Formula to Asset Pricing

The lecturer applies Ito's formula to derive the stochastic differential equation (SDE) that the asset price, modeled as geometric Brownian motion, follows. By defining a function 'f' in terms of the Ito process 'Xt', the formula is used to express the change in asset price 'dSt' in terms of the volatility and drift components. The resulting SDE confirms that the geometric Brownian motion is indeed an Ito process, which is crucial for financial modeling and analysis.

📉 Geometric Brownian Motion and Its SDE

This section confirms that the geometric Brownian motion, which models the price process of an asset, follows a specific stochastic differential equation (SDE). The SDE includes a drift term (αSt dt) and a volatility term (σSt dWt), which are key components in financial modeling. The lecturer explains how the application of Ito's calculus leads to this conclusion, which is widely used in finance for modeling stock price movements.

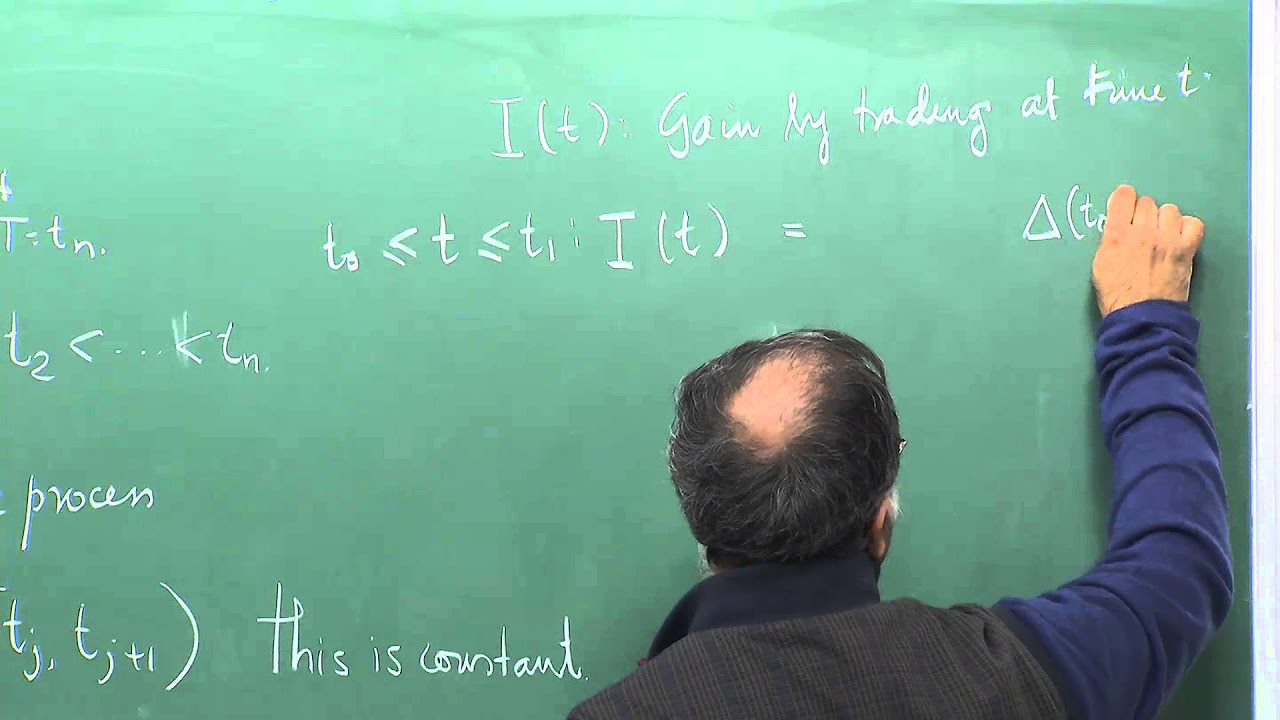

🧬 Ito Integral and Its Properties

The script moves on to discuss the Ito integral, emphasizing its properties as a martingale, which means that its expected value remains constant over time. The lecturer explains that the mean of an Ito integral is zero, and introduces the Ito isometry formula to calculate the variance of the Ito integral. These concepts are foundational for further applications in finance, such as modeling interest rates.

🏦 Basics of Interest Rates and Instantaneous Rates

The final paragraph introduces the concept of interest rates, explaining how they function in banking and investment contexts. The讲师 discusses the difference between fixed rates over short periods and the fluctuating nature of instantaneous rates, which are random and can change based on market conditions. The script concludes with a teaser for the next lecture, where the properties of instantaneous interest rates as stochastic processes will be explored, and the role of Ito's calculus in understanding these models will be discussed.

Mindmap

Keywords

💡Ito's Calculus

💡Ito Process

💡Stochastic Differential Equation (SDE)

💡Drift Term

💡Volatility Term

💡Geometric Brownian Motion

💡Martingale

💡Ito Isometry

💡Interest Rate

💡Risk-Free Rate

💡Instantaneous Interest Rate

Highlights

Introduction to applications of Ito's calculus in finance.

Expressing financial processes as Ito processes using stochastic differential equations (SDEs).

Explanation of the drift term and volatility term in the context of SDEs.

Modeling stock price movements as a geometric Brownian motion to ensure non-negativity.

Defining an Ito process with constant volatility and drift parameters.

Deriving the stochastic differential equation for a geometric Brownian motion.

Ensuring the asset price process follows an Ito process through Ito's formula application.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: