Ito Calculus-II

TLDRThis lecture delves into the final version of Ito calculus essential for finance, introducing Ito's formula to compute the Ito integral. It defines an Ito process, a stochastic process involving both deterministic and random components, and discusses its quadratic variation. The lecture also covers the shorthand representation of stochastic differential equations (SDEs) and the application of Ito's formula to Ito processes. The focus is on understanding the mathematical foundations that underpin financial models, setting the stage for the Black-Scholes formula in subsequent sessions.

Takeaways

- 📚 The lecture concludes the third week of Ito calculus, a crucial component for financial mathematics, with one more week and five lectures remaining.

- 🧩 Ito's formula is applied to compute the Ito integral, which was previously discussed, and can be derived from the formula itself when f(x) is set to x^2/2.

- 🔍 The definition of an Ito process is introduced, which includes a non-random initial value, a stochastic integral, and an ordinary integral, all adapted to a filtration associated with Brownian motion.

- 📈 The shorthand form of a stochastic differential equation (SDE) is presented, which is a simplified representation of the Ito process commonly used in financial models.

- 📊 The concept of quadratic variation is highlighted as a significant element in stochastic calculus, particularly in the context of Ito processes.

- 📐 Two approaches to understanding quadratic variation are discussed: an easy approach using shorthand notations and a more rigorous method involving deeper analysis.

- 🔢 The expectation that the L2 norm of the Ito integral process is strictly less than infinity is emphasized as a necessary condition for the theory's validity.

- 📝 The formal writing of the Ito process and its quadratic variation is detailed, explaining the sample quadratic variation and its relation to the Ito integral.

- ∫ The integration of an adapted process with respect to an Ito process is defined, showing how to perform such an integration using the Ito process's differentials.

- 🔄 Ito's formula for an Ito process is introduced, extending the previous formula to include the process's differentials, which is vital for modeling in finance.

- 🏁 The lecture wraps up with an overview of the Ito's formula for Ito processes, preparing students for its applications in upcoming lectures, including the Black-Scholes formula.

Q & A

What is the primary focus of this lecture?

-The primary focus of this lecture is Ito calculus, particularly the second part that is essential for finance.

What key concept does Ito's formula help to compute?

-Ito's formula helps to compute the Ito integral.

What is an Ito process?

-An Ito process is a stochastic process that consists of a non-random initial value and a combination of stochastic and ordinary integrals.

How can an Ito process be represented in shorthand form?

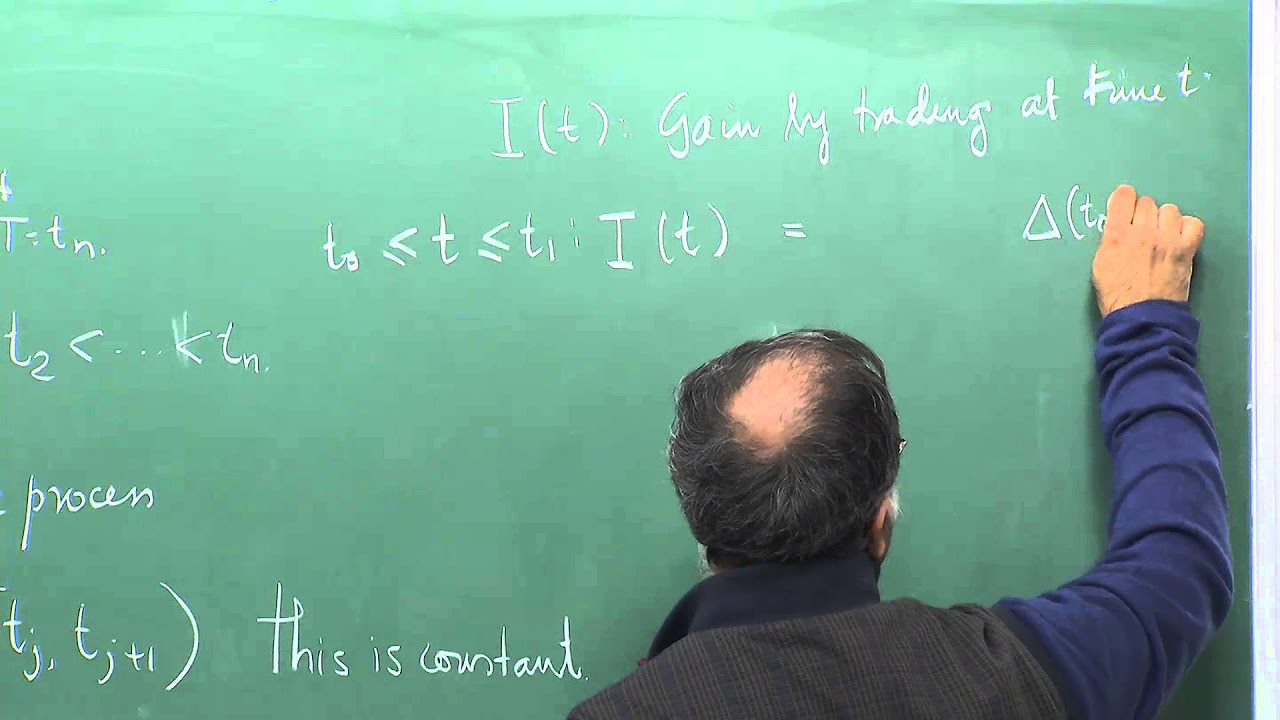

-In shorthand form or SDE (Stochastic Differential Equation) form, an Ito process can be written as d(X(t)) = delta(u) dW + theta(u) du.

What is the significance of quadratic variation in the context of Ito processes?

-Quadratic variation is a major player in the stochastic world and is essential for understanding the behavior and properties of Ito processes.

How is the quadratic variation of an Ito process computed?

-The quadratic variation of an Ito process is computed by considering the quadratic variation of the Ito integral and proving that certain parts (like R(t)) vanish as the partition norm goes to zero.

What does the term 'adapted to the filtration' mean in the context of Ito processes?

-'Adapted to the filtration' means that the processes are aligned with the information available up to time t, associated with the Brownian motion W(t).

What is the Ito formula for an Ito process?

-The Ito formula for an Ito process is similar to the general Ito formula but applied to an Ito process, considering the quadratic variation of the process.

Why is rigor not fully pursued in this lecture?

-Complete rigor is not pursued because it would require many lectures to cover all steps thoroughly, and the goal is to provide practical formulas for finance studies.

What will be covered in the upcoming lectures after this one?

-The upcoming lectures will cover applications of the Ito calculus in finance and will conclude with the Black-Scholes formula.

Outlines

📚 Introduction to Ito Calculus and Its Application in Finance

The script introduces the final version of Ito calculus, essential for understanding finance. It discusses how Ito's formula can be used to compute the Ito integral, which was previously derived. The lecturer explains the concept of an Ito process, which is a stochastic process involving both a stochastic integral and an ordinary integral. Ito processes are characterized by certain processes adapted to a filtration associated with Brownian motion. The shorthand form of a stochastic differential equation (SDE) is also introduced, providing a simplified representation of Ito processes.

📈 Exploring the Quadratic Variation in Ito Processes

This paragraph delves into the concept of quadratic variation, a key component in the stochastic world. The lecturer presents two approaches to understanding quadratic variation: an easy approach and a more in-depth one. The easy approach involves using the shorthand form of Ito processes to derive the quadratic variation. The paragraph also touches on the importance of the expected value of the L2 norm of the Ito integral and the conditions required for the difference between a simple process and a continuous process to converge to zero.

🔍 Formal Definition and Continuity of Ito Processes

The script provides a formal definition of the Ito process, emphasizing the continuity of the Ito integral and ordinary integral components. It explains how the Ito process can be represented as the sum of its initial value, the Ito integral, and the ordinary integral. The focus then shifts to the quadratic variation of the Ito process, which is computed by examining the sample quadratic differences. The lecturer also discusses the importance of the partitioning of the process and the cancellation of the initial value in the computation of quadratic variation.

📘 Proof of Quadratic Variation and Its Implications

The paragraph presents a proof for the quadratic variation of the Ito process, starting with the assumption of the finiteness of certain terms. It discusses the integration theory and the use of the modulus of continuity to show that the limit of the quadratic variation as the norm of the partition goes to zero is also zero. The proof illustrates the convergence of the quadratic variation and

Mindmap

Keywords

💡Ito Calculus

💡Ito Integral

💡Ito Process

💡Quadratic Variation

Highlights

Introduction to the final version of Ito calculus necessary for finance.

Review of computing the Ito integral using Ito's formula.

Explanation of how to derive half of W^2(T) using Ito's formula.

Introduction of the concept of an Ito process and its components.

Description of the shorthand form of a stochastic differential equation (SDE).

Discussion on the importance of quadratic variation in stochastic processes.

Two approaches to understanding the quadratic variation of a process.

Demonstration of calculating quadratic variation using an easy approach.

Clarification on the difference between simple and continuous processes in the context of quadratic variation.

Assumption of finite expected value for the L2 norm of the Ito integral.

Formal writing of the Ito process and its components.

Explanation of the sample quadratic variation and its calculation.

Proof of the quadratic variation of the Ito integral.

Integration of an adapted process with respect to an Ito process.

Introduction to Ito's formula for an Ito process and its components.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: