Ito Integral-II

TLDRThe video script delves into the complexities of mathematical finance, introducing the concept of Ito integral for stochastic processes. It discusses the properties of Ito integral, such as continuity, measurability, linearity, and martingale behavior, with a focus on the quadratic variation property. The instructor provides an example to illustrate the computation of Ito integral, highlighting the difference between stochastic and standard calculus. The session aims to prepare viewers for understanding advanced topics like the Black-Scholes formula for European call options.

Takeaways

- 📘 The course is delving deeper into finance, with a focus on mathematical finance tools and the Black-Scholes formula for European call option pricing.

- 📚 The lecturer has received feedback from students and adjusted the course to include more finance content, aiming to provide a 'finance flavor'.

- 🔍 An introduction to Ito integrals is given, explaining the concept of a general integral in the context of stochastic processes, as opposed to a simple process.

- 📉 The integral of a random variable over a probability space is defined using the limit of integrals of simple processes, highlighting the supremum in the definition.

- 📈 The concept of 'sameness' in probability theory is discussed, relating to the expected value of the distance between simple processes approximating a continuous process.

- 🧩 The Ito isometric theorem is mentioned as a way to show the existence of the Ito integral as a limit of a Cauchy sequence, though it is not elaborated upon in the script.

- 📝 Properties of the Ito integral are outlined, including its continuity, measurability with respect to the filtration associated with Brownian motion, linearity, and its behavior as a martingale.

- 📊 The Ito isometry property and the concept of quadratic variation are introduced, emphasizing the latter's importance in distinguishing stochastic integrals from standard calculus integrals.

- 📐 An example is provided to illustrate the computation of the Ito integral, contrasting it with the standard calculus integral and highlighting the additional term introduced by quadratic variation.

- 🔑 The quadratic variation of the Ito integral is a key property, showing that the accumulated quadratic variation up to time 't' is 't' itself, which is path-dependent.

- 🔍 The script concludes with a discussion on the importance of understanding the quadratic variation in stochastic calculus, setting the stage for further exploration of Ito's calculus.

Q & A

What is the main focus of the course described in the script?

-The main focus of the course is to delve deeper into the tools of mathematical finance, with a particular emphasis on the Ito integral and the Black-Scholes formula for pricing European call options.

Outlines

📚 Introduction to Advanced Financial Mathematics

The speaker introduces a deeper dive into the realm of finance, specifically mathematical finance, with a focus on tools and concepts. They mention an adjustment in the course format to include more finance-related content. The session will culminate with lectures on the Black-Scholes formula for pricing European call options, explaining what a call option is and how to approach related financial instruments. The initial topic of discussion is the Ito integral, a fundamental concept in stochastic calculus, moving beyond simple integrals to a more general form.

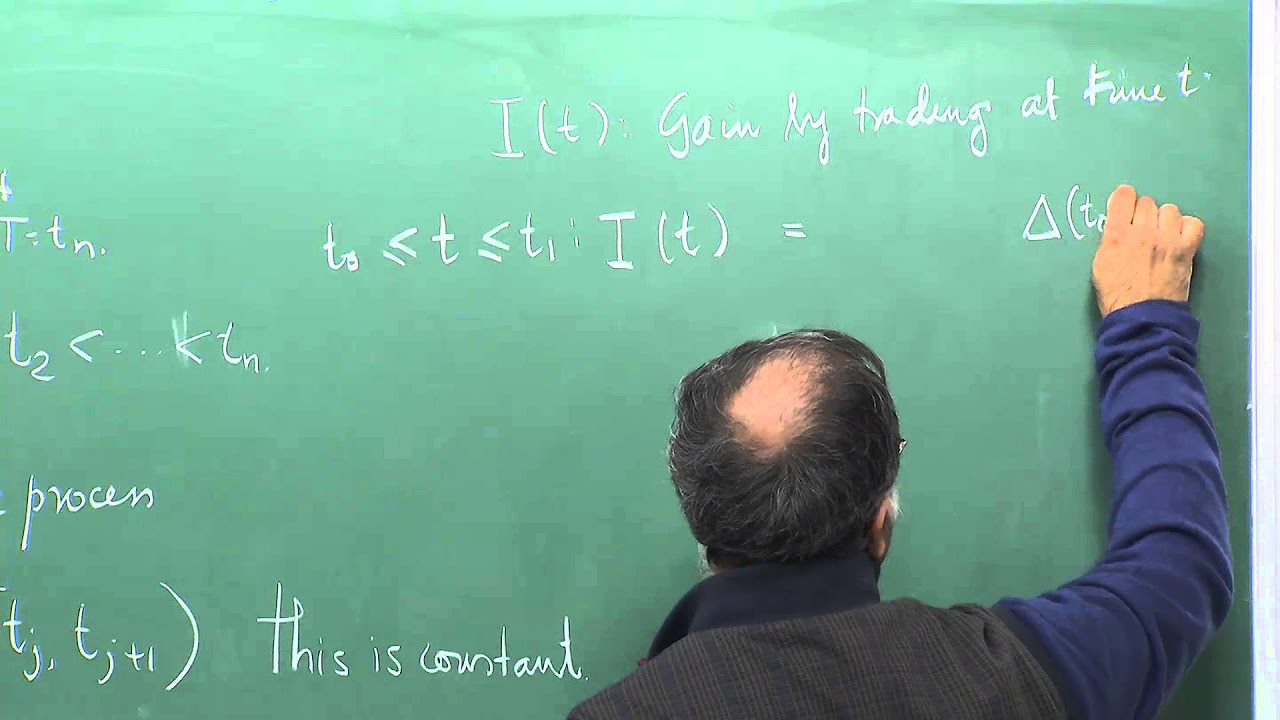

🔍 Exploring the Ito Integral and Its Properties

This paragraph delves into the Ito integral's definition and its properties, starting with the integral of a random variable over a probability space. The speaker explains the concept of 'sameness' in probability theory, which involves the expectation of the distance between discrete and continuous processes diminishing as the processes become more refined. The Ito isometric theorem is alluded to as a justification for the existence of such limits. Key properties of the Ito integral, such as continuity, measurability, linearity, and being a martingale, are highlighted, with a particular emphasis on the Ito isometry and the quadratic variation property.

📉 The It

Mindmap

Keywords

💡Finance

💡Black-Scholes Formula

💡Ito Integral

💡Call Option

💡Stochastic Process

💡Quadratic Variation

💡Martingale

💡Filtration

💡Brownian Motion

💡Ito Isometry

💡Simple Process

Highlights

Introduction to deeper financial concepts and tools of mathematical finance.

Course format change to include more finance flavor and tools.

Discussion on the Black-Scholes formula for pricing European call options.

Explaining the concept of a call option and its components.

Introduction to Ito integral for a general integral in finance.

Defining an integral over a probability space in the context of finance.

The concept of a simple process and its approximation to a continuous process.

The importance of the L2 norm in defining the 'sameness' in probability theory.

The expectation that the distance between simple processes and the actual process should approach zero.

Properties of the Ito integral, including continuity and measurability.

Linearity and martingale properties of the Ito integral.

Ito isometry and its relation to the properties of the Ito integral.

Quadratic variation of the Ito integral.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: