Dave Ramsey Thinks IUL is CRAP (My Response!)

TLDRIn this video response, David McKnight addresses Dave Ramsey's critique of index universal life insurance (IUL), arguing that Ramsey's understanding of IUL is flawed. McKnight explains that IUL should complement, not replace, retirement accounts like Roth IRAs and 401ks. He clarifies misconceptions about IUL's cost structure, emphasizing its transparency and potential benefits when used correctly. McKnight invites viewers to his website for a comprehensive approach to tax-free retirement planning.

Takeaways

- 📚 David McKnight, author of 'The Power of Zero', critiques Dave Ramsey's views on index universal life insurance (IUL).

- 🤔 McKnight acknowledges Ramsey's generally sound advice but takes issue with his understanding of IUL's nuances.

- 📉 Ramsey is accused of conflating features of whole life and IUL policies, which McKnight sees as misguided.

- 🔎 McKnight points out that IUL policies offer living benefits, like tax-free loans and advance death benefits for long-term care costs.

- 💡 IUL should complement, not substitute, retirement accounts like Roth IRAs and 401ks, according to McKnight.

- 🚫 McKnight emphasizes that IUL is not a financial panacea and should be part of a broader financial strategy.

- 📈 IUL's insurance cost decreases over time as the policy's cash value increases, contrary to Ramsey's claims.

- 🔑 Transparency is a key feature of IUL, with clear breakdowns of expenses and cash value growth.

- 💼 McKnight argues that IUL policies, when properly structured, can offer significant financial benefits without becoming a financial burden.

- 📊 A detailed example is given to illustrate how IUL can grow cash value significantly with relatively low ongoing insurance costs.

- 👉 McKnight invites viewers to his website for a comprehensive approach to tax-free retirement, offering personal responses to comments and questions.

Q & A

What is David McKnight's opinion on Dave Ramsey's advice in general?

-David McKnight generally likes Dave Ramsey's advice, believing that it provides sound financial guidance for many Americans, especially those who are spending more than they earn.

What is the main topic of the critique in David McKnight's video?

-The main topic of the critique is Dave Ramsey's views on indexed universal life insurance (IUL), which McKnight believes Ramsey does not fully understand or accurately represent.

Why does Dave Ramsey's co-host, George Camel, express concern about young people gravitating towards Universal Life policies?

-George Camel is concerned because he sees these policies being marketed as a brilliant investment opportunity, which he believes is misleading and results in high commissions and fees for sellers.

What does David McKnight believe IUL should be seen as in relation to retirement accounts like Roth IRAs and Roth 401ks?

-McKnight believes that IUL should be seen as a complement to Roth IRAs and Roth 401ks, not a substitute for them, and should never be considered the centerpiece of a financial plan.

How does David McKnight describe the transparency of index universal life insurance compared to whole life insurance?

-McKnight describes index universal life insurance as 100% transparent, with all expenses clearly disclosed on the policy illustration and annual statement, unlike whole life insurance, which is often referred to as a 'black box' due to its lack of transparency.

What is the 'annual renewable term' (ART) and why is it a feature of IUL?

-The annual renewable term (ART) is a feature of IUL where the insurance portion of the policy increases every year. It is an undeniable feature but should not be seen as negative, especially as the amount of life insurance paid for decreases over time as the cash value increases.

What misunderstanding does David McKnight point out in Dave Ramsey's critique of IUL?

-McKnight points out that Ramsey misunderstands the relationship between the cash value of an IUL policy and the amount of life insurance being paid for, often conflating IUL with whole life insurance and misrepresenting how the costs and benefits work over time.

How does the cost of life insurance within an IUL policy change as the policyholder ages?

-As the policyholder ages, the cost of term insurance increases, but the amount of life insurance they are paying for actually decreases because the cash value of the policy is growing, offsetting the need for as much insurance.

What is the potential issue with IUL that Dave Ramsey warns about, according to the transcript?

-Dave Ramsey warns that if you keep an IUL policy long enough, the premium you pay may not even cover the insurance cost, causing the policy to become 'upside down' and start eating into your savings.

How does David McKnight counter Dave Ramsey's claim that IUL policies can become a financial burden?

-McKnight counters by explaining that if IUL policies are structured properly, the insurance expense becomes negligible compared to the cash value growth, and the policy provides a death benefit that doubles as long-term care.

What is the final message David McKnight gives to viewers regarding IUL and financial planning?

-McKnight's final message is that while no financial instrument is perfect, IUL, when used as part of a balanced and comprehensive approach to tax-free retirement, can offer significant financial benefits, and it's important not to mischaracterize the product based on misunderstandings.

Outlines

📚 Critique of Dave Ramsey's View on Index Universal Life Insurance

In this paragraph, David McKnight, author of 'The Power of Zero', addresses Dave Ramsey's critique of index universal life insurance (IUL). McKnight acknowledges Ramsey's overall sound financial advice but takes issue with his understanding of IUL. He suggests Ramsey conflates features of whole life and IUL policies and criticizes the marketing of IUL to young people as a financial panacea. McKnight emphasizes that IUL should complement, not replace, retirement accounts like Roth IRAs and 401ks. He also explains the mechanics of IUL, highlighting its transparency and the decreasing cost of insurance as cash value increases.

🔍 Debunking Misconceptions About Index Universal Life Insurance

This paragraph delves deeper into the mechanics of IUL, using a chart to illustrate how the cost of insurance within an IUL policy decreases as the policy's cash value grows. McKnight refutes Ramsey's claim that IUL policies become a financial burden as one ages, by explaining that the annual renewable term (ART) feature is not inherently negative. He argues that with proper structuring, the insurance expense becomes negligible compared to the cash value accumulated, and clarifies the relationship between cash value and death benefit, countering Ramsey's portrayal of IUL as a poor investment.

🌐 Promoting a Balanced Approach to Tax-Free Retirement

In the final paragraph, McKnight offers his assistance in developing a comprehensive retirement strategy that includes IUL as one component among others for tax-free income. He invites viewers to engage with him for personalized advice and encourages interaction through comments. McKnight also reminds viewers to subscribe and stay updated with his content, emphasizing his commitment to responding to all feedback personally.

Mindmap

Keywords

💡Index Universal Life Insurance (IUL)

💡Dave Ramsey

💡Cash Value

💡Death Benefit

💡Tax-Free Income

💡Roth IRAs and Roth 401ks

💡Transparency

💡Annual Renewable Term (ART)

💡Financial Panacea

💡Long-Term Care

💡Self-Insured

Highlights

David McKnight, author of 'The Power of Zero', begins by acknowledging Dave Ramsey's mostly sound advice but criticizes his stance on index universal life insurance.

McKnight believes Ramsey doesn't fully understand the nuances of different life insurance policies, particularly conflating whole life and index universal life.

Index universal life (IUL) is criticized by Ramsey for being marketed to young people as a financial panacea, which McKnight also finds concerning.

IUL policies offer living benefits such as tax-free loans and death benefits for long-term care, but should complement, not replace, retirement accounts like Roth IRAs and 401ks.

McKnight argues that IUL is transparent, with clear breakdowns of expenses and cash value growth, unlike the 'black box' of whole life insurance.

The annual renewable term (ART) feature of IUL is misunderstood by Ramsey; it's a positive as the insurance cost decreases over time with increasing cash value.

McKnight refutes Ramsey's claim that IUL policies become a financial burden as they 'eat back into savings', explaining how the cost of insurance decreases with age.

A detailed explanation is provided on how the cost of life insurance in IUL policies is calculated and decreases as cash value increases.

McKnight uses a hypothetical example to illustrate how IUL can be beneficial, showing minimal expenses relative to cash value growth.

He emphasizes the importance of proper structuring of IUL policies to avoid 'upside down' situations, contrary to Ramsey's assertions.

McKnight corrects Ramsey's misunderstanding of the relationship between cash value and life insurance costs in IUL, using a clear chart for explanation.

A 40-year-old's hypothetical IUL investment is used to demonstrate the significant cash value growth and minimal annual expenses.

McKnight addresses Ramsey's oversimplification of financial planning, suggesting it can mislead those in need of nuanced advice.

He invites viewers to his website for help in developing a balanced approach to tax-free retirement, emphasizing the benefits of IUL when used correctly.

McKnight offers to personally respond to comments and questions, encouraging viewer interaction and further discussion on the topic.

The video concludes with a reminder to like, subscribe, and enable notifications for future content from David McKnight.

Transcripts

Browse More Related Video

This is Just Another Example of Why Whole Life Policies Suck!

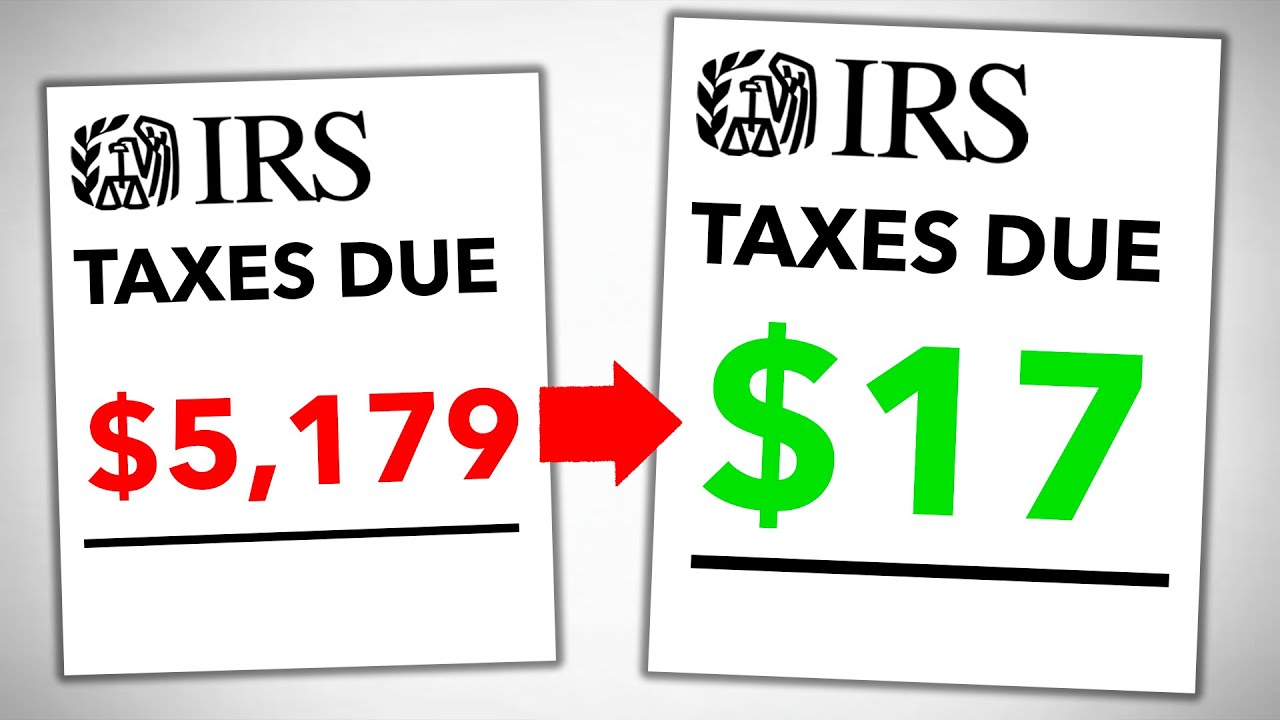

How to AVOID Taxes... Legally (Do This Now)

How to invest as a beginner (and everything to do BEFORE that!)

Term Vs. Whole Life Insurance (Life Insurance Explained)

I was wrong about Whole Life Insurance...

How to Use a 401K Properly to Retire Faster (Do This Now!)

5.0 / 5 (0 votes)

Thanks for rating: