Martingales

TLDRThis script delves into the concept of Martingales, a type of stochastic process with intriguing properties in probability theory. It begins by explaining the necessity of understanding filtration, a sequence of sigma-algebras that represent the accumulation of information over time. The discussion then moves to the definition of discrete and continuous Martingales, highlighting their adaptation to filtration and the key property that their expected value remains constant over time given the information available. The script concludes with the uniform expectation property of Martingales and a teaser for the next topic, Brownian motion, which is pivotal in financial modeling.

Takeaways

- 🎲 Martingales are a type of stochastic process that has a specific behavior in terms of the expectation of future values given present information.

- 📊 Filtration is a sequence of sigma-algebras that represents the accumulation of information over time, with each sigma-algebra revealing more about the underlying probability space.

- 🔍 The concept of filtration is crucial for understanding martingales, as it defines the information set available at each stage of a stochastic process.

- 🚀 A filtration is formally defined as a sequence of sigma-algebras where each subsequent sigma-algebra contains the previous one, reflecting the increasing information over time.

- 🔑 In the context of a coin toss experiment, the sigma-algebra represents the possible outcomes, and as more tosses are revealed, the sigma-algebra is refined to represent the remaining possibilities.

- 🎯 A stochastic process is said to be adapted to a filtration if it is measurable with respect to the sigma-algebra at each point in time, meaning it incorporates all available information up to that time.

- 🃏 A discrete martingale is defined by the property that the conditional expectation of the next step in the process, given the information up to the current step, is equal to the current value.

- 📉 Continuous martingales have the property that the expected value of the process at any future time, given the information up to the present, is equal to its current value.

- 💡 The expectation of each random variable in a martingale sequence is constant, meaning that the process has a consistent long-term expected value regardless of time.

- 🧩 The tower law of conditional expectation is used to explain the properties of martingales, showing that the expectation of a future value, given more information, is the same as the current value.

- 📚 The script suggests that further study of Brownian motion, which is closely related to continuous martingales, is important for modeling stock prices in financial markets.

Q & A

What is the main topic of discussion in the script?

-The main topic of the script is Martingales, a type of stochastic process, and the concept of filtration in probability theory.

What is a filtration in the context of probability and stochastic processes?

-A filtration is a sequence of sigma-algebras that represents the accumulation of information over time in a stochastic process. As time progresses and new information becomes available, part of the sigma-algebra is revealed, and the filtration captures this sequence of progressively revealed information.

How does the concept of filtration relate to the random experiment of tossing a coin?

-In the script, the concept of filtration is illustrated using the example of tossing a coin. As each coin is tossed, new information becomes available, and the sigma-algebra is updated to reflect the known outcomes, thus changing the filtration.

Outlines

🎰 Introduction to Martingales and Filtration

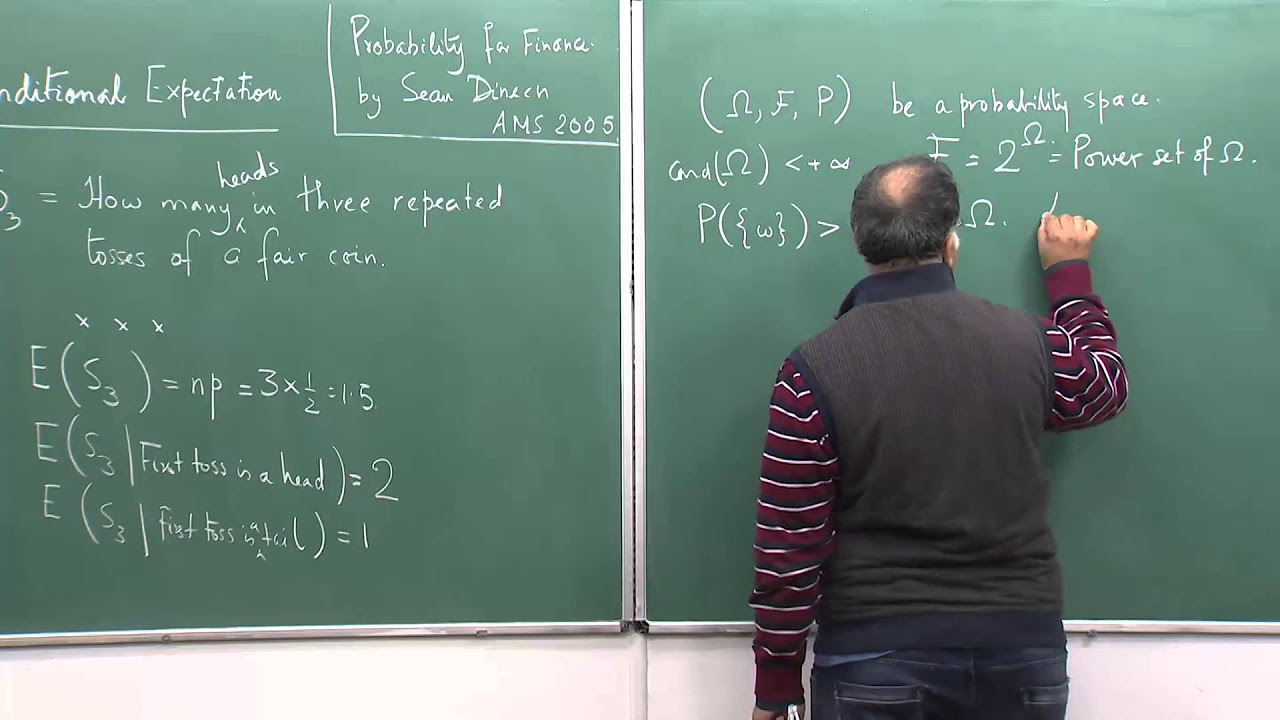

The paragraph introduces the concept of Martingales, a type of stochastic process, and the importance of understanding filtration in probability theory. Filtration refers to the information revealed as a random experiment progresses. The speaker uses the example of tossing a coin multiple times to illustrate how the sigma-algebra changes with each new piece of information. The concept of sigma-algebra subsets being revealed with each coin toss is explained, emphasizing the foundational role of the probability space in these discussions.

🔍 Deep Dive into Filtration and Sigma-Algebra

This paragraph delves deeper into the concept of filtration, explaining how it partitions the sigma-algebra as new information becomes available. The speaker uses the example of coin tosses to demonstrate how knowing the outcome of the first toss narrows down the possibilities for subsequent tosses, thus refining the filtration. The paragraph also discusses the properties of a sigma-algebra, such as closure under complementation and countable unions, and how these properties are essential for constructing the filtration.

📈 Constructing Filtration with Coin Tosses

The speaker continues the discussion on filtration, using the coin toss example to illustrate how the sigma-algebra evolves with each new piece of information. The paragraph explains how to construct the filtration F1, F2, and F3 based on the outcomes of the first, second, and third coin tosses, respectively. It emphasizes the growth in the cardinality of the sets involved and the process of taking complements and unions to ensure the filtration adheres to the rules of sigma-algebras.

🔑 Understanding Filtration in Discrete Settings

The paragraph introduces the concept of F0, representing the sigma-algebra when no information is revealed. It then explains how the filtration forms a chain of sigma-algebras, with each subsequent sigma-algebra revealing more information. The speaker provides a formal definition of filtration from Steven Shreve’s book, 'Stochastic Calculus for Finance,' and emphasizes the importance of understanding the sequence of sigma-algebras in both discrete and continuous settings.

🎲 Stochastic Processes and Adaptation to Filtration

This paragraph discusses the concept of a stochastic process being adapted to a filtration. It explains that a stochastic process Xt is adapted to the filtration Ft if it is measurable with respect to Ft, meaning that the process's values can be determined by the information available at time t. The paragraph also introduces the idea of discrete Martingales and sets the stage for discussing continuous Martingales, highlighting the relevance of these concepts in finance.

🃏 Definition and Properties of Discrete Martingales

The speaker defines a discrete Martingale in the context of a given filtration Fn and a stochastic process Xn adapted to this filtration. A Martingale is characterized by the property that the conditional expectation of Xn+1, given the information up to time n, is equal to Xn. This reflects the idea that the expected payoff at the next step in a game is the same as the current payoff, assuming no new information. The paragraph also touches on the concept of super and sub Martingales and the application of the tower law of conditional expectation.

📊 Expectation Properties of Martingales

The final paragraph discusses a key property of Martingales: the expectation of each random variable in a Martingale sequence is the same, regardless of the time index. The speaker illustrates this by calculating the expectation of Xn and showing that it is equal to the expectation of all other variables in the sequence. This property is fundamental for understanding the behavior of Martingales and sets the stage for the discussion of Brownian motion, which is crucial for modeling stock prices in financial markets.

Mindmap

Keywords

💡Martingales

💡Filtration

💡Sigma-algebra

💡Stochastic process

💡Adapted stochastic process

💡Conditional expectation

💡Tower law of conditional expectation

💡Brownian motion

💡Continuous Martingales

💡Expectation

Highlights

Introduction to the concept of Martingales as a type of stochastic process.

The importance of understanding filtration in the context of stochastic processes.

Filtration defined as the progression of information in a random experiment.

Illustration of filtration with an example of a fair coin toss experiment.

Explanation of how the revelation of the first coin toss outcome narrows down possible outcomes.

The concept of Sigma-algebra and its role in defining the known events in an experiment.

Construction of a Sigma-algebra based on the outcomes of coin tosses.

The evolution of Sigma-algebra as more information becomes available.

Definition of a filtration as a sequence of Sigma-algebras that grows with information.

The definition of an adapted stochastic process in relation to a filtration.

Martingales as a special type of adapted stochastic process with unique properties.

The discrete Martingale defined through conditional expectations.

Connection between Martingales and gambling, illustrating the concept of 'fair game'.

The tower law of conditional expectation applied to Martingales.

Continuous Martingales and their definition in terms of filtration.

A property of Martingales where the expectation of all random variables in the sequence is the same.

Introduction to the practical application of Martingales in modeling stock prices through Brownian motion.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: