How to Read Your Brokerage 1099 Form

TLDRThe video script provides an informative overview of the 1099 tax form, which is issued by brokerage firms like Schwab to report taxable investment income to the IRS. It explains that various financial accounts, including bank and retirement accounts, are subject to tax reporting. The video outlines the types of accounts that generate a 1099 and highlights key sections of the form, such as 1099-DIV for dividends and capital gains, 1099-INT for interest income, and 1099-B for realized gains and losses from asset sales. It also discusses the process of receiving and using the form, including the possibility of receiving a corrected 1099 and the importance of consulting with a tax professional. The script emphasizes the availability of resources on Schwab's online Tax Center and the convenience of accessing 1099 forms digitally or through the mobile app.

Takeaways

- 📄 **1099 Tax Form**: The 1099 form is issued by brokerage firms to report taxable investment income to the IRS.

- 💼 **Financial Accounts**: Almost every financial account, including bank, brokerage, and retirement accounts, is subject to tax reporting.

- 🧾 **1099 Composite**: Schwab provides a '1099 Composite and Year-End Summary' that consolidates several 1099 forms into one document for simplified tax reporting.

- 💡 **Income Generation**: Any activity within a tax year that generates income, even if not reported on a tax form, is taxable.

- 📈 **Investment Income**: Investments like stocks, bonds, or options may produce income through dividends, interest, or capital gains, triggering a 1099 form.

- 📊 **Common Sections**: Focus on sections 1099-DIV for dividends, 1099-INT for interest income, and 1099-B for realized gains and losses when filing taxes.

- 🔄 **Tax Preparation**: Information from 1099 forms may be imported directly into online tax preparation software.

- 📅 **1099 Timing**: Schwab sends 1099s in two waves, typically by the end of January and by the February deadline.

- ✉️ **Receiving 1099**: You may receive a corrected 1099 if there are updates to the tax information provided by the security issuer.

- 🔍 **Finding 1099**: Schwab's 1099 forms can be accessed digitally, via mail, online 1099 Dashboard, or the mobile app, with email or push notifications for availability.

- ❓ **Consulting Professionals**: For specific questions or assistance with tax filing, it is advised to reach out to a tax professional.

Q & A

What is the purpose of the 1099 tax form?

-The 1099 tax form is issued by a brokerage firm to help individuals report taxable investment income to the IRS.

Which types of financial accounts are typically subject to tax reporting?

-Almost every financial account is subject to tax reporting, including bank accounts, brokerage accounts, and retirement accounts if distributions are taken.

What is a '1099 Composite and Year-End Summary'?

-At Schwab, the '1099 Composite and Year-End Summary' is a simplified tax reporting document that consolidates several 1099 forms into a single document.

Can you receive more than one type of 1099 from Schwab?

-Yes, in addition to the 1099 Composite, you may also receive other 1099 forms from Schwab, such as a 1099-R for distributions from a retirement account.

Why would someone receive a 1099 even if they didn't engage in any buy or sell transactions during the year?

-A 1099 may be issued if the investments in your account, like stocks, bonds, or options, produced income during the year, such as through dividends, interest, or capital gains.

What are the three common sections of a 1099 form that one should focus on when filing a tax return?

-The three common sections are 1099-DIV (lists dividend payments and capital gains from securities), 1099-INT (lists interest income), and 1099-B (lists realized gains and losses from buying and selling assets).

How can the information on the 1099 forms be used when filing a tax return?

-The information on the 1099 forms may need to be included when filing your tax return. Depending on how you prepare your taxes, you may be able to import the information directly into an online tax preparation software.

When does Schwab typically send out its 1099s?

-Schwab sends its 1099s in two waves, with the first wave typically sent out at the end of January and the second wave by the February deadline.

What should you do if you receive a corrected 1099 after you have already submitted your tax return?

-If you have already submitted your tax return and receive a corrected 1099, you may need to file an amended return that includes the corrected information. It is advisable to work with a tax professional if you need help with this.

How can you access your 1099 forms from Schwab?

-You can access your 1099 forms digitally or as a paper copy in the mail. Additionally, they can be found on Schwab's online 1099 Dashboard and on the mobile app, and you'll receive an email or push notification when they are ready to view.

Where can one find more resources related to Schwab's Consolidated 1099?

-Additional resources can be found online in Schwab's Tax Center, which provides helpful information for understanding and reporting investment income on taxes.

Why is it important to consult with a tax professional when dealing with 1099 forms and tax reporting?

-Consulting with a tax professional is important because they can provide specific guidance and help ensure that all necessary information is accurately reported on your tax return, which can be especially helpful given the complexity of tax reporting requirements.

Outlines

📊 Understanding the 1099 Tax Form and Its Importance

The 1099 form is a crucial tax document issued by brokerage firms, such as Schwab, to report taxable investment income to the IRS. It is applicable to a variety of financial accounts including bank accounts, brokerage accounts, and retirement accounts when distributions are made. The video explains the types of accounts that generate a 1099, its key sections, and how the information is utilized. It also covers the process of receiving the form, the potential for corrected 1099s, and additional resources available at Schwab. The '1099 Composite and Year-End Summary' is a simplified form that consolidates multiple 1099s. The video emphasizes the importance of consulting with a tax professional for personalized advice. It outlines common sections of the 1099 form, such as 1099-DIV for dividends and capital gains, 1099-INT for interest income, and 1099-B for realized gains and losses from asset sales. The form's information is integral for tax return filing and may be imported directly into tax preparation software. The viewer is reminded that other forms like 1099-MISC and 1099-OID might also be part of the Consolidated 1099. The expected timeline for receiving the 1099 is between January and February, with corrected versions being sent out if necessary. The video concludes with guidance on where to find the 1099 form, either digitally or as a paper copy, and the availability of email notifications and resources in Schwab's Tax Center.

📲 Receiving and Navigating the 1099 Electronically

If a user has opted for an electronic version of the 1099 form, they can expect to receive a push notification on their mobile device when it's available. Schwab's Tax Center provides additional resources to assist with tax reporting, which can be a complex process. The video emphasizes the importance of understanding the different sections of the 1099 form and being aware of the income that investments may generate to ease the stress of tax reporting. The digital delivery of the 1099 form contributes to a more streamlined and accessible tax reporting experience for users.

Mindmap

Keywords

💡1099 Tax Form

💡Taxable Investment Income

💡Financial Accounts

💡Tax Reporting

💡1099 Composite

💡Distributions

💡Dividends

💡Interest Income

💡Capital Gains

💡Realized Gains and Losses

💡Tax Preparation Software

💡Corrected 1099

Highlights

The 1099 tax form is issued by brokerage firms to help investors report taxable investment income to the IRS.

Almost every financial account is subject to tax reporting, including bank, brokerage, and retirement accounts.

Schwab provides a '1099 Composite and Year-End Summary' to simplify tax reporting by consolidating multiple 1099s into one document.

Investors may receive separate 1099-R forms for retirement account distributions.

Investments like stocks, bonds, and options can produce taxable income through dividends, interest, or capital gains.

Income from activities like cryptocurrency transactions or rental property income is also taxable, even if not reported on a 1099.

Investors may receive a 1099 even if they did not buy or sell any securities, due to income from investments like mutual funds.

The 1099-DIV section lists dividend payments and capital gains from securities like stocks and ETFs.

The 1099-INT section reports interest income from securities like Treasuries and CDs.

The 1099-B section details realized gains and losses from buying and selling assets.

Investors may owe taxes on realized capital gains if they have a net profit for the year.

The 1099 information may need to be included when filing a tax return, and can often be imported directly into tax software.

Schwab's Consolidated 1099 may also include forms like 1099-MISC, 1099-OID, and the Year-End Summary.

Investors should consult a tax professional for guidance on including all relevant 1099 information on their tax return.

Schwab sends its 1099s in two waves, with the first wave typically sent by the end of January.

Investors with multiple Schwab accounts will receive a 1099 for each account.

Corrected 1099s may be issued if updated tax information is provided by security issuers.

Most corrected 1099s are sent before the April tax filing deadline, but they can also be received afterwards.

Investors who have already filed their taxes may need to file an amended return to include corrected 1099 information.

Schwab sends 1099s digitally or as paper copies, and they are also accessible online through the 1099 Dashboard and mobile app.

Investors will be notified via email or push notification when their 1099 is available online or has been mailed.

Schwab's Tax Center provides helpful resources for investors to better understand and report their investment income on taxes.

Transcripts

Browse More Related Video

ISSO Tax Workshop for International Students & Scholars, 2022 Tax Returns

How to Amend Tax Returns - TurboTax Tutorial

2023 VITA Tax Webinar for international students from India filing as nonresidents

USA Taxes (1040NR) for International Students on F1, J1 and H1B

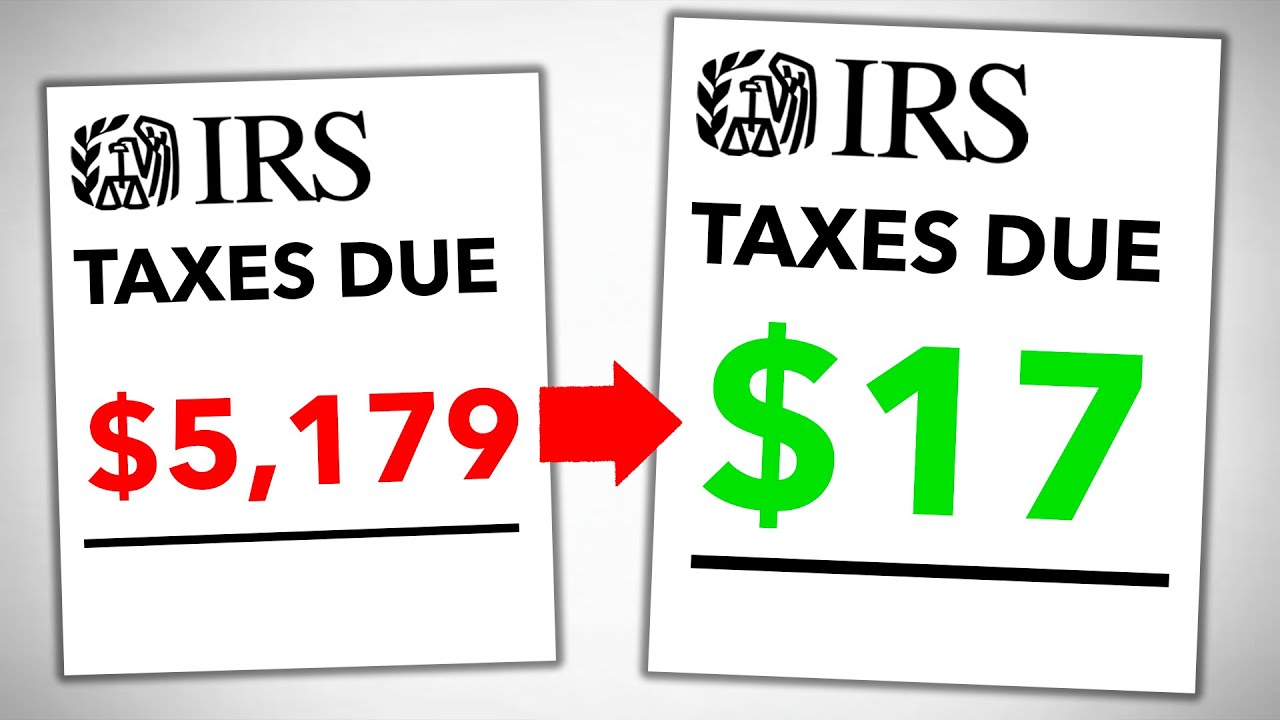

How to AVOID Taxes... Legally (Do This Now)

How to File Tax Returns as an international student | Tax Refund 2022

5.0 / 5 (0 votes)

Thanks for rating: