Taxation and dead weight loss | Microeconomics | Khan Academy

TLDRThis script explores the economic impact of a hypothetical tax on hamburgers, illustrating the concept of market equilibrium and surpluses. It explains how a $1 tax per hamburger shifts supply and demand, leading to a new equilibrium with higher prices and lower quantity sold. The script also discusses the resulting dead weight loss, reduced consumer and producer surplus, and the government's tax revenue, highlighting the inefficiencies and trade-offs of taxation.

Takeaways

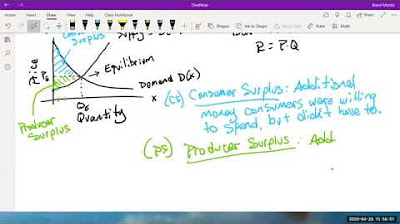

- 🍔 The script discusses the market for hamburgers, illustrating the supply and demand curves and their equilibrium point.

- 📈 The equilibrium price of hamburgers without any intervention is $3.75, with an equilibrium quantity of 3.5 million hamburgers sold per day.

- 💰 Consumer surplus is the value consumers get beyond what they pay, shown as the area below the demand curve and above the price line.

- 🏭 Producer surplus represents the extra amount producers receive for each hamburger compared to their opportunity cost, found between the price line and the supply curve.

- 🔍 The script uses a hypothetical example to compare the market for hamburgers to McDonald's sales in the United States, noting that McDonald's sells over 4 million hamburgers per day.

- 📉 The introduction of a $1 tax per hamburger shifts the supply curve from the consumer's perspective, leading to a new equilibrium price of over $4 and a reduced quantity of 3 million hamburgers per day.

- 💔 The tax creates a dead weight loss, which is the reduction in total surplus that is not captured by either consumers or producers and represents inefficiency.

- 💼 The government's tax revenue from the hamburger tax is calculated as 3 million hamburgers sold per day times $1, resulting in $3 million per day.

- 📊 The script highlights that the tax reduces both consumer and producer surplus, with the consumer surplus being diminished by the increased price and the producer surplus by the reduced quantity sold.

- 🤔 It points out that taxation can lead to a non-efficient market state, causing some of the potential benefit to disappear, but it is necessary for governments to generate revenue.

- 📚 The discussion concludes by emphasizing the trade-offs of taxation, including the potential for dead weight loss and the need for revenue to fund government operations.

Q & A

What is the equilibrium price of hamburgers in the unfettered market scenario described in the script?

-The equilibrium price of hamburgers in the unfettered market scenario is about $3.75 per hamburger.

What is the equilibrium quantity of hamburgers sold per day in the market without any intervention?

-The equilibrium quantity of hamburgers sold per day is approximately 3.5 million hamburgers.

What is the concept of consumer surplus as explained in the script?

-Consumer surplus is the difference between the value consumers perceive in a product and the price they actually pay for it, which in this case is the area below the demand curve and above the price line of $3.75.

What is the concept of producer surplus as described in the script?

-Producer surplus is the difference between the price producers receive for a product and their opportunity cost of producing it, which is the area between the supply curve and the price line of $3.75.

How many hamburgers does McDonald's sell per day in the United States according to the script?

-According to the script, McDonald's sells a little over 4 million hamburgers per day in the United States.

What is the impact of a $1 tax per hamburger on the market equilibrium?

-The $1 tax per hamburger shifts the supply curve from the consumer's point of view upwards by $1, leading to a new equilibrium price of a bit over $4 per burger and a reduced equilibrium quantity to about 3 million burgers per day.

What is the term used to describe the loss of total surplus due to the introduction of a tax in the script?

-The term used to describe the loss of total surplus due to the introduction of a tax is 'dead weight loss.'

How does the tax affect the consumer surplus and producer surplus?

-The tax reduces both the consumer surplus and the producer surplus. The consumer surplus is reduced because consumers now pay more, and the producer surplus is reduced because producers receive less for each hamburger sold.

What is the government's daily tax revenue from the hamburger tax, assuming the new equilibrium quantity of 3 million burgers per day?

-The government's daily tax revenue from the hamburger tax, assuming the new equilibrium quantity of 3 million burgers per day, is $3 million.

Why might the actual tax revenue be less than what the government initially projected?

-The actual tax revenue might be less than initially projected because the tax increases the price of hamburgers, leading to a decrease in the quantity demanded and thus a lower overall tax revenue.

What is the broader implication of the script regarding government taxation and market efficiency?

-The broader implication of the script is that while government taxation is necessary for revenue, it can lead to a non-efficient state in the market, causing dead weight loss and reducing the overall surplus that could have been achieved in an unfettered market.

Outlines

🍔 Market Equilibrium for Hamburgers

This paragraph discusses the concept of market equilibrium in the context of hamburger sales. It explains the supply and demand curves, establishing an equilibrium price of $3.75 per hamburger and an equilibrium quantity of 3.5 million hamburgers sold daily. The paragraph introduces the idea of consumer and producer surplus, highlighting the benefits consumers receive beyond what they pay and the extra revenue producers gain compared to their opportunity costs. It also provides a real-world example, noting that McDonald's sells over 4 million hamburgers daily in the United States, and sets the stage for a hypothetical government intervention in the form of a tax on hamburgers.

💰 Impact of Hamburger Taxation

The second paragraph delves into the effects of a government-imposed tax of $1 per hamburger on the market. It describes how this tax shifts the supply curve from the consumer's perspective, leading to a new equilibrium price of over $4 per burger and a reduced quantity of 3 million hamburgers sold daily. The paragraph illustrates the resulting dead weight loss, a reduction in total surplus that neither consumers nor producers benefit from. It also calculates the government's tax revenue, pointing out that the actual revenue is less than initially projected due to the decrease in quantity demanded. The summary concludes by reflecting on the trade-offs of taxation, noting its role in generating government revenue but also causing inefficiencies and dead weight loss in the market.

Mindmap

Keywords

💡Market

💡Supply and Demand Curves

💡Equilibrium Price

💡Equilibrium Quantity

💡Consumer Surplus

💡Producer Surplus

💡McDonalds

💡Taxation

💡Dead Weight Loss

💡Revenue

💡Opportunity Cost

Highlights

Introduction to the market for hamburgers with supply and demand curves.

Equilibrium price of $3.75 and equilibrium quantity of 3.5 million hamburgers per day.

Explanation of consumer surplus and its calculation below the demand curve and above the price line.

Producer surplus is the difference between what producers get and their opportunity cost.

McDonalds sells over 4 million hamburgers per day in the United States.

Assumption of equal value for all hamburgers in the market analysis.

Government decision to tax hamburgers at $1 per unit for additional revenue.

Impact of a $1 tax on the supply and demand dynamics of hamburgers.

Shift in the supply curve from the consumer's perspective due to the tax.

New equilibrium price of over $4 and reduced quantity to 3 million hamburgers per day after the tax.

Loss of total surplus due to the tax, resulting in dead weight loss.

Calculation of government tax revenue at $3 million per day.

Unexpected reduction in quantity demanded due to increased price from the tax.

Decrease in both consumer and producer surplus as a result of the tax.

The non-efficient state caused by taxation and its impact on surpluses.

Necessity of taxation for government revenue and its trade-offs.

Transcripts

Browse More Related Video

Tax Revenue and Deadweight Loss

How to calculate Excise Tax and the Impact on Consumer and Producer Surplus

equilibrium price and tax revenue after the imposition a per unit tax from Demand & Supply function

Consumer Surplus, Producer Surplus,& Deadweight Loss before and after imposing the price ceiling?

Math 11 - Section 5.1

Animation on How to Price Floors and Price Ceilings

5.0 / 5 (0 votes)

Thanks for rating: