Tax Revenue and Deadweight Loss

TLDRThis video script explores the purpose and effects of taxation on market prices, focusing on the concept of deadweight loss. It explains how a tax reduces consumer and producer surplus, leading to a decrease in overall market efficiency. The script uses a simple diagram to illustrate the changes in surplus and introduces the idea of deadweight loss through a hypothetical trip to New York. It further discusses the impact of demand elasticity on deadweight loss, suggesting that goods with inelastic demand should be taxed to minimize economic waste. The video concludes with a real-world example of a luxury tax on yachts, which resulted in lower revenue and job losses, reinforcing the importance of understanding the economic implications of taxation.

Takeaways

- 💼 Taxes are levied by governments primarily to generate revenue.

- 📉 The imposition of taxes leads to a reduction in both consumer and producer surplus due to market intervention.

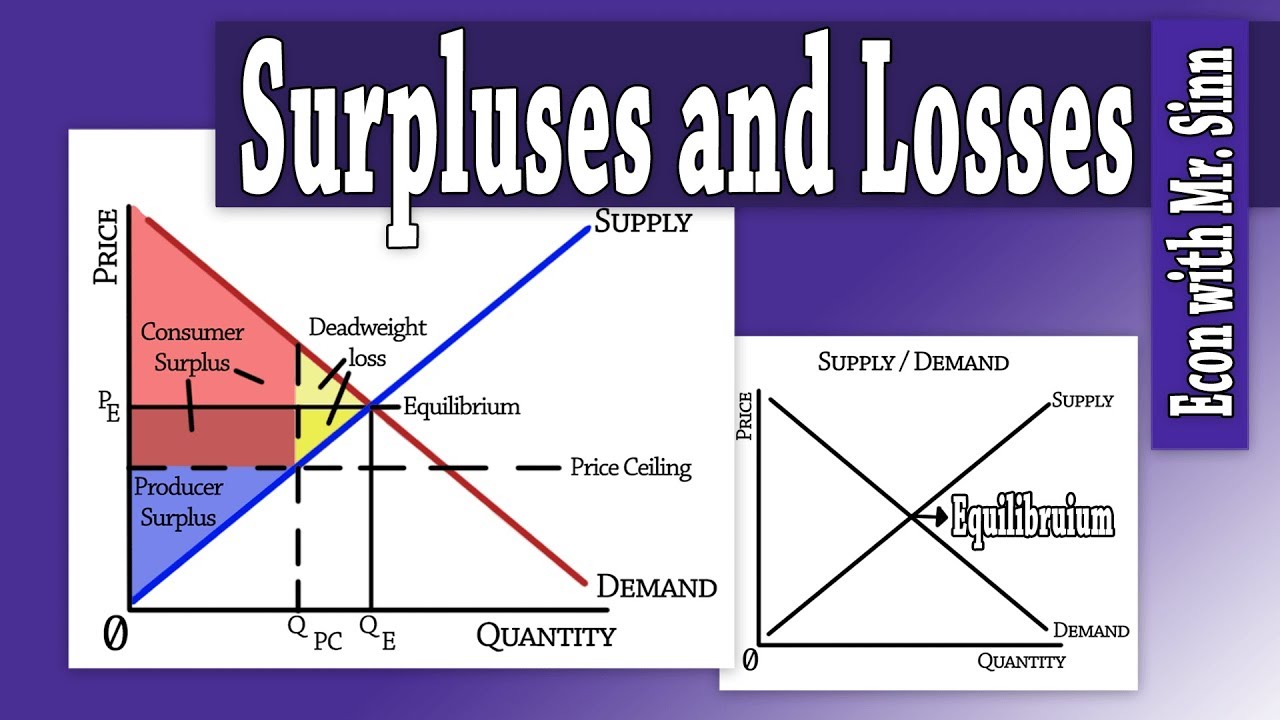

- 💰 Consumer surplus is the gain from exchange for consumers, represented by the area under the demand curve and above the market price.

- 🏭 Producer surplus is the gain from exchange for producers, represented by the area above the supply curve and below the market price.

- 📈 A free market maximizes the sum of consumer and producer surplus, but a tax disrupts this equilibrium.

- 🛍️ The introduction of a tax increases the price for buyers and decreases the quantity exchanged, reducing consumer surplus.

- 📉 Similarly, a tax reduces the price received by sellers, thus diminishing producer surplus.

- 💔 The area between the original and new equilibrium represents the tax revenue for the government, while the area outside this represents the deadweight loss.

- 🚫 Deadweight loss occurs when the tax prevents trades that would have been beneficial to both parties, resulting in a loss of value.

- 🔍 Deadweight loss is larger when the demand is more elastic, as it deters more trades for the same amount of revenue.

- 🛳️ Historical examples, such as the luxury yacht tax in 1990, demonstrate the potential negative consequences of taxing goods with elastic demand, including job losses and reduced tax revenue.

- 💡 It is generally more efficient to tax goods with inelastic demand to minimize deadweight loss and maximize tax revenue.

Q & A

What is the primary reason for a government to levy taxes?

-The primary reason for a government to levy taxes is to generate revenue.

What is the term used to describe the consumer's gain from exchange in the context of the script?

-The term used to describe the consumer's gain from exchange is 'consumer surplus'.

How is consumer surplus represented in the script's diagram?

-Consumer surplus is represented by the green area under the demand curve and above the price, up to the quantity exchanged.

What is the term used to describe the producer's gain from exchange?

-The term used to describe the producer's gain from exchange is 'producer surplus'.

How is producer surplus represented in the script's diagram?

-Producer surplus is represented by the blue area above the supply curve, up to the quantity exchanged and below the price.

What happens to consumer and producer surplus when a tax is introduced?

-When a tax is introduced, both consumer and producer surplus decrease because the price to the buyer increases and the price received by the seller decreases.

What is the term used to describe the loss of value from trades not occurring due to a tax?

-The term used to describe the loss of value from trades not occurring due to a tax is 'deadweight loss'.

How does the script illustrate the concept of deadweight loss with the example of a trip to New York?

-The script illustrates deadweight loss by comparing the value of a trip to New York with the cost of the trip, including a tax on bus fares. If the tax makes the trip uneconomical and the trip is not taken, the value of the trip is lost, representing deadweight loss.

Why are deadweight losses larger when the demand curve is more elastic, holding revenues constant?

-Deadweight losses are larger when the demand curve is more elastic because a tax will deter more trades, leading to a greater reduction in the quantity exchanged and thus a larger area of lost consumer and producer surplus.

What is the script's stance on taxing goods with inelastic demand versus elastic demand?

-The script suggests that it is better to tax goods with inelastic demand because they create less deadweight loss for the same amount of revenue compared to goods with elastic demand.

What was the outcome of the 10% luxury tax on yachts in 1990, and why was it repealed?

-The 10% luxury tax on yachts in 1990 resulted in significantly lower tax revenues than expected and a loss of jobs in the yacht industry. The federal government ended up paying more in unemployment benefits than it collected in tax revenues, leading to the repeal of the tax in 1993.

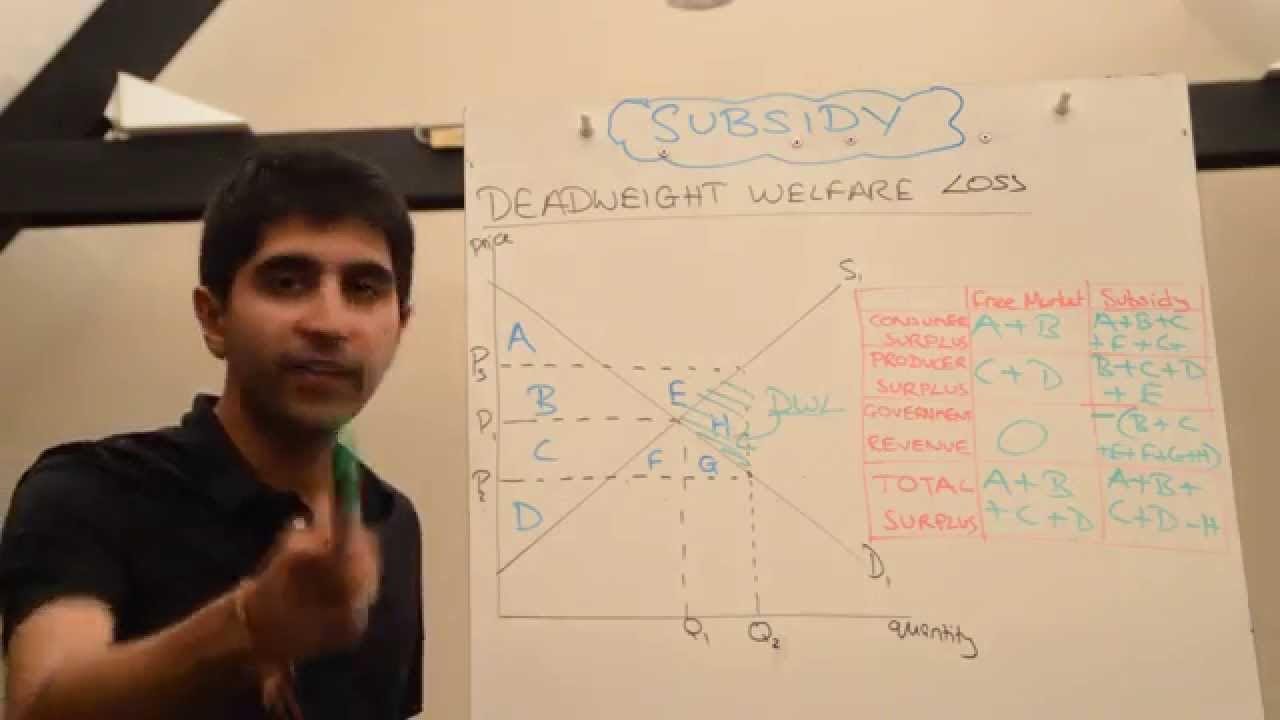

How does the script relate subsidies to taxes?

-The script relates subsidies to taxes by stating that subsidies are essentially negative taxes, and the principles discussed about taxes can be applied to subsidies with some adjustments in language.

Outlines

💼 Understanding Taxes and Deadweight Loss

In this segment, Prof. Alex Tabarrok introduces the concept of why governments levy taxes and the associated costs, specifically focusing on deadweight loss. He uses a diagram to illustrate the initial market equilibrium with no tax, where the price is $2 and 700 units are exchanged. The concept of consumer and producer surplus is explained, with the former being the area under the demand curve and above the price, and the latter above the supply curve and below the price. The introduction of a tax reduces both surpluses, leading to a decrease in the quantity exchanged and an increase in price for buyers. The tax revenue is calculated as the product of the tax rate and the quantity exchanged post-tax. Deadweight loss is introduced as the lost gains from trade due to the tax, which is the area that used to be part of consumer and producer surplus but is now unattainable. The segment concludes with an example of planning a trip to New York with a bus fare tax to further clarify the concept of deadweight loss.

🛳 The Impact of Taxes on Trade and Revenue

This paragraph delves deeper into the implications of deadweight loss, using the analogy of a bus trip tax to explain how taxes can deter trades and result in lost value for both consumers and producers. The example shows that when a tax is imposed, it can lead to a situation where the cost exceeds the perceived benefit, causing the consumer to forgo the trip entirely. This not only results in no revenue for the government but also in a deadweight loss, as the value created by the trade is lost. The concept is then generalized to trades in a market, illustrating how a tax reduces the number of trades and the associated value. The paragraph also discusses how deadweight losses are influenced by the elasticity of demand, with more elastic demand curves leading to larger deadweight losses for a given tax revenue. The narrative includes a historical example of a luxury tax on yachts in 1990, which resulted in reduced sales, lower tax revenue than expected, and significant job losses in the yacht industry, ultimately leading to the repeal of the tax.

💡 Lessons from Taxation and the Introduction of Subsidies

The final paragraph wraps up the discussion on taxes by highlighting the lesson that goods with elastic demand should not be taxed heavily as it leads to significant deadweight loss and potential secondary negative effects, such as job losses in related industries. It uses the example of the luxury yacht tax to emphasize the point. The paragraph then transitions to the topic of subsidies, which are described as negative taxes, suggesting that the principles discussed regarding taxes can be applied with some modifications to understand subsidies. The video concludes with an invitation for viewers to engage with practice questions or proceed to the next video in the series.

Mindmap

Keywords

💡Taxes

💡Revenues

💡Deadweight Loss

💡Consumer Surplus

💡Producer Surplus

💡Equilibrium

💡Tax Revenue

💡Elasticity of Demand

💡Inelastic Demand

💡Luxury Tax

💡Subsidies

Highlights

The primary purpose of government taxes is to generate revenue.

The cost of raising revenues through taxation includes deadweight loss, which is the loss of consumer and producer surplus.

Consumer surplus is the area under the demand curve and above the market price, representing the consumer's gain from exchange.

Producer surplus is the area above the supply curve and below the market price, indicating the producer's gain from exchange.

A free market maximizes the sum of consumer and producer surplus.

Taxation disrupts the free market equilibrium, leading to a reduction in both consumer and producer surplus.

The introduction of a tax results in a new equilibrium with a higher price for buyers and a lower price for sellers.

Tax revenue is calculated as the product of the tax rate and the quantity of goods exchanged after the tax is applied.

Deadweight loss occurs when the tax prevents certain trades from happening, resulting in a loss of value for both consumers and producers.

An example of deadweight loss is given through the hypothetical scenario of a tax on bus fares deterring trips to New York.

Deadweight loss is the value of the trades that do not occur due to the imposition of a tax.

The size of deadweight loss is influenced by the elasticity of the demand curve; it is larger with more elastic demand, holding revenues constant.

Taxing goods with inelastic demand results in smaller deadweight losses compared to goods with elastic demand.

The 1990 luxury tax on yachts in the U.S. resulted in lower tax revenues and job losses, illustrating the negative effects of taxing goods with elastic demand.

Economists suggest that taxing goods with inelastic demand is more efficient in terms of minimizing deadweight loss.

Subsidies can be understood as negative taxes and will be discussed in the next lecture.

Transcripts

Browse More Related Video

How to calculate Excise Tax and the Impact on Consumer and Producer Surplus

Taxation and dead weight loss | Microeconomics | Khan Academy

Rent control and deadweight loss | Microeconomics | Khan Academy

Y1/IB 29) Subsidy and Deadweight Welfare Loss

Price floors and surplus

Consumer/Producer Surplus & Deadweight Loss

5.0 / 5 (0 votes)

Thanks for rating: