How to calculate Excise Tax and the Impact on Consumer and Producer Surplus

TLDRThis tutorial explains the impact of excise taxation on consumer and producer surplus. It demonstrates through numerical examples how a tax imposed by the government reduces both consumer and producer surplus, depending on the elasticity of supply and demand. The video illustrates the calculation of surplus before and after a tax, the resulting tax revenue, and the deadweight loss to society. It also discusses who bears the tax burden, which is influenced by the relative elasticities of supply and demand, and notes the decrease in quantity produced post-tax.

Takeaways

- 📚 The tutorial discusses the impact of excise taxation on consumer and producer surplus.

- 💰 A government-imposed tax leads to a decrease in both consumer and producer surplus.

- 📉 The extent of the decrease in surplus is influenced by the elasticity of supply and demand.

- 🏦 The government benefits from additional tax revenue, but society experiences a deadweight loss.

- 📈 The initial equilibrium is established with a price of 8 and a quantity of 6, creating a consumer surplus triangle.

- 🟨 The consumer surplus is calculated as half the base times the height of the demand curve triangle, resulting in 36.

- 🟦 Producer surplus is the area below the price and above the supply curve, calculated as 18 before the tax.

- 🚫 The imposition of a tax shifts the supply curve up by the tax amount, creating a new equilibrium with altered price and quantity.

- 🛒 After the tax, the new equilibrium has a higher price (10) and lower quantity (5), affecting consumer and producer surplus.

- 📊 Consumer surplus post-tax is recalculated based on the new price and quantity, resulting in 25.

- 📝 Producer surplus is recalculated as the area between the original supply curve and the price received by producers, now 12.5.

- 🔢 Deadweight loss is determined by comparing total benefits before and after the tax, resulting in a loss of 1.5.

- 🔄 The distribution of the tax burden between consumers and producers depends on the elasticity of demand and supply.

- 📉 The tax results in a higher price and reduced quantity of goods produced and sold in the market.

Q & A

What is the main topic of this tutorial?

-The main topic of this tutorial is the impact of excise taxation on consumer surplus and producer surplus.

How does the government's imposition of a tax affect consumer and producer surplus?

-When the government imposes a tax, there is a decrease in both consumer surplus and producer surplus.

What factors determine the amount of decrease in consumer or producer surplus due to taxation?

-The amount of decrease in consumer or producer surplus is dependent upon the elasticity of supply and the elasticity of demand.

What are the two benefits mentioned for the government from imposing a tax?

-The two benefits mentioned for the government are additional tax revenue and the ability to influence market prices and quantities.

What is the concept of deadweight loss in the context of taxation?

-Deadweight loss refers to the inefficiency created by taxation, where there is a loss of total benefit to society that is not captured by either the government or the market participants.

How is consumer surplus calculated in the script?

-Consumer surplus is calculated by determining the area of the triangle formed above the price and below the demand curve, using the formula 1/2 * base * height.

What is the formula used to calculate producer surplus in the script?

-Producer surplus is calculated by determining the area of the triangle formed below the price and above the supply curve, using the formula 1/2 * base * height.

What is the total benefit before the tax according to the script?

-The total benefit before the tax is the sum of consumer surplus (36) and producer surplus (18), which equals 54.

How does the imposition of a tax of three units shift the supply curve and affect equilibrium?

-The imposition of a tax of three units shifts the entire supply curve up by three units, leading to a new equilibrium point with a higher price and a lower quantity.

What is the formula used to calculate the deadweight loss in the script?

-Deadweight loss is calculated by subtracting the total benefit after the tax (consumer surplus + tax revenues + producer surplus) from the total benefit before the tax.

How does the script illustrate the distribution of the tax burden between consumers and producers?

-The script shows that the producer incurs one unit of the tax, and the consumer incurs two units of the tax, indicating that the tax burden is shared between them. The ratio of this burden is dependent on the elasticity of demand and supply.

What is the impact of the tax on the quantity of goods produced after the tax, as mentioned in the script?

-The quantity of goods produced drops from 6 to 5 after the tax, indicating a reduction in production due to the imposition of the tax.

Outlines

📊 Understanding the Impact of Excise Tax on Surplus

In this tutorial, the concept of excise taxation and its effects on consumer and producer surplus is explored. It starts with an explanation of how taxation generally reduces both consumer and producer surplus, depending on the elasticities of supply and demand. The government gains additional tax revenue, but society experiences a deadweight loss. The tutorial then illustrates these concepts using a supply and demand graph. Initially, consumer surplus is calculated by finding the area of a triangle above the equilibrium price and below the demand curve. Producer surplus is similarly calculated as the area below the equilibrium price and above the supply curve. The total benefit before taxation is the sum of consumer and producer surplus.

🔍 Calculating the Effects of Taxation on Market Equilibrium

After introducing a tax of three units, the tutorial explains how the supply curve shifts upward by the tax amount. This results in a new equilibrium point where the quantity decreases to five units and the price rises to ten units. The consumer now pays a higher price, reducing the consumer surplus, which is recalculated as the area of a new triangle above the new price and below the demand curve. The producer receives a lower effective price after the tax, reducing producer surplus, which is calculated as the area below the new effective price and above the original supply curve. The deadweight loss, representing the inefficiency introduced by the tax, is the reduction in total surplus from the original pre-tax total to the new post-tax total. The tax burden is shared between consumers and producers, depending on the elasticities of supply and demand. The tutorial concludes by noting the overall decrease in quantity produced and sold due to the tax.

Mindmap

Keywords

💡Excise Taxation

💡Consumer Surplus

💡Producer Surplus

💡Elasticity of Supply and Demand

💡Deadweight Loss

💡Equilibrium

💡Tax Revenue

💡Supply and Demand Curves

💡Price Ceiling

💡Quantity Effect

💡Tax Burden

Highlights

The tutorial discusses the impact of excise taxation on consumer and producer surplus.

Taxation leads to a decrease in both consumer and producer surplus.

The extent of the decrease in surplus is influenced by the elasticity of supply and demand.

Government benefits from additional tax revenue, but society experiences a deadweight loss.

A graphical representation of the supply and demand curves is used to illustrate the equilibrium point.

Consumer surplus is calculated as the area above the price and below the demand curve.

Producer surplus is the area below the price and above the supply curve.

The total benefit before tax is the sum of consumer and producer surplus.

Imposition of a tax shifts the supply curve upward, creating a new equilibrium point.

The new equilibrium results in a lower quantity and a higher price.

Total tax revenue is calculated as the tax rate multiplied by the quantity.

Consumer surplus after tax is the area above the new price and below the demand curve.

Producer surplus after tax is the area below the price received by producers and above the supply curve.

Deadweight loss is calculated by comparing total benefits before and after the tax.

The distribution of the tax burden depends on the elasticity of demand and supply.

A decrease in quantity post-tax indicates a change in market dynamics.

The tutorial concludes with a summary of the effects of taxation on market prices and quantities.

Transcripts

Browse More Related Video

Tax Revenue and Deadweight Loss

Taxation and dead weight loss | Microeconomics | Khan Academy

How to calculate the impact of import and export tariffs.

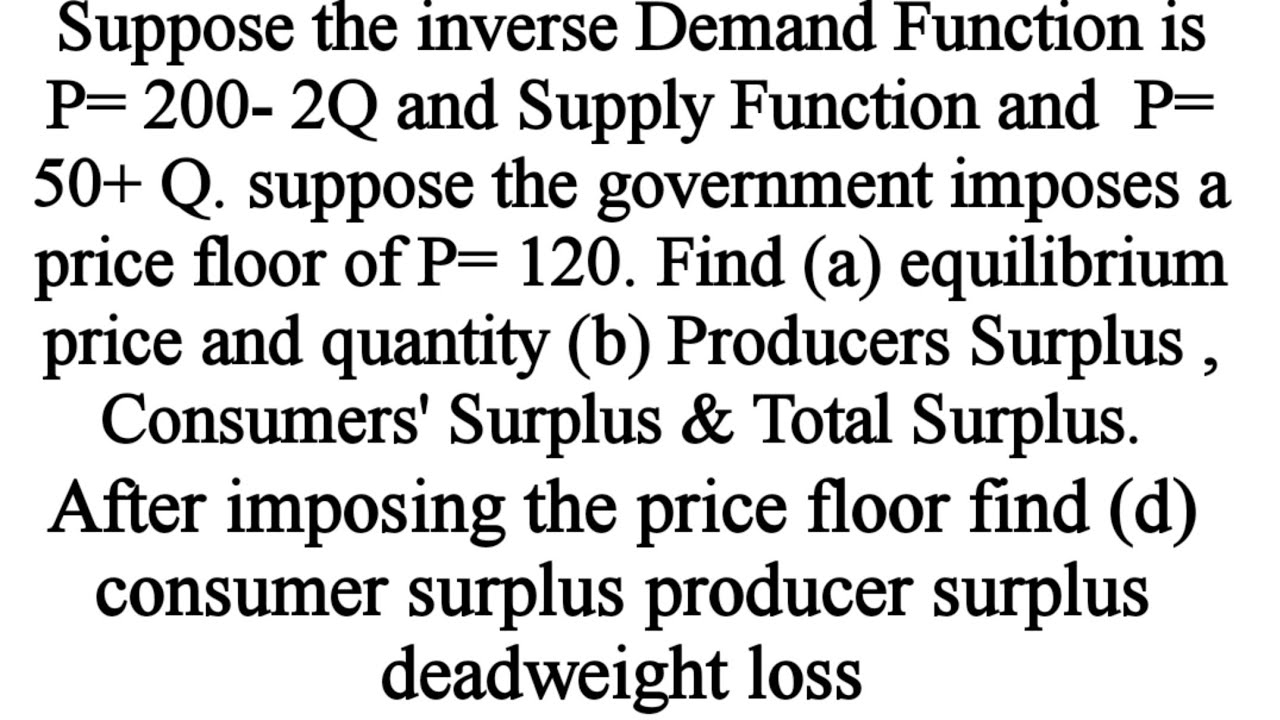

Consumer Surplus, Producer Surplus,& Deadweight Loss before and after imposing the price ceiling?

Consumers 'surplus Producers' Surplus , Total surplus, deadweight loss with price floor

Price floors and surplus

5.0 / 5 (0 votes)

Thanks for rating: