Business Calculus - Math 1329 - Section 4.1 - Exponential Functions and Continuous Compounding

TLDRThis video script delves into the world of exponential functions, focusing on their applications and properties. It begins by defining exponential functions and their use in modeling scenarios such as population growth, disease spread, and financial investments. The script explores the properties of these functions, including their continuity, positivity, and asymptotic behavior. It then guides viewers through an interactive exploration with GeoGebra, a mathematical software, to better understand the topic. The rules of exponents are reviewed, and several examples are provided to illustrate their application in simplifying expressions and solving equations. The concept of continuous compounding in finance is introduced, explaining how it leads to exponential growth in investment accounts. The video also covers the calculation of effective interest rates to compare different investment options. Finally, it challenges viewers to explore a special limit to discover the natural base e, a fundamental constant in mathematics.

Takeaways

- 📈 Exponential functions are used to model situations where future value depends on the current value, such as population growth, spread of disease, money investments, and radioactive decay.

- 📊 The properties of exponential functions include being continuous for all real numbers, always positive, having a horizontal asymptote at y=0, no x-intercepts, and depending on the base, either increasing or decreasing behavior.

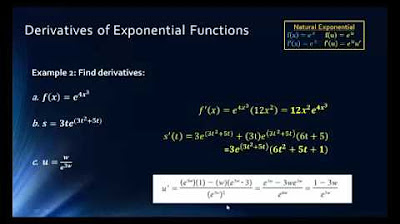

- 🔢 The algebraic properties of exponents include rules for multiplication and division, powers and roots, and zero and negative exponents.

- 🧮 Solving exponential equations often involves making the bases the same and then comparing the exponents to find the variable's value.

- 🏛 The natural base 'e' is discovered by examining a special limit involving (1 + 1/n)^n as n approaches infinity.

- 💰 Compound interest is calculated using the formula A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest.

- 📊 Continuous compound interest is represented by the formula A = Pe^(rt), which is derived from the limit of compound interest as the number of compounding periods per year approaches infinity.

- 📊 The graph of continuous compound interest shows an exponential growth that is less steep than might be expected, due to the limiting factor of the base 'e'.

- 💵 The effective interest rate is a way to compare different investment options by calculating the equivalent simple interest rate after one year.

- 🤔 The decision between different investment options should not be based solely on the stated interest rate due to varying compounding frequencies; the effective interest rate provides a more accurate comparison.

- 📚 Understanding the properties of exponential functions and the rules of exponents is crucial for solving a wide range of mathematical and real-world problems, from finance to scientific calculations.

Q & A

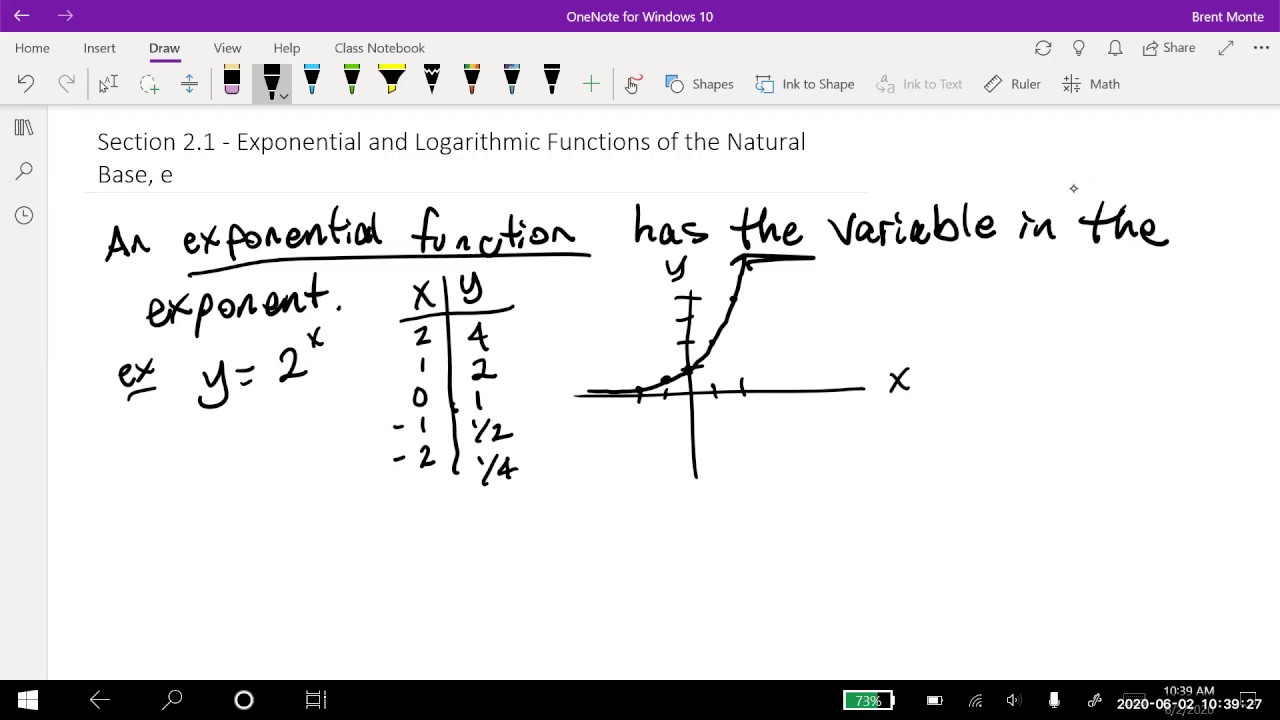

What is an exponential function and what is its general form?

-An exponential function is a mathematical function in the form y = B^x, where B is called the base. The base must be positive and cannot be equal to 1.

What are some real-world applications of exponential functions?

-Exponential functions are used to model situations where future value depends on the current value, such as population growth, spread of disease, money investments, and radioactive decay in chemistry.

What are the properties of exponential functions when the base B is greater than 1?

-When the base B is greater than 1, the function is increasing for all x, approaches 0 as x approaches negative infinity, and approaches infinity as x approaches positive infinity. It has a horizontal asymptote on the left side and goes to infinity on the right side.

How does the behavior of an exponential function change when the base B is between 0 and 1?

-When the base B is between 0 and 1, the function is decreasing for all x, goes to positive infinity as x approaches negative infinity, and approaches 0 as x approaches positive infinity. Its horizontal asymptote is on the right side.

What is the significance of the number e in the context of continuous compounding?

-The number e, known as Euler's number, is a special constant that is the base for natural logarithms. In the context of continuous compounding, e is used as the base for the exponent in the formula for continuous compound interest, which is A = P * e^(RT).

How does the compound interest formula change when we consider continuous compounding?

-For continuous compounding, the formula becomes A = P * e^(RT), where A is the amount of money accumulated after n years, including interest, P is the principal amount, R is the annual interest rate (in decimal), and T is the time the money is invested for in years.

What is the effective interest rate and why is it used?

-The effective interest rate is the equivalent simple interest rate after one year. It is used to compare different compound interest rates to determine which investment is more advantageous by standardizing the comparison to a single year period.

How does the frequency of compounding affect the amount of money accumulated in an account?

-The more frequently the money is compounded, the more interest is earned. This is because with each compounding period, the interest earned is added to the principal, which then earns more interest in the next period.

What is the formula for calculating the effective interest rate for compound interest?

-The formula for the effective interest rate (EAR) for compound interest is EAR = (1 + (R/n))^n - 1, where R is the annual interest rate, n is the number of compounding periods per year.

What is the main difference between compound interest and continuous compound interest in terms of the formula used?

-The main difference is that compound interest uses the formula A = P * (1 + R/n)^(nt), while continuous compound interest uses the formula A = P * e^(RT).

How does the concept of limits play a role in deriving the formula for continuous compound interest?

-The concept of limits is used to allow the number of compounding periods per year (n) to approach infinity, which results in the formula for continuous compound interest A = P * e^(RT).

What is the relationship between the natural base e and the limit of (1 + 1/n)^n as n approaches infinity?

-The number e is defined as the limit of (1 + 1/n)^n as n approaches infinity. This special limit is used as the base for the exponent in the formula for continuous compound interest.

Outlines

📈 Exponential Functions and Their Applications

The first paragraph introduces the topic of exponential functions, emphasizing their use in modeling scenarios where future value is contingent on the current value, such as population growth, disease spread, and financial investments. The properties of exponential functions are discussed, including their continuous nature, positivity, and the presence of a horizontal asymptote. The role of the base in determining the function's behavior, particularly when it's greater than 1 or between 0 and 1, is also explained. The paragraph concludes with an invitation to explore these properties using GeoGebra and to review the algebraic properties of exponents.

🧮 Exponent Rules and Simplification Techniques

This section reviews the rules for exponents, including operations such as raising a power to a power, multiplying and dividing powers with the same base, and dealing with zero and negative exponents. It then delves into simplifying expressions using these rules, providing a step-by-step approach to complex problems. The paragraph uses examples to illustrate how to apply the exponent rules to simplify expressions and solve exponential equations, highlighting the importance of understanding the underlying mathematical properties.

🔍 Solving Exponential Equations and Understanding Limits

The focus shifts to solving exponential equations by making the bases the same and then equating the exponents. The paragraph also explores the concept of limits, particularly the natural base 'e', which is derived from a specific limit involving the function (1 + 1/n)^n as n approaches infinity. The importance of this limit in understanding the behavior of exponential functions and the value of 'e' is emphasized. Additionally, the paragraph encourages viewers to work on a group activity to further explore this limit and its implications.

💰 Demand Functions and Exponential Modeling in Economics

The application of exponential functions in economics is discussed, specifically in the context of price demand functions. An example is provided where the price per case of energy drinks is calculated based on the number of cases demanded, using an exponential model. The revenue function and the revenue earned from selling a certain number of cases are also calculated, demonstrating how exponential functions can be applied to real-world economic scenarios.

📊 Compound Interest and Its Exponential Nature

The concept of compound interest is introduced, explaining how it is an exponential function of time due to the accumulation of interest on interest. The compound interest formula is derived and its components are defined, including the principal, interest rate, compounding frequency, and time. The benefits of long-term compounding, especially in retirement accounts, are highlighted, emphasizing the power of exponential growth over time.

📉 Continuous Compound Interest and Its Formula

The paragraph delves into continuous compound interest, which is a limit of the compound interest formula as the number of compounding periods per year approaches infinity. The formula for continuous compound interest is derived, and the natural base 'e' is shown to be a factor in this formula. An example calculation is provided to demonstrate how to use the formula to find the amount in an account after a certain period, illustrating the practical application of continuous compounding.

🏦 Effective Interest Rate and Investment Comparison

The final paragraph discusses the effective interest rate, which is a way to compare different investment options by calculating the equivalent simple interest rate after one year. The formula for the effective interest rate is derived, and an example is provided to illustrate how to determine which investment option is more favorable when given two choices with different interest rates and compounding frequencies. The importance of precise calculations and understanding the impact of compounding frequency on investment growth is emphasized.

Mindmap

Keywords

💡Exponential Function

💡Continuous Compounding

💡Base of Natural Logarithm (e)

💡Compound Interest

💡Effective Interest Rate

💡Exponentiation

💡Limit

💡Rational Functions

💡Algebraic Properties of Exponents

💡Interest Rate Conversion

💡Asymptote

Highlights

Section 4.1 focuses on exponential functions and their application in areas such as money, population growth, disease spread, and radioactive decay.

Exponential functions are defined as y = B^x, where B is the base and must be greater than 0 and not equal to 1.

The natural base 'e' is discovered by examining a specific limit involving (1 + 1/n)^n as n approaches infinity.

Exponential functions have distinct properties when the base B is greater than 1 or between 0 and 1, affecting their growth and decay rates.

The properties of exponents are reviewed, including multiplication, division, and powers of exponents.

A step-by-step guide to simplifying exponential expressions using the properties of exponents is provided.

Solving exponential equations involves making the bases the same and then equating the exponents.

The concept of continuous compounding is introduced as a way to model situations where money is invested and interest is added continuously over time.

The formula for continuous compounding is derived, showing how it leads to the natural base 'e'.

An example calculation demonstrates the revenue function for a company selling energy drinks, highlighting the use of exponential functions in real-world scenarios.

The compound interest formula is explained, emphasizing the power of compounding over extended periods, such as for retirement accounts.

The difference between continuous and discrete compounding is explored, with an example comparing the growth of an investment under both scenarios.

The effective interest rate is introduced as a method to compare different investment options with varying interest rates and compounding frequencies.

A formula for calculating the effective interest rate is derived, allowing for a direct comparison between different compounding investment scenarios.

An example is worked through to illustrate which investment option is better between two choices with different compounding periods and interest rates.

The importance of understanding the properties and applications of exponential functions is emphasized for various real-world applications, including finance and growth modeling.

Transcripts

Browse More Related Video

5.0 / 5 (0 votes)

Thanks for rating: