How to Calculate Deadweight Loss (with a Price Floor) | Think Econ

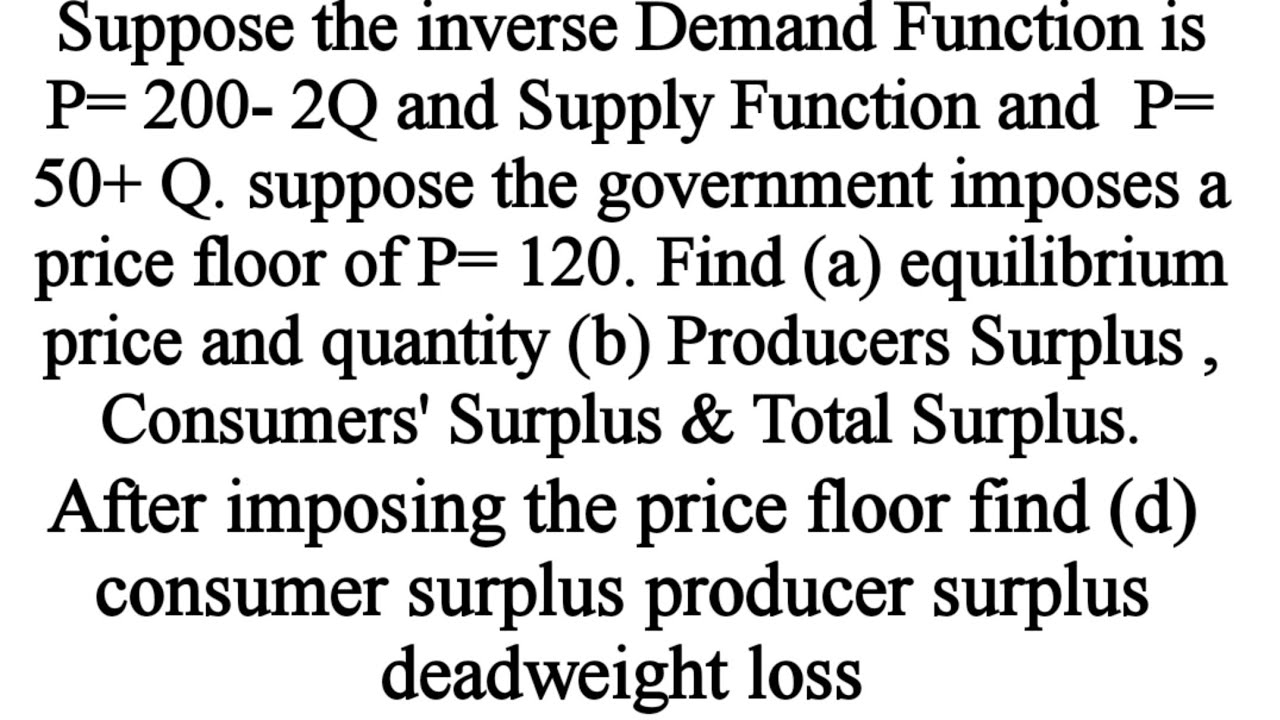

TLDRThis educational video delves into the concept of deadweight loss in economics, explaining its definition, occurrence in markets, and calculation methods. It starts with an overview of producer and consumer surplus, then introduces the supply and demand equations to find equilibrium price and quantity (P* and Q*). The video illustrates how a price floor can cause a market imbalance, resulting in deadweight loss, and provides a step-by-step guide to calculate this loss using the area of triangles in a supply and demand graph. The example given shows the impact of a price floor set above the equilibrium, leading to a surplus and a calculable deadweight loss of $540.

Takeaways

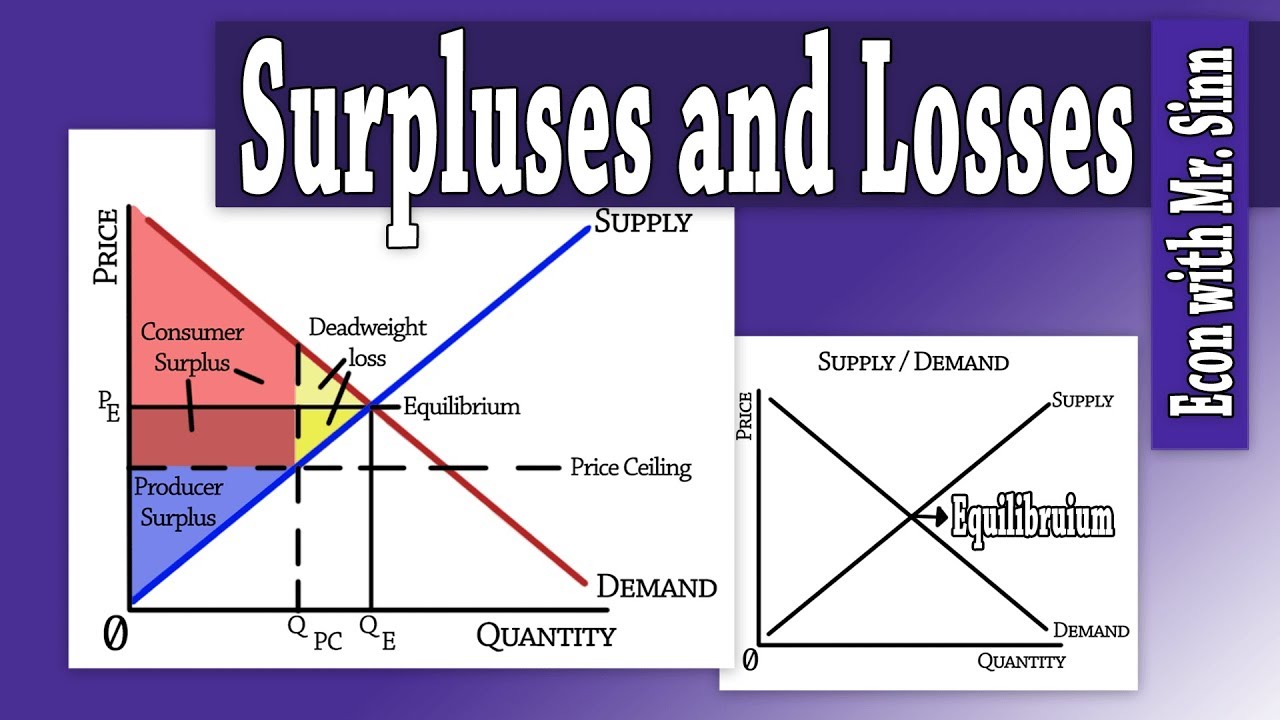

- 📚 Deadweight Loss is a concept in economics that represents the loss in total surplus when the quantity traded is less than the competitive equilibrium.

- 🔍 Understanding Deadweight Loss requires knowledge of producer surplus and consumer surplus, which are the sums of the gains to producers and consumers in a market transaction.

- 📈 The script explains how to calculate Deadweight Loss through a step-by-step process, starting with setting up a supply and demand graph.

- 📝 The video uses specific supply and demand equations to illustrate the calculation, with the demand equation being Qd = 270 - 5P and the supply equation being Qs = 10P.

- 🧩 To find the equilibrium price (P*) and quantity (Q*), the script demonstrates solving the equations by setting Qd equal to Qs.

- 📉 Deadweight Loss occurs when there is a market distortion, such as a price floor set by the government, which results in a quantity traded (Q floor) that is less than Q*.

- 💰 The script shows how to calculate the new consumer and producer surpluses under a price floor and how these changes lead to a reduction in total surplus.

- 📊 The area of the 'yellow triangle' in the graph represents the Deadweight Loss, which is the difference between the equilibrium surplus and the surplus under the price floor.

- 📐 The calculation of the Deadweight Loss involves determining the base and height of the 'yellow triangle', which are the price difference and quantity difference, respectively.

- 🔢 The final calculation of Deadweight Loss is shown as the area of the triangle, calculated as (base * height) / 2, resulting in a specific dollar amount.

- 👍 The video encourages viewers to engage with the content by liking, subscribing, and commenting on what economic topics they would like to see covered in future videos.

Q & A

What is deadweight loss?

-Deadweight loss is a loss in total surplus that occurs when the quantity traded in a market is less than the competitive equilibrium quantity.

Why is understanding producer surplus and consumer surplus important when studying deadweight loss?

-Understanding producer surplus and consumer surplus is important because deadweight loss is a loss in total surplus, which is the sum of producer surplus and consumer surplus.

What are the supply and demand equations used in the example?

-The supply equation is Qs = 10P, and the demand equation is Qd = 270 - 5P.

How do you find the equilibrium price (P*) and quantity (Q*) in the example?

-You set the supply and demand equations equal to each other (270 - 5P = 10P) and solve for P. This gives P* = 18. Then, substitute P* into one of the equations to find Q*. Using Qs = 10P, Q* = 180.

What happens when a price floor is set above the equilibrium price?

-When a price floor is set above the equilibrium price, it creates a surplus in the market because the quantity supplied exceeds the quantity demanded.

How is the new quantity traded (Q floor) determined when a price floor is imposed?

-Q floor is determined by substituting the price floor value into the demand equation. For example, with a price floor of 30, Q floor = 270 - 5*30 = 120.

What is the corresponding price when the quantity supplied equals Q floor?

-The corresponding price is found by substituting Q floor into the supply equation. For Q floor = 120, the price is 12 (120 = 10P, so P = 12).

How do you calculate the area of the deadweight loss triangle?

-The area of the deadweight loss triangle is calculated using the formula: area = base * height / 2. The base is the difference between the price floor and the corresponding price (30 - 12 = 18), and the height is the difference between the equilibrium quantity and Q floor (180 - 120 = 60). Therefore, the area is 18 * 60 / 2 = 540.

What changes occur to consumer and producer surplus when a price floor is imposed?

-Consumer surplus decreases because it is the area below the demand curve and above the new selling price, while producer surplus changes to the area above the supply curve and below the new selling price. The area in the middle represents the deadweight loss.

What is the significance of calculating deadweight loss in terms of dollars?

-Calculating deadweight loss in terms of dollars provides a tangible measure of the economic inefficiency introduced by policies like price floors, helping to quantify the loss in welfare for consumers and producers.

Outlines

📚 Introduction to Deadweight Loss

The video begins by introducing the concept of Deadweight Loss, explaining its importance in understanding market economics. It emphasizes the need to know producer and consumer surplus before diving into deadweight loss, as it is a loss in total surplus. The presenter outlines the steps to calculate deadweight loss and uses a supply and demand graph to demonstrate the process. The video also provides equations for supply and demand, which are essential for calculating the equilibrium price (P*) and quantity (Q*), and ultimately the deadweight loss.

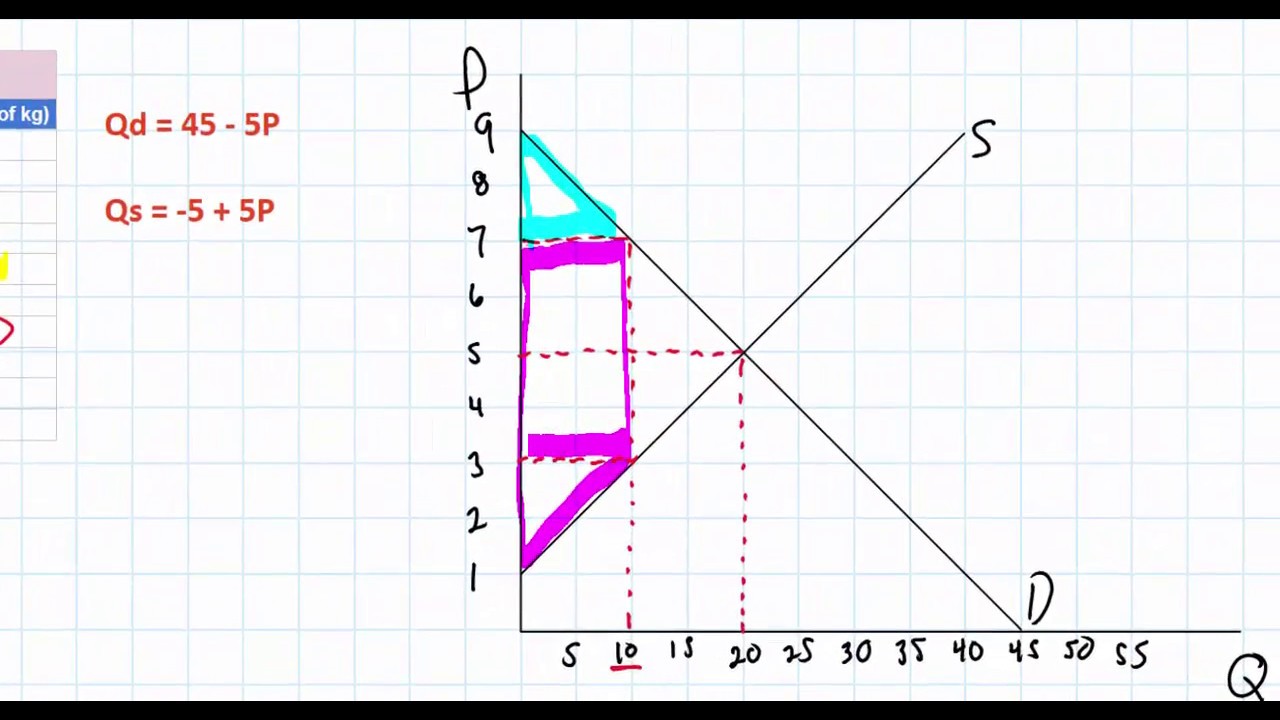

📉 Calculating Deadweight Loss with a Price Floor

This paragraph delves into the specifics of calculating deadweight loss when a price floor is imposed by the government. It explains how a price floor disrupts the market equilibrium, leading to a surplus and a reduction in both consumer and producer surplus. The presenter guides through the process of finding the new quantity traded (Q floor) at the price floor and the corresponding price where the supply curve intersects this quantity. Using the area of a triangle, the video demonstrates how to calculate the deadweight loss in monetary terms, providing a step-by-step approach to understand the impact of a price floor on market efficiency.

Mindmap

Keywords

💡Deadweight Loss

💡Consumer Surplus

💡Producer Surplus

💡Equilibrium Price (P*)

💡Equilibrium Quantity (Q*)

💡Price Floor

💡Supply and Demand Equations

💡Total Surplus

💡Law of Supply

💡Law of Demand

💡Quantity Traded (Q floor)

Highlights

Introduction to the concept of Deadweight Loss and its importance in economic analysis.

Explanation of the prerequisites for understanding Deadweight Loss, specifically producer and consumer surplus.

Guidance on where to find additional resources for producer and consumer surplus concepts.

The fundamental relationship between total surplus, consumer surplus, and producer surplus.

Demonstration of how to set up a basic supply and demand graph for analysis.

Use of specific supply and demand equations for practical calculation of Deadweight Loss.

Step-by-step calculation of equilibrium price (P*) and quantity (Q*) using the given equations.

Graphical representation of consumer and producer surplus in a market equilibrium.

Discussion of market disequilibrium scenarios leading to Deadweight Loss.

Impact of a government-imposed price floor on market equilibrium and the creation of Deadweight Loss.

Calculation of the new quantity traded (Q floor) under a price floor scenario.

Determination of the intersection points of the demand curve and the price floor.

Adjustment of consumer and producer surplus areas due to the change in market price.

Identification of the area representing Deadweight Loss in the context of a price floor.

Methodology for calculating the magnitude of Deadweight Loss using geometric principles.

Final calculation of Deadweight Loss in dollars as an example for test or practical scenarios.

Encouragement for viewer engagement and feedback on the video content.

Conclusion and sign-off, inviting viewers to the next video in the series.

Transcripts

Browse More Related Video

Consumers 'surplus Producers' Surplus , Total surplus, deadweight loss with price floor

Calculating the area of Deadweight Loss (welfare loss) in a Linear Demand and Supply model

Price floors and surplus

Consumer Surplus, Producer Surplus,& Deadweight Loss before and after imposing the price ceiling?

Consumer/Producer Surplus & Deadweight Loss

How to Calculate Producer Surplus and Consumer Surplus from Supply and Demand Equations | Think Econ

5.0 / 5 (0 votes)

Thanks for rating: