Top 10 Excel Financial Formulas From Beginner to PRO

TLDRThis educational video offers an in-depth exploration of Excel's financial formulas across three proficiency levels. It begins with basic time value of money functions, illustrating how to calculate present and future values with examples. The intermediate section delves into capital budgeting, teaching viewers how to assess investment projects using NPV, IRR, and their semi-annual counterparts, XNPV and XIRR. The advanced segment focuses on creating a loan schedule, detailing how to calculate monthly payments, interest, and principal over time. The video is sponsored by NordPass, emphasizing secure password management in a business context.

Takeaways

- 📈 The video covers Excel's financial formulas across three levels: basic, intermediate, and advanced.

- 🚀 Basic functions include calculating present value (PV) and future value (FV) using the time value of money concept.

- 💰 An example is provided where you want to buy a car in three years, and you need to invest money to grow it to the future value of the car.

- 🏦 Intermediate functions discuss capital budgeting techniques such as Net Present Value (NPV), Modified Internal Rate of Return (MIRR), and Internal Rate of Return (IRR).

- 🛍️ A scenario of opening a new store for Nike is used to illustrate how to assess the profitability of a project using NPV and IRR.

- 📊 The importance of discounting cash flows to year zero to accurately compare their value over time is highlighted.

- 📚 Advanced functions include creating a loan schedule to understand the breakdown of monthly payments into principal and interest.

- 💼 The video demonstrates how to calculate monthly payments, principal payments, interest payments, and remaining balance over the loan term.

- 🔢 Formulas like PMT, PPMT, and IPMT are used to create a detailed loan payment schedule in Excel.

- 📋 The script shows how to use Excel functions to automate the calculation of loan payments for each month over the term.

- 🔗 Nordpass is mentioned as a sponsor, offering a secure way to manage passwords and confidential information in a business setting.

Q & A

What are the three levels of financial formulas covered in the video?

-The video covers basic functions on the time value of money, intermediate functions on capital budgeting like the NPV and IRR, and advanced functions including a loan schedule.

What is the purpose of calculating the present value (PV)?

-The present value calculation determines how much money is needed currently to reach a future value after a certain period of time, taking into account an expected rate of return on investment.

How is the future value (FV) calculated in Excel?

-The future value is calculated in Excel using the FV function, which requires the input of the present value, the interest rate, and the number of periods.

What is the significance of the time value of money concept in financial formulas?

-The time value of money concept states that a sum of money today is worth more than the same sum in the future due to its potential to grow through investment, which is crucial for accurately comparing cash flows over time.

What does NPV stand for and why is it important in capital budgeting?

-NPV stands for Net Present Value, which is important in capital budgeting as it helps to determine the profitability of an investment by discounting all cash flows to their present value.

How does the video demonstrate the calculation of NPV in Excel?

-The video demonstrates the NPV calculation by using the NPV function in Excel, which requires the discount rate and a series of cash flows, including the initial investment.

What is the difference between NPV and XNPV?

-While NPV calculates the net present value based on a series of cash flows and a discount rate, XNPV accounts for the dates of those cash flows, making it more accurate for projects with irregular cash flow dates.

What does IRR stand for and what does it represent?

-IRR stands for Internal Rate of Return, which represents the percentage return on an investment that makes the NPV of all cash flows equal to zero.

How is the loan schedule created in the video?

-The loan schedule is created by calculating monthly payments, interest, and principal for each payment period, and then adjusting the remaining balance accordingly for the next period.

What is the purpose of calculating the monthly payment, interest, and principal in a loan schedule?

-Calculating these components helps to understand the breakdown of each loan payment, showing how much goes towards paying off the principal and how much is interest, which is important for financial planning and budgeting.

What is the significance of the remaining balance in a loan schedule?

-The remaining balance indicates how much of the loan has been paid off over time, which is crucial for tracking the progress of loan repayment and ensuring that the loan is fully repaid by the end of the term.

How does the video ensure the accuracy of the loan schedule calculations?

-The video ensures accuracy by verifying that the sum of the principal and interest payments for each month equals the total monthly payment, and by confirming that the remaining balance is zero at the end of the loan term.

Outlines

📈 Basic Financial Formulas in Excel

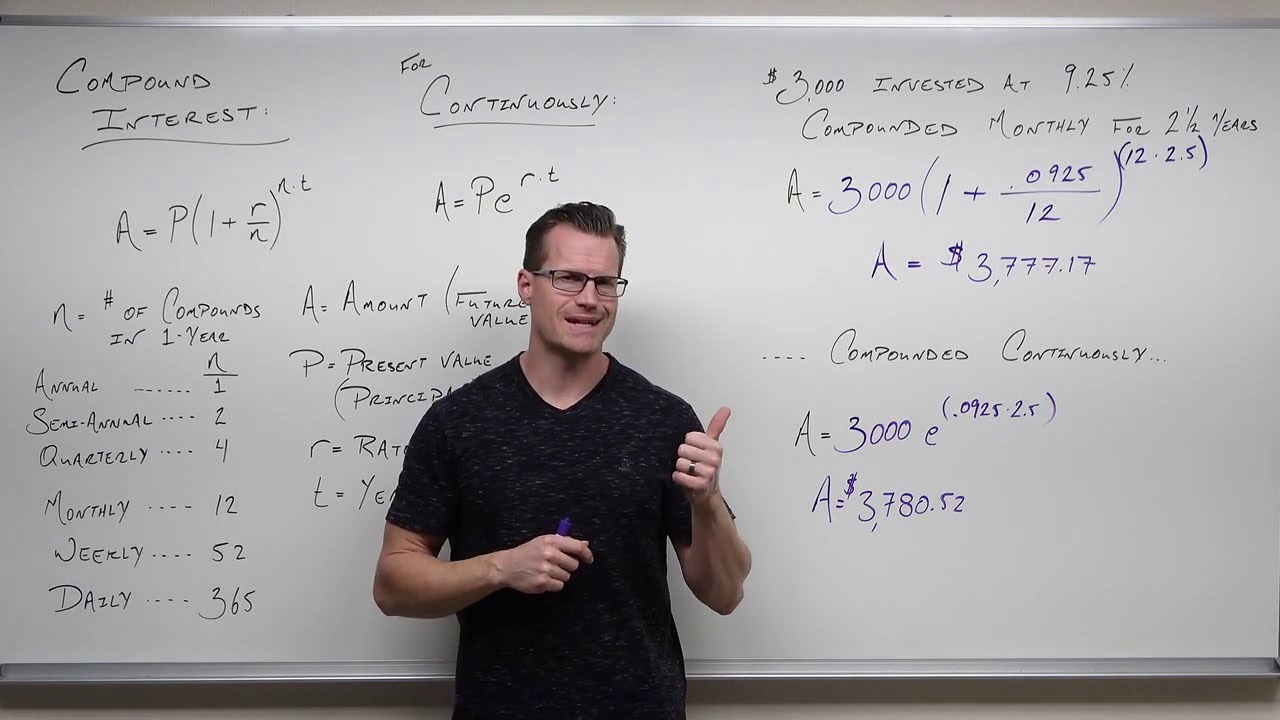

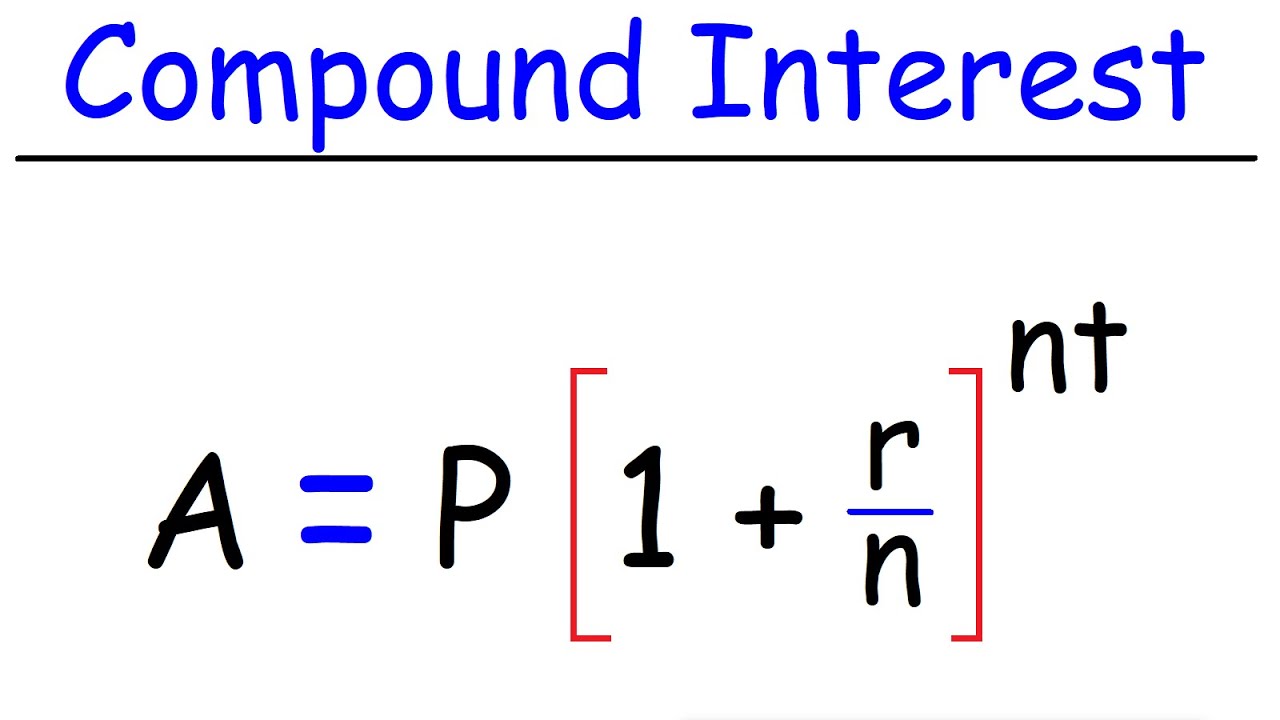

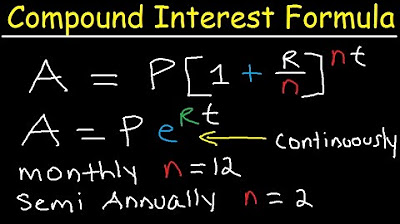

This paragraph introduces the basic financial formulas in Excel, focusing on the time value of money. It explains how to calculate present value (PV) and future value (FV) using examples. The script walks through a scenario where one might want to buy a car in three years, calculating the PV required to reach a future value of $100,000 with an 8% return rate. It also discusses how to determine the FV of an investment of $79,000 over 30 years, assuming the same 8% return rate. Additionally, it covers the future value of an annuity with recurring payments, illustrating how to calculate the growth of an investment with annual contributions.

🚀 Intermediate Financial Functions: Capital Budgeting

The second paragraph delves into intermediate financial functions, specifically capital budgeting techniques such as the Modified Internal Rate of Return (MIRR) and the Net Present Value (NPV). It uses a hypothetical scenario where a company like Nike is considering opening a new store. The script explains how to calculate NPV using a 6% discount rate and how to adjust for semi-annual cash flows using the XNPV and XIRR functions. The paragraph emphasizes the importance of considering the time value of money when assessing investment projects and provides a step-by-step guide on how to perform these calculations in Excel.

💼 Advanced Financial Analysis: Loan Payment Schedule

The final paragraph discusses advanced financial analysis, specifically creating a loan payment schedule in Excel. It outlines the process of obtaining a loan to open a store, using a $500,000 loan with a 7% annual interest rate over five years as an example. The script explains how to convert annual interest rates to monthly rates, calculate the number of payments, and determine the monthly payment amount using the PMT function. It also details how to break down the monthly payment into principal and interest components using the PPMT and IPMT functions. The paragraph concludes with instructions on creating a table to visualize the loan repayment process over time, ensuring that the loan is fully repaid by the end of the term.

Mindmap

Keywords

💡Excel

💡Financial formulas

💡Time value of money

💡Capital budgeting

💡Present value (PV)

💡Future value (FV)

💡Loan schedule

💡Net Present Value (NPV)

💡Internal Rate of Return (IRR)

💡XNPV and XIRR

Highlights

Introduction to Excel's financial formulas across basic, intermediate, and advanced levels.

Explanation of basic functions like Present Value (PV) and Future Value (FV).

Example of calculating PV to determine investment needed today to reach a future goal.

Demonstration of FV function to project investment growth over a 30-year period.

Assumption of constant investment returns over 30 years without additional contributions.

Introduction of FV with recurring payments for a more realistic investment scenario.

Intermediate functions for capital budgeting such as Modified Internal Rate of Return (MIRR) and Net Present Value (NPV).

Use of NPV to assess the profitability of a project with time value of money considerations.

Explanation of the time value of money and its impact on project evaluation.

Application of XNPV and XIRR functions to account for semi-annual cash flows and dates.

Decision-making criteria based on comparing IRR with the discount rate.

Advanced stage discussion on creating a loan schedule using Excel.

Calculation of monthly payments for a loan using the PMT function.

Determination of principal and interest components of loan payments.

Creating a table to automate and visualize loan payment breakdown over time.

Verification of loan schedule accuracy by ensuring zero remaining balance at the end of the loan term.

Sponsorship mention of Nordpass for secure password management in a business context.

Transcripts

Browse More Related Video

5.0 / 5 (0 votes)

Thanks for rating: