Basic Math For Everyday Life

TLDRThis video script provides a comprehensive guide to solving everyday math problems using basic arithmetic operations such as multiplication, addition, subtraction, and division. It covers a variety of scenarios including calculating total money from different denominations, determining change from a purchase, splitting profits equally, comparing unit prices for value, calculating tips and interest, and understanding compound interest and ROI. The script also explains how to calculate monthly mortgage payments and the total amount repaid over a loan period, emphasizing the impact of interest rates on total repayment. The video is a practical resource for enhancing arithmetic skills and financial literacy.

Takeaways

- 🧮 **Multiplication and Addition**: John's total money is calculated by multiplying the number of bills by their value and then adding the results together, resulting in $715.

- 🛍️ **Subtraction for Change**: Karen should expect to receive $7.35 back from the store clerk after purchasing shoes that cost $32.65 with two $20 bills.

- 💵 **Division for Equal Splits**: Each college student receives $97.20 after a team earns a net profit of $486, split equally among five members.

- 📦 **Unit Pricing for Value**: To find the best value, calculate the unit price of items by dividing the cost by the weight, with the five-pound bag of rice offering the better deal at 83 cents per pound.

- 🍽️ **Percentage Calculation for Tips**: Timothy calculates a 15% tip on a $50 bill by first finding 10% and 5% separately and then adding them together to get a $7.50 tip.

- 📈 **Simple Interest Formula**: Megan receives $1,000 in interest annually on her $50,000 checking account with a 2% simple interest rate.

- 💻 **Discount and Tax Calculation**: Greg spends $512.74 on a laptop after a 20% discount and a 7% sales tax, demonstrating the process of applying discounts and taxes to a purchase.

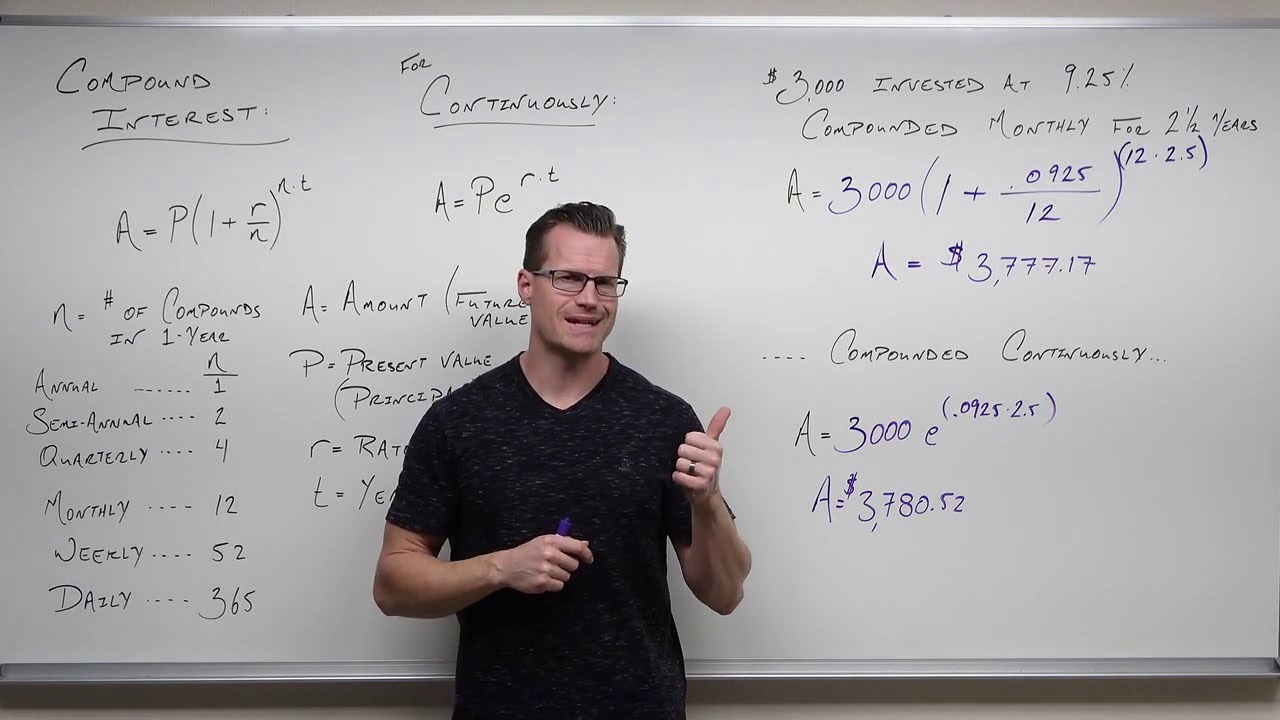

- 📊 **Continuous Growth vs. Annual Compounding**: Andrew's mutual fund grows to $221,671.68 over 20 years with a 10% continuous growth rate, compared to $201,825 if the interest is compounded annually.

- 🏠 **Return on Investment (ROI)**: David's ROI for his house is 60% over 10 years, calculated by dividing the profit ($120,000) by the cost of investment ($200,000) and multiplying by 100%.

- 📋 **Mortgage Calculation**: Julia's monthly mortgage payment for a 30-year, $250,000 loan at a 4% fixed interest rate is $1,193.54, determined using the formula for calculating monthly payments.

- 💹 **Total Repayment and Interest**: Over 30 years, Julia will repay a total of $429,674.40, which includes the principal and interest. The total interest paid on the loan is $179,674.40.

Q & A

How much money does John have in total with his different bills?

-John has a total of seven fifty-dollar bills, twelve twenty-dollar bills, eight ten-dollar bills, and nine five-dollar bills. By calculating the sum of these amounts (350 + 240 + 80 + 45), John has a total of $715.

How much change should Karen expect to receive back after buying a pair of shoes that cost $32.65 with two twenty-dollar bills?

-Karen gave the store clerk two twenty-dollar bills, which totals $40. The cost of the shoes is $32.65. The difference between what she gave and the cost is $40 - $32.65 = $7.35. So, Karen should expect to receive $7.35 in change.

How much will each college student receive if a team of five earns a net profit of $486 and splits it equally?

-To find out how much each student will receive, divide the total profit by the number of students. So, $486 divided by 5 equals $97.20. Each student will receive $97.20.

What is the unit price per pound for the four-pound bag of rice that costs $3.69?

-To find the unit price, divide the total cost by the weight. For the four-pound bag of rice, the unit price is $3.69 divided by 4 pounds, which equals $0.9225 per pound.

How much is the tip amount that Timothy should leave on the table after eating a meal that cost $50 and wanting to give a 15% tip?

-To calculate a 15% tip on $50, you can multiply the total bill by 0.15. So, $50 times 0.15 equals $7.50. Timothy should leave $7.50 as a tip.

What is the annual interest Megan will receive on her $50,000 checking account with a 2% annual interest rate?

-Using the simple interest formula, where the interest (i) is the principal (p) times the rate (r) times the time (t), and since the time is one year, the interest Megan will receive annually is $50,000 times 0.02, which equals $1,000.

What is the final price Greg will pay for a laptop that costs $599 after a 20% discount and a 7% sales tax?

-First, calculate the discount: 20% of $599 is $119.80. Subtract this from the original price to get the discounted price: $599 - $119.80 = $479.20. Then, calculate the sales tax on the discounted price: 7% of $479.20 is $33.544, which rounds to $33.54. Add this to the discounted price to get the final price: $479.20 + $33.54 = $512.74.

What will be the value of Andrew's mutual fund after 20 years if it grows at an average rate of 10% per year?

-Using the compound interest formula for continuous growth, the value of the mutual fund can be calculated as the principal amount times e raised to the power of the product of the rate and time. So, $30,000 times e^(0.10 * 20) equals approximately $221,671.68.

What is David's return on investment (ROI) after selling his house for $320,000 that he bought for $200,000 ten years ago?

-David's profit is the selling price minus the purchase price, which is $320,000 - $200,000 = $120,000. His ROI is the profit divided by the cost of investment times 100%. So, ROI is ($120,000 / $200,000) * 100% = 60%.

What is Julia's monthly mortgage payment for a 30-year, $250,000 loan at a fixed interest rate of 4%?

-Using the mortgage payment formula, the monthly payment is the principal times the monthly interest rate divided by 1 minus (1 plus the monthly interest rate) raised to the negative power of the number of payments. So, $250,000 times 0.04/12 divided by 1 - (1 + 0.04/12)^(-360) equals approximately $1,193.54.

What is the total amount of money Julia will have to repay over the 30-year loan period, including both principal and interest?

-To find the total repayment amount, multiply the monthly payment by the total number of payments. So, $1,193.54 times 360 payments equals approximately $429,674.40. This total includes both the original loan amount and the accumulated interest over the 30 years.

Outlines

💼 John's Money Calculation

The first paragraph focuses on calculating the total amount of money John has. It involves multiplying the number of bills by their respective values and then adding the totals together. John has seven $50 bills, twelve $20 bills, eight $10 bills, and nine $5 bills. By performing the multiplication and addition, John is found to have a total of $715.

👠 Karen's Shoe Purchase

The second paragraph deals with Karen's transaction of buying shoes that include sales tax, and calculating her change. Karen pays with two $20 bills for a pair of shoes that cost $32.65. The difference between what she pays and the cost of the shoes is calculated using subtraction. By subtracting the cost from the amount paid, it's determined that Karen should receive $7.35 in change.

👕 T-Shirt Sales Profit

The third paragraph is about a team of college students who split their net profit equally. They made $486 from selling t-shirts. To find out how much each student receives, the total profit is divided by the number of team members, which is five. Using long division, it's determined that each student will receive $97.20.

🍚 Carla's Rice Value Comparison

In the fourth paragraph, Carla is deciding between buying a four-pound bag of rice for $3.69 or a five-pound bag for $4.15. To determine the better value, the unit price for each bag is calculated by dividing the cost by the weight. The four-pound bag has a unit price of $0.9225 per pound, while the five-pound bag has a unit price of $0.83 per pound. Therefore, the five-pound bag offers the better value.

🍽️ Timothy's Restaurant Tip

The fifth paragraph covers how to calculate a 15% tip for a restaurant bill. Timothy spends $50 and wants to leave a 15% tip. By first calculating 10% and then finding half of that for 5%, the total tip is determined to be $7.50. This is verified by converting the percentage to a decimal and multiplying it by the bill amount, yielding the same result.

💵 Megan's Simple Interest

The sixth paragraph is about Megan, who has $50,000 in a checking account with a simple interest rate of 2% annually. To find out how much interest Megan will receive each year, the simple interest formula is used. The interest rate is converted to a decimal, and the calculation results in Megan receiving $1,000 in interest each year.

💻 Greg's Laptop Purchase

The seventh paragraph involves Greg buying a laptop with a discount and tax. The laptop costs $599, and Greg has a coupon for a 20% discount. After calculating the discount, a sales tax of 7% is applied to the discounted price. The final calculation shows that Greg will spend $512.74 on the laptop after the discount and tax are applied.

📈 Andrew's Mutual Fund Investment

In the eighth paragraph, Andrew invests $30,000 in a mutual fund that grows at an average rate of 10% per year. To estimate the value of the investment after 20 years, the compound interest formula is used. The calculation, using the continuous growth formula, results in the mutual fund being worth $221,671.68 after 20 years.

🏠 David's Real Estate ROI

The ninth paragraph calculates David's return on investment (ROI) for a house. David buys a house for $200,000, and after ten years, it's worth $320,000. The ROI is calculated by dividing the profit (the difference between the selling price and the purchase price) by the cost of investment and then multiplying by 100%. David's ROI is found to be 60% over the 10-year period.

🏡 Julia's Mortgage Calculation

The final paragraph, number six, deals with calculating Julia's monthly mortgage payment for a 30-year, $250,000 loan at a 4% fixed interest rate. Using the mortgage payment formula, the monthly payment is determined to be $1,193.54. The total amount to be repaid over the 30 years is $429,674.40, which includes both the principal and the interest. The total interest paid over the life of the loan is $179,674.40.

📚 Everyday Math Application

The last paragraph, number seven, concludes the video by emphasizing the practical application of basic math in everyday life. It serves as a summary of the various real-life scenarios presented in the video, highlighting the importance of mathematical skills for daily transactions and decision-making.

Mindmap

Keywords

💡Multiplication

💡Addition

💡Long Multiplication

💡Subtraction

💡Sales Tax

💡Division

💡Unit Price

💡Percentage

💡Simple Interest

💡Compound Interest

💡Mortgage Payment

Highlights

The video focuses on solving basic math problems encountered in everyday life.

John has a total of seven hundred and fifteen dollars with various denomination bills.

Karren should expect to receive seven dollars and thirty-five cents back from the store clerk after purchasing shoes.

A team of five college students earned a net profit of 486 dollars, with each member receiving 97.20 dollars.

Carla finds that the five-pound bag of rice offers the best value at a unit price of 83 cents per pound.

Timothy calculates a 15% tip on a 50-dollar restaurant bill to be seven dollars and fifty cents.

Megan receives a thousand dollars in interest annually from a checking account with a simple interest rate of 2%.

Greg spends 512.74 dollars on a laptop after a 20% discount and a 7% sales tax.

Andrew's mutual fund grows to 221,671.68 dollars in 20 years with an average growth rate of 10% per year.

David's ROI for his house is 60% after it appreciates to 320,000 dollars in ten years.

Julia's monthly mortgage payment for a 30-year, 250,000 loan at a 4% interest rate is 1,193.54 dollars.

The total amount Julia will repay over 30 years is 429,674.40 dollars, including principal and interest.

The total interest paid by Julia over the loan period is 179,674.40 dollars.

Reducing the loan period can lead to higher monthly payments but lower total interest paid.

The video provides an introduction to basic math applicable to everyday life scenarios.

Multiplication, addition, subtraction, and division are used to solve the problems presented.

Mental math techniques are demonstrated for quick calculations.

The simple interest formula and compound interest formula are explained for different investment scenarios.

The concept of return on investment (ROI) is introduced using David's house as an example.

A formula for calculating monthly mortgage payments is provided and applied to Julia's loan scenario.

Transcripts

Browse More Related Video

Tutorial of Ramos Family Home Purchase (part 2) on in excel on Mac

Basic Math Review

Math Videos: How To Learn Basic Arithmetic Fast - Online Tutorial Lessons

Review of Compound Interest (Precalculus - College Algebra 65)

Ch. 12.4 Mathematics of Finance

Top 10 Excel Financial Formulas From Beginner to PRO

5.0 / 5 (0 votes)

Thanks for rating: