Ch. 12.4 Mathematics of Finance

TLDRThis lecture delves into the mathematics of finance, focusing on annuities—a series of regular payments into investments like savings or bonds. It explains the concept of annuity, its total future value, and the formula to calculate it. The instructor also covers the present value of an annuity, which is the lump sum needed today to achieve the same future value, using the example of a money market account with monthly deposits and a fixed interest rate. The session further explores installment buying, calculating monthly payments for loans like cars or mortgages, providing formulas and examples to illustrate the calculations.

Takeaways

- 📚 The lesson is focused on the mathematics of finance, a topic typically covered in business or applied calculus courses but not in regular calculus classes.

- 💼 An annuity is a type of investment that includes savings accounts, money market accounts, bonds, retirement accounts, trust funds, and mortgages, characterized by regular payments.

- 💰 The annuity amount (AF) is the total value received after the final payment, including all invested money and accrued interest.

- 📈 The interest rate (i) per time period is crucial in calculating the growth of an annuity, and it can vary depending on the frequency of payments.

- 🔢 The regular payment (r) into an annuity is a fixed amount made at consistent intervals, which is essential for calculating the annuity's future value.

- 🌐 An example provided calculates the future value of a money market account with monthly payments of $200 and an annual interest rate of 3%, resulting in approximately $5,000 after two years.

- 📊 The formula for the future value of an annuity is given by AF = r * [(1 + i)^n - 1] / i, where r is the payment amount, i is the interest rate per period, and n is the number of payments.

- 🏦 The present value of an annuity (PV) is the amount you would need to invest today to have the same value as a series of future payments, calculated using a different formula.

- 🎰 The script uses the lottery as an analogy for understanding present value, explaining how a lump sum now could be worth less than future installments due to interest.

- 🚗 Installment buying is related to finding the regular payment amount for a loan, using the formula that incorporates the loan amount, interest rate, and number of payments.

- 📝 An example calculation for a car loan of $6,000 with a 10% annual interest rate over 5 years results in a monthly payment of approximately $127.48.

Q & A

What is the main topic of discussion in this section of the video?

-The main topic of discussion is the mathematics of finance, specifically focusing on annuities and their calculations.

What is an annuity in the context of this video?

-An annuity is an investment where you make regularly scheduled payments, such as into a savings account, money market account, bonds, retirement account, trust fund, or mortgage.

What does the term 'AF' represent in the script?

-AF represents the total amount of the annuity, which includes all the money invested from the first payment to the last, as well as all the interest accrued on those earnings.

What is the difference between the interest rate 'i' and the regular payment 'r' in the context of annuities?

-The interest rate 'i' is the rate at which your investment accrues interest per time period, while 'r' is the amount of the regular payment made into the annuity at each interval.

Can you provide an example of how the script describes the growth of an annuity over time?

-The script provides an example of depositing $200 every month into a money market account with a 3% annual interest rate, explaining how the balance grows with each payment and the interest accrued.

What is the formula for calculating the future value of an annuity (AF), as described in the script?

-The formula for calculating the future value of an annuity is AF = r * [(1 + i)^n - 1] / i, where r is the regular payment, i is the interest rate per period, and n is the number of payments.

What is the present value of an annuity (AP), and why is it important?

-The present value of an annuity (AP) is the amount you would need to invest today to achieve the same final amount as making regular payments over time. It's important for determining lump-sum investments or cash-out values of annuity payments.

How does the script calculate the present value of an annuity for a scenario where you invest a lump sum instead of making regular payments?

-The script demonstrates calculating the present value by using the formula AP = AF / [(1 + i)^n], and then solving for AP to find out how much you would need to invest today to have the same amount in two years as investing $200 monthly.

What is the formula for calculating installment payments (r) when taking out a loan, as described in the script?

-The formula for calculating installment payments when taking out a loan is r = AP * (i / (1 - (1 + i)^(-n))).

Can you provide an example from the script that calculates monthly payments for a car loan?

-The script provides an example of calculating monthly payments for a $6,000 car loan with a 10% annual interest rate over 5 years, resulting in a monthly payment of $127.48.

How does the script explain the concept of installment buying in relation to loans?

-The script explains installment buying as the process of determining how much your payments will be on a loan, using the present value of an annuity and solving for the regular payment amount.

Outlines

📚 Introduction to the Mathematics of Finance

The instructor begins by introducing the topic of finance mathematics, emphasizing its importance in business and applied calculus courses. The focus is on annuities, which are regular investments like savings accounts, bonds, or retirement accounts. The concept of an annuity is explained as a series of payments made at steady intervals, with the total amount including both the invested capital and the accrued interest. The instructor provides a formula for calculating the future value of an annuity, using variables for interest rate, payment amount, and time.

📈 Understanding Annuity Calculations and Examples

This section delves deeper into the calculations of annuities, using a money market account as an example. The instructor illustrates how to calculate the total amount accumulated after a series of regular payments, including the interest earned on each payment. A formula for the sum of a geometric series is introduced, and an example calculation is provided for a 24-payment scenario with a 3% annual interest rate, resulting in a total of approximately $5,000 after two years.

💰 Present Value of an Annuity and Installment Buying

The instructor shifts the discussion to the present value of an annuity, which is the amount one would need to invest today to achieve the same future value as a series of annuity payments. The concept is likened to the difference between a lump sum payment and installment payments, such as lottery winnings or investment plans. Formulas for calculating the present value are provided, and an example is given where a lump sum investment of $4,653.19 would yield the same result as monthly payments of $200 over two years, assuming a 3% annual interest rate.

🚗 Installment Buying and Loan Payment Calculations

The final paragraph discusses installment buying, which is the process of determining monthly payments for a loan based on its present value. The instructor uses the formula for calculating the regular payment amount on a loan, providing an example of a $6,000 car loan with a 10% annual interest rate over 60 months. The calculation results in a monthly payment of $127.48, illustrating how to determine the cost of borrowing money over time.

Mindmap

Keywords

💡Annuity

💡Regularly Scheduled Payments

💡Interest Rate

💡Geometric Series

💡Accrual Rate

💡Present Value

💡Lump Sum

💡Loan

💡Yearly Interest Rate

💡Monthly Payment

Highlights

Introduction to the mathematics of finance, an important topic in business and applied calculus courses.

Annuities are investments with regular scheduled payments, such as savings accounts, bonds, retirement accounts, and mortgages.

The total amount of an annuity includes all invested money and the accrued interest, represented as AF.

Interest rate per time period (i) and regular payment value (r) are key components in calculating annuity growth.

Example calculation: Depositing $200 monthly into a money market account with a 3% annual interest rate.

Geometric series formula applied to calculate the future value of an annuity.

After two years, a $200 monthly investment in a 3% interest account yields approximately $5,000.

Difference between investing a lump sum versus making regular payments in terms of interest earned.

Present value of an annuity (PV) is the amount needed to be invested today to achieve a future value.

Calculating the present value to understand how much one would need to invest now for future installment payments.

Present value formula derived from the future value of an annuity formula, solving for the initial investment needed.

Example: Calculating the lump sum investment needed to equal two years of $200 monthly payments at 3% interest.

The installment buying concept, relating to loan payments and calculating monthly payments based on loan amount and interest.

Loan payment formula derived from the present value of an annuity, solving for the regular payment amount (r).

Example calculation: Determining monthly payments for a $6,000 car loan at a 10% annual interest rate over 5 years.

Understanding the practical applications of annuity calculations in loans, such as car loans and mortgages.

The importance of the mathematics of finance in making informed decisions about investments and loans.

Transcripts

Browse More Related Video

Top 10 Excel Financial Formulas From Beginner to PRO

Basic Math For Everyday Life

Continuous Money Flow: Future Value with increasing rate of growth

How to buy a car without getting ripped off (Marketplace)

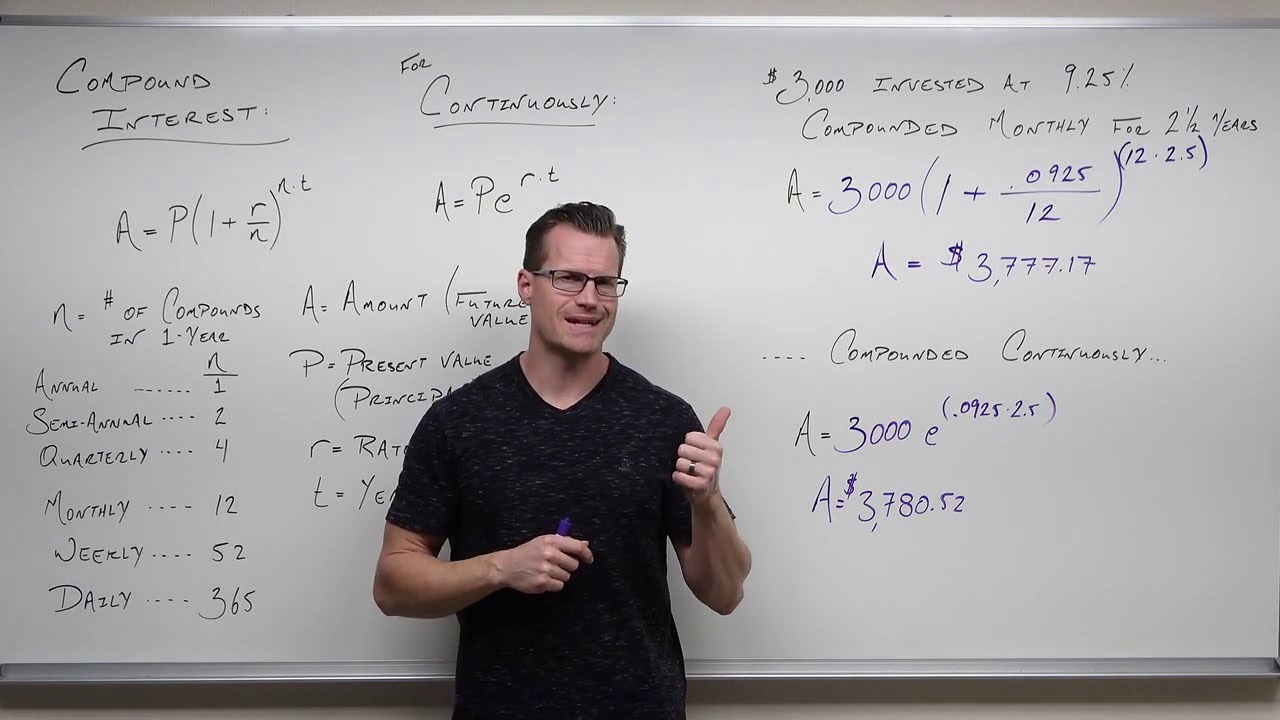

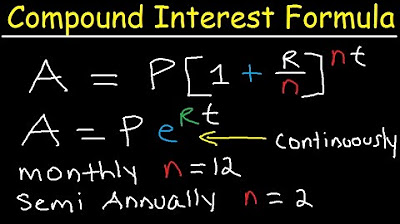

Review of Compound Interest (Precalculus - College Algebra 65)

Compound Interest Formula Explained, Investment, Monthly & Continuously, Word Problems, Algebra

5.0 / 5 (0 votes)

Thanks for rating: