What causes economic bubbles? - Prateek Singh

TLDRThis script explores the concept of economic bubbles through the historical lens of 'Tulip Mania' in 17th century Netherlands and compares it to modern phenomena like the dot-com bubble. It explains how the desire for tulips, once an exotic and rare flower, led to skyrocketing prices and a market frenzy, which eventually collapsed when people realized the flowers were not worth the inflated prices. The script draws parallels to the dot-com bubble of the 1990s and the real estate bubble of the late 2000s, illustrating the cyclical nature of booms and busts in economic markets. It concludes by suggesting that understanding these historical examples can help predict and avoid future bubbles.

Takeaways

- 🌷 Tulip Mania: The script introduces the concept of a bubble with the historical example of 'Tulip Mania' in the Netherlands during the 17th century.

- 🏛 Dutch Golden Age: The 1630s saw Amsterdam as a wealthy commercial center, where tulips became a symbol of prosperity and status.

- 🌐 Exotic Appeal: Tulips, brought from the East, were considered exotic and difficult to grow, which increased their desirability and price.

- 💐 Tulip Virus: A virus causing multicolored streaks on tulips made them even more scarce and valuable, fueling the mania.

- 📈 Price Inflation: The price of tulips rose dramatically, with a single bulb costing more than a craftsman's annual salary.

- 🔗 Dot-com Bubble: The script draws a parallel between tulip mania and the dot-com bubble of the 1990s, where internet stocks were overvalued.

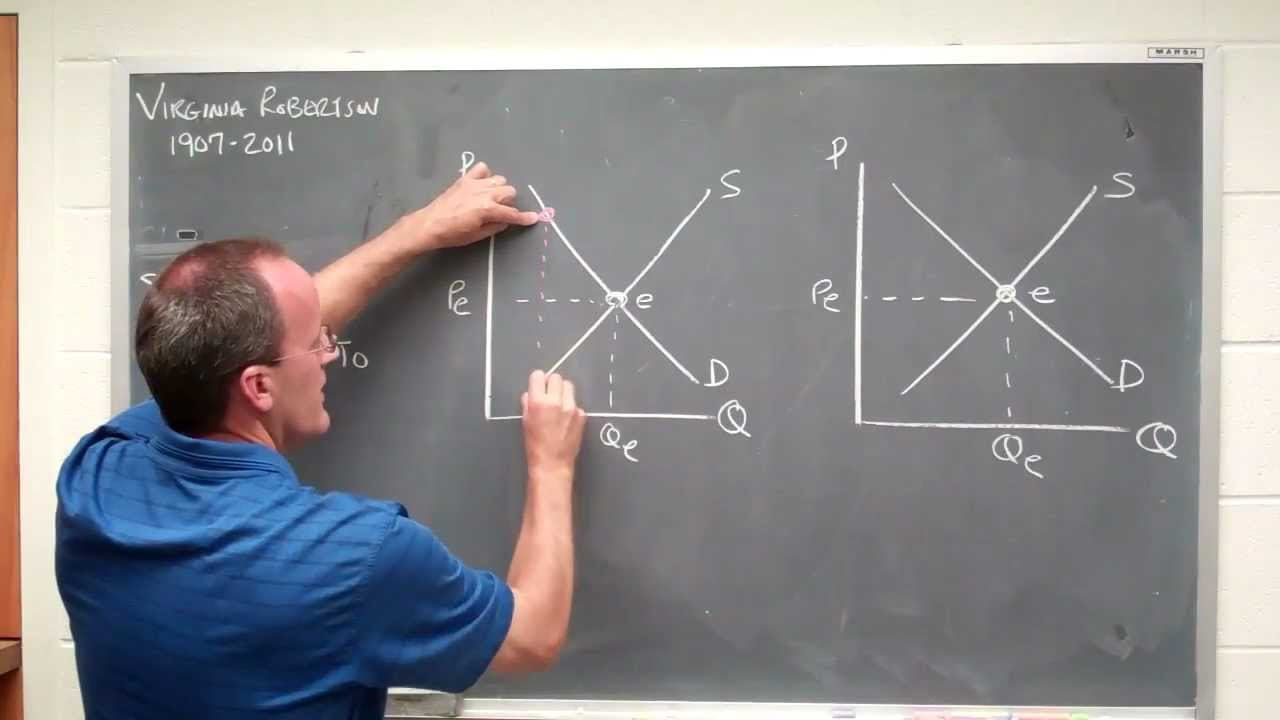

- 🔄 Supply and Demand: Stock prices, like tulip prices, are driven by supply and demand, and can be driven up by investor hype.

- 🔄 Feedback Loop: A feedback loop can occur where increasing demand leads to higher prices, which in turn attracts more investors.

- 💥 Bubble Burst: Both manias ended when people realized the prices were far above the intrinsic value, leading to a market crash.

- 🧐 Scholarly Pursuit: Scholars continue to study bubbles to understand their causes and how to prevent them.

- 🏘️ Real Estate Bubble: The script mentions the real estate bubble of the late 2000s as a more recent example of an economic bubble.

Q & A

What is the historical event referred to as 'Tulip Mania'?

-Tulip Mania refers to a period in the 17th century Dutch Golden Age when the price of tulips rose dramatically due to their scarcity and exotic appeal, leading to a speculative bubble and subsequent market crash.

Why were tulips so highly sought after in the Netherlands during the Dutch Golden Age?

-Tulips were highly sought after because they were considered exotic, difficult to grow, and their beauty was enhanced by the tulip breaking virus, which created multicolored, flame-like streaks on the petals.

What economic phenomenon does the term 'bubble' describe?

-A 'bubble' describes an economic phenomenon where the price of an asset, such as tulips or stocks, rises far above its intrinsic value due to speculation and hype, leading to a sudden crash when the bubble bursts.

How did the tulip breaking virus contribute to the rise in tulip prices during Tulip Mania?

-The tulip breaking virus caused select tulips to have multicolored streaks on their petals, making them even more beautiful and scarce, which in turn increased their demand and price.

What is the relationship between supply and demand in the stock market?

-In the stock market, the price of a stock is based on the supply and demand of investors. When demand increases, stock prices tend to rise, and vice versa.

How does a feedback loop contribute to the formation of a bubble?

-A feedback loop can contribute to a bubble by creating a cycle where increased demand leads to higher prices, which in turn attracts more investors, further driving up the price and creating a speculative bubble.

What event marked the end of both Tulip Mania and the dot-com bubble?

-The end of both Tulip Mania and the dot-com bubble was marked by a collective realization that the prices of the assets far exceeded their intrinsic worth, leading to a sudden drop in demand and the bursting of the bubble.

What is the role of scholars in understanding and potentially avoiding economic bubbles?

-Scholars work to analyze and understand the causes of economic bubbles, with the aim of developing strategies and policies to predict and potentially avoid such financial crises.

How can the principles of Tulip Mania be applied to understand more recent economic events?

-The principles of Tulip Mania can be applied to understand more recent economic events, such as the real estate bubble of the late 2000s, by illustrating the dynamics of speculation, demand, and the eventual bursting of a bubble.

What advice does the script provide for individuals as they wait for the next potential economic bubble?

-The script suggests that individuals should enjoy the present, such as treating oneself to a bouquet of tulips, without worrying about the high costs associated with speculative bubbles.

Outlines

🌷 Tulip Mania: The Birth of Economic Bubbles

The script begins with a rhetorical question about the value of a bouquet of tulips, setting the stage for a discussion on economic bubbles. It delves into the historical account of the Dutch Golden Age in the 17th century, where Amsterdam's prosperity led to a high demand for exotic tulips. The introduction of the tulip breaking virus, which created multicolored streaks on the petals, further increased their desirability and value. This demand and scarcity led to 'tulip mania,' where prices skyrocketed far beyond the flowers' intrinsic worth. The concept of a bubble is introduced as a situation where prices rise significantly due to speculation and then crash when the market realizes the overvaluation. The script uses tulip mania as a historical example to explain the mechanisms behind economic bubbles, which are still relevant in understanding modern financial phenomena such as the dot-com bubble of the 1990s and the real estate bubble of the late 2000s.

Mindmap

Keywords

💡Tulip Mania

💡Economic Bubble

💡Intrinsic Value

💡Supply and Demand

💡Feedback Loop

💡Dot-com Bubble

💡Real Estate Bubble

💡Market Crash

💡Speculative Bubble

💡Hype

💡Boom and Bust

Highlights

Tulips, real estate, and stock in pets.com have all sold for much more than they were worth, leading to economic bubbles.

The Dutch golden age in the 17th century saw the rise of Amsterdam as a major port and commercial center.

Wealthy merchants in Amsterdam displayed their prosperity with mansions and flower gardens, particularly favoring tulips.

Tulips were considered exotic and difficult to grow, leading to high demand and prices in the Netherlands.

Tulip breaking virus in the 1630s made certain tulips more beautiful and scarce, further driving up their prices.

Tulip mania emerged as a nationwide sensation with prices and popularity soaring.

Mania is characterized by a price surge and willingness to pay large sums for items with low intrinsic value.

Dot-com mania in the 1990s is a modern example of tulip mania, with stocks in new websites being highly sought after.

Stock prices are influenced by supply and demand, with investors driving prices up based on future earnings potential.

A feedback loop can occur where hype leads to increased demand and stock prices far exceeding intrinsic value.

The end of a mania and the bursting of a bubble is marked by the realization that prices exceed worth.

Both tulip mania and dot-com mania ended with a sudden drop in demand and market crash.

Scholars study the causes of bubbles and strategies to avoid them, using tulip mania as an example.

Tulip mania illustrates the principles of economic bubbles and helps understand phenomena like the real estate bubble of the late 2000s.

Economic cycles of booms and busts are ongoing, with the potential for new manias and bubbles in the future.

The enjoyment of tulips today is a reminder of the irrational exuberance of past manias and the importance of avoiding overpaying.

Transcripts

Browse More Related Video

Inflation and Bubbles and Tulips: Crash Course Economics #7

How Do Bubbles Form? Gamestop and Tulips Can Help Explain | WSJ

supply demand in equilibrium

Tax Revenue and Deadweight Loss

How The Roaring 20s Became A Precursor To World War | Impossible Peace | Real History

101 Facts That Will Make You Raise an Eyebrow

5.0 / 5 (0 votes)

Thanks for rating: