Inflation and Bubbles and Tulips: Crash Course Economics #7

TLDRThe video defines key economics concepts related to inflation—including nominal and real values, consumer price index, and rates of inflation—and explains what drives inflation up or down. It covers demand-pull inflation when consumers bid prices higher and cost-push inflation when supply shortages raise production costs. The video also discusses economic bubbles, when prices skyrocket beyond normal supply and demand, often fueled by speculation. Historical examples are provided, from 17th century Dutch tulip mania to the early 2000s housing bubble.

Takeaways

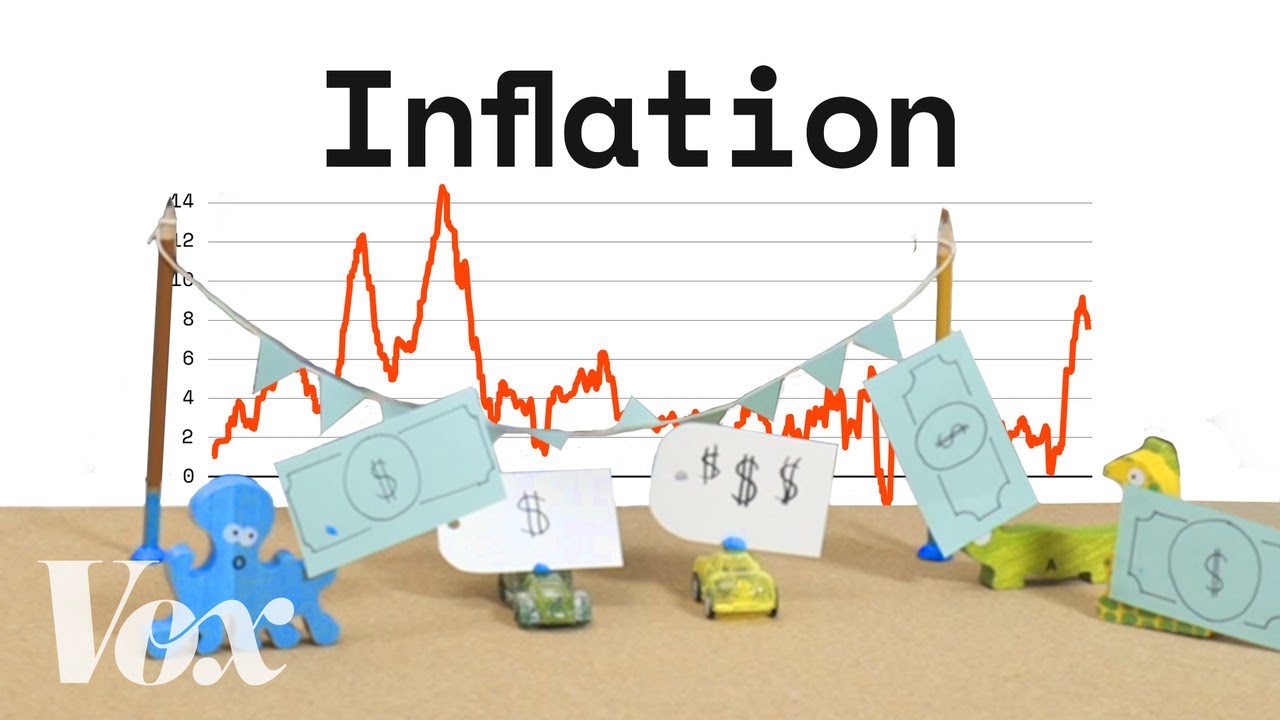

- 😀 Inflation refers to the overall rise in prices over time. Economists use the Consumer Price Index (CPI) to measure inflation.

- 📈 The CPI tracks the prices of a basket of common goods and services purchased by consumers. By comparing CPIs over time, economists can calculate inflation rates.

- 💲 Nominal prices refer to prices that haven't been adjusted for inflation. Real prices have been adjusted for inflation using the CPI.

- 🌡️ Demand-pull inflation happens when consumer demand outpaces supply, bidding up prices. Cost-push inflation occurs when production costs rise, decreasing supply.

- 🛢️ External supply shocks like oil shortages can trigger cost-push inflation across the economy.

- 🤑 Too much money chasing too few goods causes demand-pull inflation.

- 📉 Deflation refers to an overall drop in prices over time.

- 🚨 Bubbles happen when prices soar above fundamental value, often fueled by speculation.

- 📌 Bubbles eventually burst when buyers disappear and prices crash.

- 💸 Understanding inflation helps assess real wage growth and make informed financial decisions.

Q & A

How do economists adjust for inflation when making historical comparisons?

-Economists use the consumer price index (CPI) to adjust for inflation. The CPI tracks the prices of a basket of common goods and services over time. By comparing the CPI in different years, economists can convert dollar values to 'real' values that reflect the same purchasing power.

What causes demand-pull inflation?

-Demand-pull inflation happens when there is too much money chasing too few goods. As consumers bid prices higher to purchase limited supplies, inflation results.

What causes cost-push inflation?

-Cost-push inflation results from supply shocks that increase companies' production costs. As companies raise prices to maintain profits given decreased supplies, inflation occurs.

How did the housing bubble form in the early 2000s?

-Low interest rates and risky lending practices drove speculative demand. As prices rose, more people assumed the increases would continue and bought homes as investments, creating a feedback loop.

Why couldn't rising home prices in the 2000s be explained by supply and demand fundamentals?

-The population size and income growth could not account for the rapid price increases. There was no shortage of building materials or land to justify the spikes based on constrained supply.

What does it mean when economists describe a market as having a bubble?

-It means prices in that market have diverged from intrinsic values and underlying fundamentals of supply and demand. Speculative buying is fueling price increases.

What happened when the dot-com bubble burst in 2000?

-Stock prices of internet companies collapsed after years of speculation and hype. Investor optimism proved unfounded as many internet startups failed to become profitable.

What role do stories and social trends play in bubbles?

-Bubble mentality is fueled by narratives, not fundamentals. Stories of fast riches convince more people to join the bubble, regardless of underlying value.

Why should individuals care about inflation?

-Inflation reduces purchasing power over time. Understanding inflation helps individuals negotiate wage increases to maintain real income levels.

What happened after the tulip bubble burst in Holland in 1637?

-Tulip bulb prices crashed. Bulbs that had been worth thousands of dollars or acres of land traded hands for less than a dollar after the mania ended.

Outlines

😃 Measuring Inflation and Understanding Purchasing Power

This paragraph introduces the concept of inflation, explains how it reduces purchasing power over time even with pay raises, and defines key terms like purchasing power and real wages. It introduces the main character, Stan, and how inflation impacts his ability to purchase goods and services.

😊 What Causes Inflation - Demand-Pull and Cost-Push Factors

This paragraph explains the two main causes of inflation: 1) Demand-pull, when too much money chases too few goods, bidding up prices, and 2) Cost-push, when limited supplies of production inputs increase costs, resulting in higher prices and less quantity supplied.

🌷 Evolution and Impact of Price Bubbles

This paragraph defines asset price bubbles, using historical examples like Dutch tulips, tech stocks, and housing. It explains how bubbles form through speculation and burst dramatically. It also covers the economic and social impacts of bubbles.

Mindmap

Keywords

💡Inflation

💡Consumer Price Index (CPI)

💡Purchasing Power

💡Deflation

💡Demand-Pull Inflation

💡Cost-Push Inflation

💡Bubble

💡Nominal vs. Real

💡Interest Rates

💡Speculation

Highlights

Purchasing power tells him how much physical stuff, like pizza, haircuts, and Neutral Milk Hotel tickets he can actually consume.

A rise in prices is effectively the exact same thing as a cut in wages, and vice versa.

The CPI shows how prices have changed between different years, and it's by far the most commonly used measure of inflation.

"Real" means that a price from the past has been adjusted for inflation. "Nominal" means a price from the past that hasn't been adjusted for inflation.

Let's assume we gave John $10 million U.S. dollars. Is he rich? Well, not if you're stuck on a desert island. Being rich isn't about how much money you have. It's about how much purchasing power you have.

Inflation is caused by either consumers bidding up the prices of stuff, or producers rising prices and producing less because there's an increase in production cost.

Economic mis-management and political instability have reduce oil exports from Venezuela. The government's tried to keep the economy growing by printing more money, but that's only resulted in soaring prices.

Higher demand and lower supply means higher prices for chocolate.

Between 2001 and 2006, home prices diverged from these fundamentals, in what economists call "a bubble."

The problem with a bubble is that depends on an ever increasing supply of buyers, each person is betting that they'll be able to sell at a higher price to the next person. But eventually, you run out of buyers and the bubble bursts.

More and more people got in on the tulip action, making quick fortunes. And that brought in even more people, desperate to get their hands on a tulip bulb.

At the height of the mania, people were willing to exchange twelve acres of land, or ten years worth of salary for a single tulip bulb.

In the late 1990s there was a stock market bubble for companies involved in this brand new computer thingy called the internet.

The stock market collapsed in early 2000.

Understanding inflation is not just academic. This affects you. Someday you might have to ask your boss for a raise. Knowing some economics can help you negotiate a real raise, adjusted for inflation.

Transcripts

Browse More Related Video

How inflation works | CNBC Explains

Inflation Explained: What is Inflation, Types and Causes?

Introduction to inflation | Inflation - measuring the cost of living | Macroeconomics | Khan Academy

What is Inflation?

Why is everything getting so expensive?

Macro: Unit 1.6 -- Price Indices and Measuring Inflation

5.0 / 5 (0 votes)

Thanks for rating: