Continuous Money Flow: Present Value Problems

TLDRThe video script presents a comprehensive guide on calculating the present value of a continuous money flow, emphasizing the importance of accurately determining the revenue stream. It introduces three distinct examples to illustrate the process. The first example deals with a constant revenue stream, where a fixed annual income of $40,000 is received over eight years at an interest rate of 7.45%. The second example involves a revenue stream that increases annually by 4.25%, starting from a base salary of $52,000 over 23 years. The third example features a revenue stream that increases by a fixed amount of $1,000 each year, beginning with $11,000 in the first year and continuing for six years at a 4.55% interest rate. The script highlights the use of integral calculus, including the application of exponential functions and integration by parts, to solve these financial problems. It concludes by recommending the use of a tool like Desmos for evaluating the integrals and emphasizes the setup of the problems as the key to successful calculation.

Takeaways

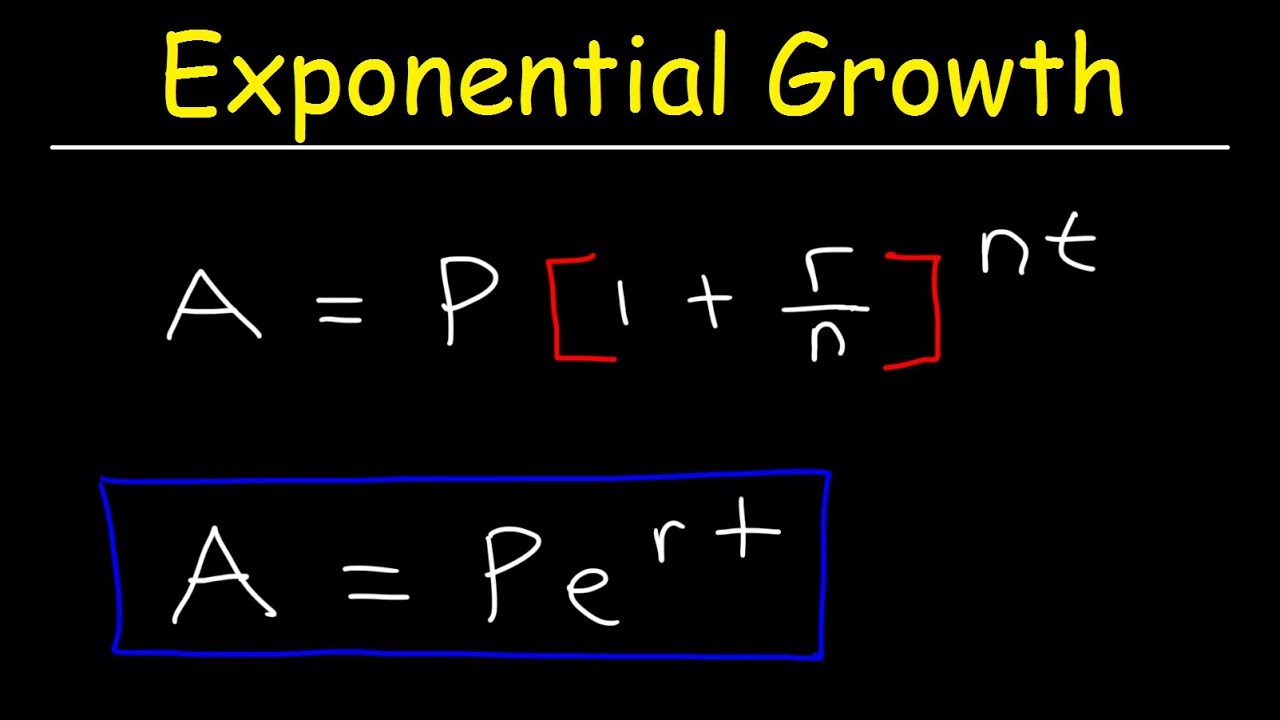

- 🧮 The basic formula for present value involves integrating the revenue stream over time, discounted by an exponential factor based on the interest rate.

- 📈 The challenge in calculating present value is usually determining the revenue stream, which can vary in complexity.

- 💰 The first example features a constant revenue stream of $40,000 per year, with an interest rate of 7.45% over eight years.

- ⏳ The integral for the first example is set up from the present time (0) to eight years in the future, with the revenue stream represented as $40,000 times an exponential term.

- 🔍 The u-substitution rule is used for integrating exponential functions, which simplifies the process of finding the antiderivative.

- 📊 In the second example, the revenue stream increases annually by 4.25%, starting from a salary of $52,000 over 23 years.

- 📈 The present value integral for the second example combines two exponentials, representing the initial revenue and the annual increase.

- 📚 The third example involves a revenue stream that starts at $11,000 and increases by a fixed amount of $1,000 each year.

- 🧩 Integration by parts is necessary for the third example due to the combination of a linear function (revenue increase) and an exponential function (discount factor).

- 📘 The integral for the third example involves a linear revenue function that increases by $1,000 times time (t), and is then discounted by an exponential term based on a 4.55% interest rate over six years.

- 📌 The process of integrating involves taking derivatives and antiderivatives, which are then evaluated from the limits of integration.

- ✅ Using a tool like Desmos can simplify the evaluation of complex integrals by providing a visual representation and numerical answers.

Q & A

What is the general formula for determining the present value of a continuous money flow?

-The general formula for determining the present value of a continuous money flow is the integral from 'a' to 'b' of the revenue stream times e to the negative 'r' times 't', where 'r' is the interest rate and 't' represents time.

What is the challenge in determining the present value of a money flow?

-The challenge in determining the present value of a money flow is usually to determine the revenue stream, as the interest rate 'r' is often given.

What is the given interest rate in the first example of the video?

-In the first example, the given interest rate 'r' is 7.45.

What type of revenue stream is described in the first example?

-In the first example, the revenue stream is a constant revenue stream, with an annual income of forty thousand dollars that does not change over time.

What is the time period considered for the first example's present value calculation?

-The time period considered for the first example's present value calculation is eight years.

How is the antiderivative found when integrating an exponential function?

-The antiderivative is found by using the u-substitution rule for an exponential function, which involves dividing the given number by the interest rate and then evaluating the expression from the upper to the lower bound of integration.

What is the nature of the revenue stream in the second example?

-In the second example, the revenue stream is not constant. It starts at a salary of 52,000 and is expected to increase annually by 4.25%.

How is a percentage increase in revenue represented in the formula for present value?

-A percentage increase in revenue is represented by multiplying the current revenue by e to the power of the increase rate times time 't'.

What is the expected increase in revenue per year in the third example?

-In the third example, the revenue is expected to increase by a constant amount of one thousand dollars every year.

What method of integration is required for the third example's present value calculation?

-Integration by parts is required for the third example's present value calculation due to the presence of two different functions of 't', a linear function and an exponential function.

What tool is recommended for evaluating the complex integral in the third example?

-Desmos, an online graphing calculator, is recommended for evaluating the complex integral in the third example.

What is the main emphasis of the video regarding the present value calculation?

-The main emphasis of the video is on how to set up the problems for present value calculation, noting that the integration itself is often straightforward, and evaluation can be done using decimals.

Outlines

🧮 Present Value of Constant Revenue Stream

This paragraph introduces the concept of calculating the present value of a continuous money flow. The general formula for present value is presented as an integral from 'a' to 'b' of the revenue stream multiplied by e^(-rt), where 'r' is the interest rate and 't' is time. The first example features a constant revenue stream of $40,000 annually for eight years at an interest rate of 7.45%. The integral setup is shown, and the method of integration using the u-substitution rule for the exponential function is explained. The process involves dividing the constant revenue by the interest rate and evaluating the antiderivative from the present time (0) to the future time (8 years).

📈 Present Value with Increasing Revenue by Percentage

The second paragraph discusses a scenario where the revenue stream increases annually by a percentage. It outlines a case where a person, Garrett, is to receive the present value of an income that increases by 4.25% per year over 23 years, starting from an initial income of $52,000. The approach to handling percentage increases is described, which involves starting with the current salary and multiplying it by e^(0.042t). The integral for the present value is then set up, and the method for combining the two exponentials by adding the exponents is explained. The integration process involves calculating the antiderivative and evaluating it from the present to the future time frame.

📊 Present Value with Linearly Increasing Revenue

The final paragraph addresses a situation where the revenue increases by a constant amount each year, rather than by a percentage. An example is given where a machine generates an income that starts at $11,000 in the first year and increases by $1,000 each subsequent year. This results in a linear revenue function. The paragraph explains the integration process for such a scenario, which requires integration by parts due to the combination of a linear and an exponential function. The integral for the present value is set up for a period of six years with an interest rate of 4.55%. The process involves differentiating and antidifferentiating the functions, and then combining them to find the present value, which is evaluated from the present time to six years in the future.

Mindmap

Keywords

💡Present Value

💡Continuous Money Flow

💡Integral

💡Revenue Stream

💡Interest Rate

💡Constant Revenue Stream

💡Percentage Increase

💡Linear Revenue Function

💡Integration by Parts

💡U Substitution Rule

💡Desmos

Highlights

The basic formula for present value is the integral from a to b of the revenue stream times e to the negative rt

The challenge is usually determining the revenue stream, which is where most of the work is

In the first example, the interest rate r is given as 7.45

The revenue stream is a constant annual income of $40,000

The time period is 8 years

The integral for the present value is 40,000 * e^(-0.0745t) dt evaluated from 0 to 8

The antiderivative is found using the u-substitution rule for exponentials

The final present value is obtained by evaluating the antiderivative from 8 to 0

In the second example, the revenue flow is not constant

Garrett is to be awarded the present value of income over 23 years, starting at $52,000 and increasing annually by 4.25%

The revenue stream is modeled as the initial salary plus the percentage increase times e^(0.0425t)

The integral for present value is 52,000 * e^(-0.0825t) dt evaluated from 0 to 23

The antiderivative is found by dividing the initial salary by the exponent and evaluating from 23 to 0

In the third example, the revenue increases by a constant amount of $1,000 per year

The revenue stream is a linear function starting at $11,000 and increasing by $1,000t

The time period is 6 years and the interest rate is 4.55%

The integral for present value involves integration by parts due to the combination of linear and exponential functions

The antiderivative is found by taking derivatives and antiderivatives of the exponential function

The final present value is obtained by evaluating the antiderivative from 6 to 0

Desmos can be used to simplify the evaluation of the integral and antiderivative

Transcripts

Browse More Related Video

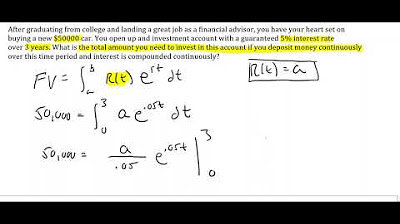

Continuous Money Flow: Future Value with increasing rate of growth

Continuous Money Flow: Finding Revenue Stream when Future Value is Known

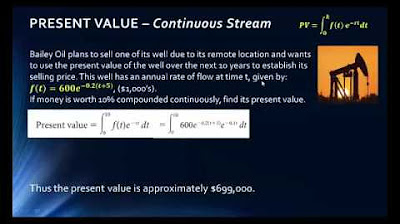

MATH 1325 13 4 Lecture

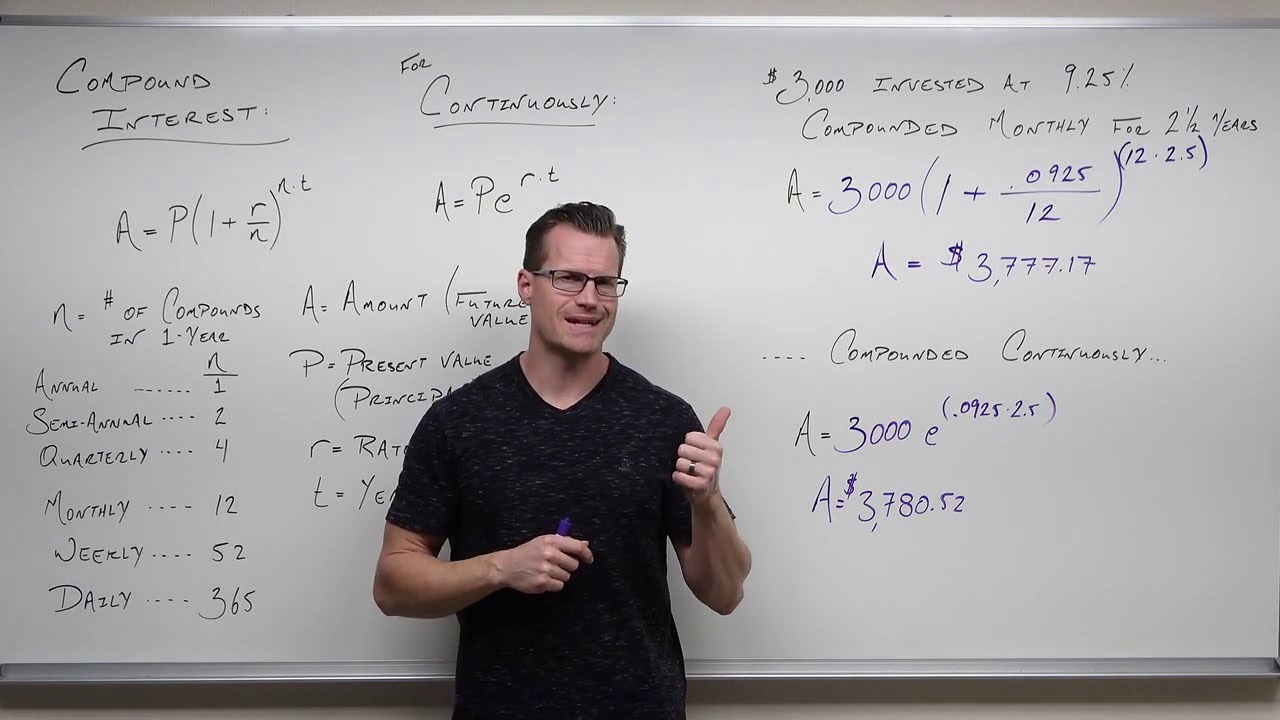

Review of Compound Interest (Precalculus - College Algebra 65)

Compound interest and e (part 4) | Exponential and logarithmic functions | Algebra II | Khan Academy

Compound Interest & Population Growth Word Problems - Logarithms

5.0 / 5 (0 votes)

Thanks for rating: