Continuous Money Flow: Finding Revenue Stream when Future Value is Known

TLDRThe video script presents a financial problem involving the future value of a continuous money flow, known as a 'working backwards' problem. The goal is to determine the initial investment needed to reach a future value of $50,000 in three years, with an interest rate of 5%. The script guides through setting up the problem using the future value formula, integrating with a constant income stream 'a', and applying u-substitution to solve for 'a'. The process involves evaluating the integral from 0 to 3, solving for 'a', and then verifying the solution by calculating the future value of the continuous income stream. The result indicates an initial investment of approximately $15,447 to achieve the desired future value, providing a clear and engaging explanation of the mathematical process.

Takeaways

- 🚗 The goal is to calculate the initial investment needed for a future value of $50,000 in 3 years for a car purchase.

- 📈 The future value (FV) is calculated using the formula for continuous compounding: FV = ∫(a * e^(r*t) dt) from 'a' to 'b'.

- 🔍 The interest rate (r) is given as 5%, and the time period (t) is 3 years.

- 💡 The problem is approached by working backwards from the known future value to find the unknown continuous income stream (a).

- 📊 The revenue stream is assumed to be constant, so 'a' is used to represent the constant deposit amount.

- ✅ The integration is performed using u-substitution with u = e^(0.05t) and du = 0.05e^(0.05t) dt.

- 🧮 After integration, the equation is simplified to solve for 'a', the initial deposit amount.

- 📉 The equation is simplified to: 50,000 = a * (e^(0.15) - 1) / 0.05.

- 🔢 By solving for 'a', the continuous income stream required is calculated to be approximately $15,447.

- 🔄 To verify, the future value of the continuous income stream (15,447 * e^(0.05t) dt) from 0 to 3 is calculated and should equal $50,000.

- 📝 The process demonstrates how to work backwards from a future value to find the required continuous investment over a given period.

Q & A

What is the future value formula used in the problem?

-The future value formula used is the integral from 'a' to 'b' of the income stream or revenue stream, times e to the r t, dt.

What is the future value the individual is aiming for?

-The future value is $50,000, which is the amount the individual wants to have in three years to buy a new car.

What is the interest rate for the investment?

-The interest rate for the investment is 5 percent.

What does 'r sub t' represent in the context of the problem?

-'r sub t' represents the unknown rate of the continuous income stream that needs to be determined.

How is the constant income stream assumed to behave in the problem?

-The constant income stream is assumed to remain constant, not increasing over time.

What is the variable 'a' used to represent in the problem?

-The variable 'a' is used to represent the constant income stream that is being deposited continuously over the time period.

What is the method used to integrate the future value formula?

-The method used to integrate the future value formula is u-substitution.

What is the result of evaluating the integral from 3 to 0?

-The result is e to the point zero five times three, minus e to the point zero five times zero, which simplifies to e^(0.15) - 1.

How is 'a' solved for in the equation?

-To solve for 'a', both sides of the equation are multiplied by 0.05, and then 'a' is divided by e to the point one five minus one.

What is the calculated continuous income stream over the next three years?

-The calculated continuous income stream is approximately $15,447.

How can the result be checked for accuracy?

-The result can be checked by calculating the future value from 0 to 3 of a revenue stream of $15,447 times e to the point zero five t, dt, which should equal $50,000.

What is the significance of working backwards in this problem?

-Working backwards allows the individual to determine the necessary continuous income stream to achieve a specific future value, given the interest rate and time period.

Outlines

🚗 Calculating Continuous Investment for a Future Car Purchase

The video script introduces a problem-solving approach for determining the continuous investment needed to reach a future value, specifically for purchasing a car. It outlines the use of the future value formula, which is an integral of an income stream multiplied by e^(rt) from time 'a' to 'b'. The scenario involves a future value of $50,000 for a car to be purchased in three years with an interest rate of 5%. The challenge is to find the constant deposit 'a' that needs to be invested continuously. The script guides through the steps of setting up the integral with the known future value, assuming a constant income stream, and performing u-substitution for integration. The final calculation results in a continuous income stream of approximately $15,447 to be invested over three years to achieve the desired future value. The script concludes with a verification step, showing that the calculated income stream, when invested continuously, indeed results in the future value of $50,000.

Mindmap

Keywords

💡Future Value

💡Continuous Money Flow

💡Interest Rate

💡Integral

💡Revenue Stream

💡Working Backwards

💡U Substitution

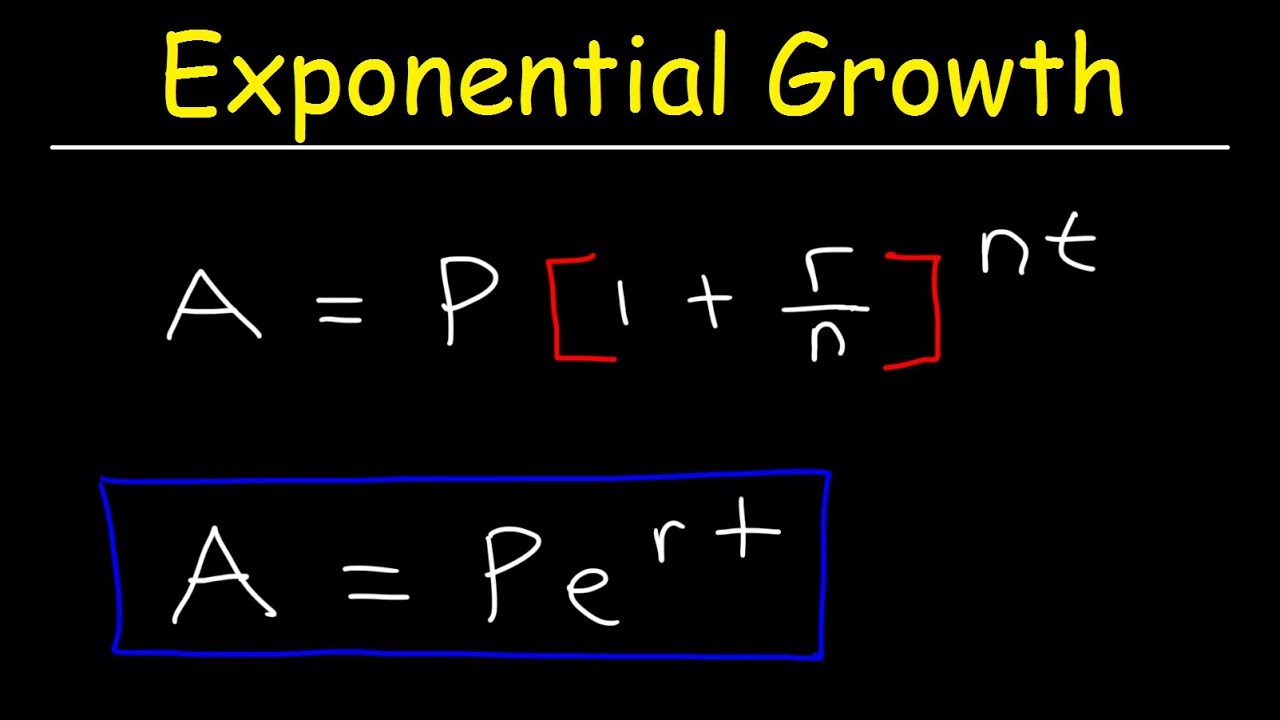

💡e to the rt

💡Exponential Function

💡Integration

💡Checking the Solution

Highlights

The problem involves calculating the future value of a continuous money flow.

The future value formula is integral from a to b of the income stream times e to the r t, dt.

The future value is known to be $50,000 for a car to be bought in three years.

The investment has a 5% interest rate.

The goal is to find the total amount needed to invest with continuous deposits over the time period.

The variable r sub t is to be determined, representing the income stream.

An assumption is made that the income stream is constant and does not change over time.

The revenue stream is represented as a constant 'a' multiplied by e to the .05 t dt.

Integration is performed using u substitution with a divided by .05 as the substitution variable.

The evaluation of the integral results in an equation with 50,000 as the future value.

Solving for 'a' involves multiplying both sides by .05 and dividing by e to the .15 minus 1.

The continuous income stream required over three years is calculated to be approximately $15,447.

To verify the result, the future value of the revenue stream from 0 to 3 years is recalculated.

The recalculated future value matches the initial known future value of $50,000.

The problem demonstrates a method of working backwards from a known future value to determine the required investment.

The mathematical process involves setting up the integral, making assumptions, performing integration, and solving for the unknown.

The transcript provides a step-by-step guide to solving a continuous money flow problem.

The use of exponential functions and integration is key to finding the solution.

The final answer confirms the practical application of mathematical formulas in financial planning.

Transcripts

Browse More Related Video

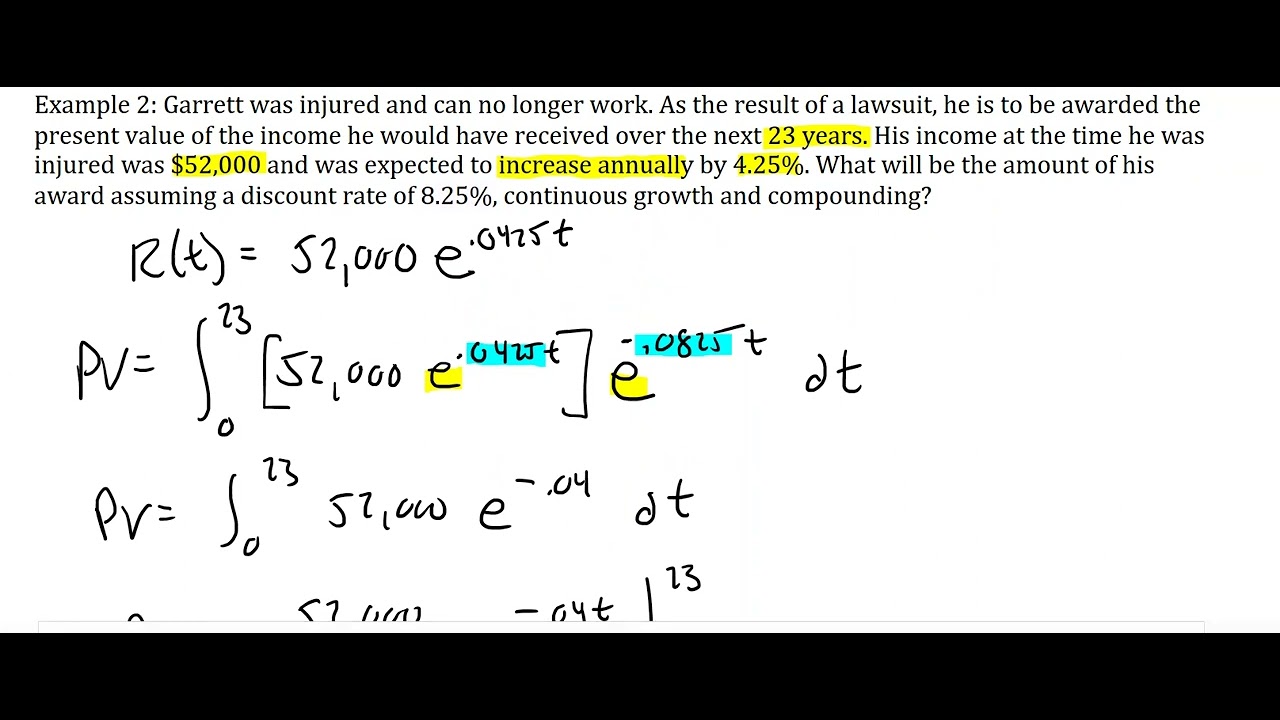

Continuous Money Flow: Future Value with increasing rate of growth

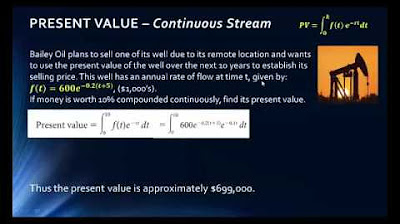

Continuous Money Flow: Present Value Problems

MATH 1325 13 4 Lecture

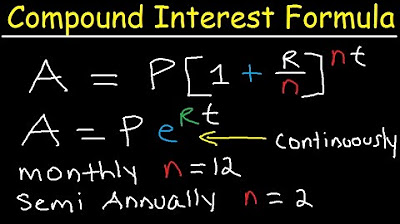

Compound Interest Formula Explained, Investment, Monthly & Continuously, Word Problems, Algebra

Interest Compounded Continuously

Compound Interest & Population Growth Word Problems - Logarithms

5.0 / 5 (0 votes)

Thanks for rating: