MATH 1325 13 4 Lecture

TLDRThis lecture introduces the application of definite integrals in business and social sciences, focusing on the concept of continuous income streams. The lecturer explains how the income from an oil company's well can be modeled as a continuous stream due to the constant production of oil. The total income is calculated by integrating the rate of income flow over time, which is exemplified using Bailey Oil's income stream function. The lecture also covers the calculation of present value and future value of income streams, using exponential functions to account for interest rates. Additionally, the concepts of consumer surplus and producer surplus are discussed, with examples of how to calculate these using integrals of demand and supply functions. The emphasis is on understanding how these mathematical concepts apply to real-world economic scenarios.

Takeaways

- 📈 **Continuous Income Streams:** The concept of a continuous stream of income is central to the lecture, where income is viewed as a function of time, eventually reducing to zero as resources deplete or equipment wears out.

- 🧮 **Integration for Total Income:** To find the total income from a continuous income stream, integration is used. The rate of change of income over time is integrated from an initial time A to a final time B.

- 🏭 **Example with Bailey Oil:** A specific example is given using Bailey Oil, where the annual rate of flow at time T is given by a function, and the total income over ten years is calculated using integration.

- 💡 **Substitution in Integration:** The technique of substitution is used in integration, setting u to a part of the integrand and solving for du, which is particularly useful when dealing with exponential functions.

- ⚖️ **Units Matter:** It's crucial to pay attention to units, as the function may represent income in thousands or millions of dollars per year, and the final answer must reflect the correct unit.

- 💰 **Present Value of Income Stream:** The present value is the current worth of future income, calculated using an integral that includes an exponential term to discount future earnings back to the present value.

- 📚 **Building Formulas:** The formulas for total income, present value, and future value of an income stream are interconnected, with the future value formula being derived from the present value formula by including an additional exponential term.

- 🔢 **Future Value Calculation:** The future value of an income stream is calculated by multiplying the present value by an exponential factor that accounts for continuous compounding over a certain period.

- 📉 **Consumer and Producer Surplus:** The concepts of consumer surplus (the benefit to consumers from paying less than they are willing to) and producer surplus (the additional income a producer receives from charging more than their minimum acceptable price) are introduced.

- 🤝 **Equilibrium Price:** The equilibrium price is where the supply and demand curves intersect, representing the optimal price point where quantity supplied equals quantity demanded.

- 🧮 **Calculating Surplus:** Both consumer and producer surplus can be calculated using integrals that determine the area between the demand/supply curves and the equilibrium price line.

- 📊 **Graphical Representation:** The lecture includes graphical representations of demand and supply functions, equilibrium points, and how to visualize consumer and producer surplus.

Q & A

What is the concept of a continuous income stream in the context of the lecture?

-A continuous income stream refers to a constant flow of income over time, such as the income generated by an oil pump that operates continuously, producing oil that is eventually sold.

How is the total income from a continuous income stream calculated?

-The total income from a continuous income stream is calculated by integrating the rate of change of income over a period of time from a starting point A to an ending point B.

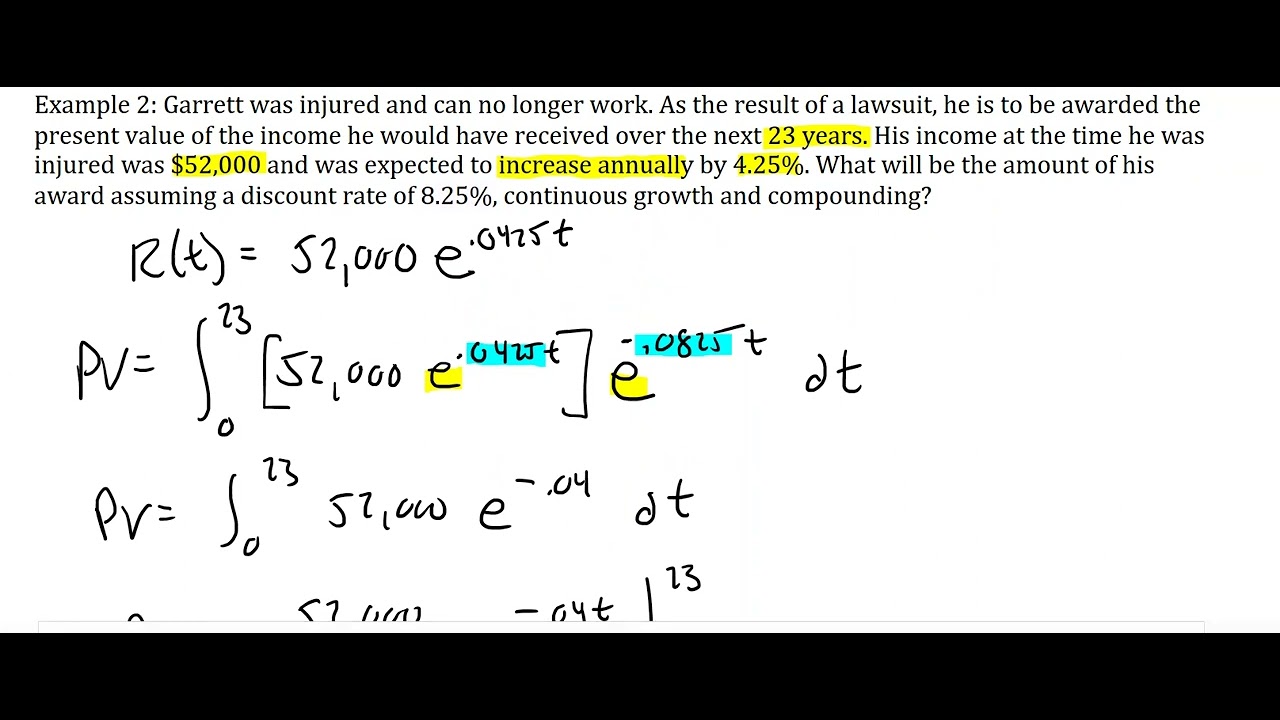

What is the formula for calculating the present value of a continuous income stream?

-The present value of a continuous income stream is calculated using the formula: Present Value = ∫(0 to K) F(T)e^(-RT) dT, where F(T) is the rate of income flow, R is the interest rate, T is the time, and K is the time interval.

Why is the present value of an income stream important?

-The present value of an income stream is important because it represents the current worth of future income. It is useful for making financial decisions, such as whether to replace machinery, select new equipment, or determine the value of an asset like an oil well.

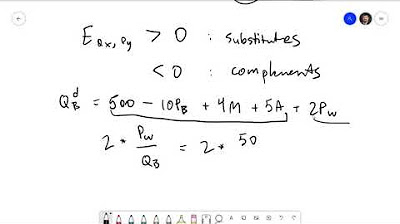

How does the concept of consumer surplus relate to the price of a product?

-Consumer surplus is the difference between the amount a consumer is willing to pay for a product and the actual price they pay. If a company charges less than what a consumer is willing to pay, the consumer benefits from the consumer surplus, which is the amount they save.

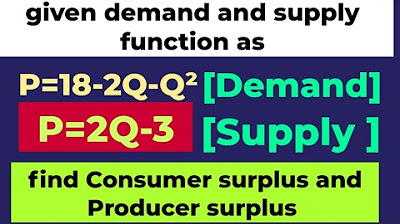

What is the equilibrium price in the context of supply and demand?

-The equilibrium price is the optimal price at which the supply and demand for a product meet. At this price, the quantity of the product that producers are willing to supply equals the quantity that consumers are willing to buy.

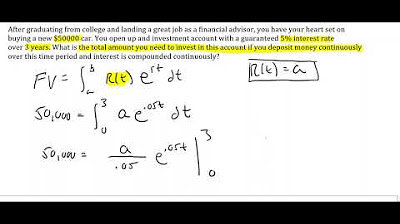

How is the future value of a continuous income stream calculated?

-The future value of a continuous income stream is calculated using the formula: Future Value = e^(RK) * Present Value, where R is the interest rate, K is the number of years, and the Present Value is determined by integrating the income rate over time.

What is the significance of the area between two curves in the context of consumer surplus?

-The area between the demand curve and the total revenue line (representing the price times quantity at equilibrium) represents the consumer surplus. It shows the total amount consumers save because they pay less than what they are willing to pay.

How is the producer surplus calculated?

-Producer surplus is calculated by subtracting the total revenue (equilibrium price times quantity) from the integral of the supply function from the equilibrium quantity back to zero.

Why is it important to pay attention to units when solving problems involving financial values?

-Attention to units is crucial because it ensures the accuracy of the final answer. For instance, failing to recognize that a value is in thousands or millions can lead to significant errors in financial calculations.

What is the role of integration in calculating the total income, present value, and future value of a continuous income stream?

-Integration is used to sum up the infinitesmal changes in income over time to find the total income. It's also used to calculate the present value by integrating the income rate adjusted for the discount factor over time, and to find the future value by integrating the income rate and then applying the compounding factor.

Outlines

📈 Calculating Total Income from a Continuous Income Stream

This paragraph introduces the concept of a continuous income stream, using an oil company as an example. It explains that the income from an oil well can be thought of as a continuous stream due to the constant pumping of oil. The paragraph details how to calculate the total income over a period of time by integrating the rate of change of income, which is given as a function of time. An example problem involving Bailey Oil is presented, where the annual rate of income flow is provided, and the task is to estimate the total income over ten years. The solution involves integration using substitution and emphasizes the importance of considering units, resulting in a total income of two million five hundred ninety-four thousand dollars.

💰 Present Value and Future Value of Income Streams

The second paragraph delves into the importance of calculating the present value of a continuous income stream, which is the current worth of future income. This is crucial for making financial decisions such as replacing machinery or evaluating the purchase or sale of assets like oil wells. The paragraph outlines the formula for calculating the present value, which involves integrating the income flow rate multiplied by an exponential decay function. An example is provided using Bailey Oil with a different income flow rate function, and the present value is calculated for a ten-year period with a 10% continuous interest rate, resulting in a present value of 699 thousand dollars. The concept of future value is also introduced, which is the value of an investment at a future date when it has been continuously compounded, and a formula is provided for this calculation.

🔍 Understanding Consumer and Producer Surplus

The third paragraph explores the economic concepts of consumer surplus and producer surplus. Consumer surplus is the difference between what consumers are willing to pay and what they actually pay, representing the benefit they receive from a product being priced lower than their willingness to pay. Producer surplus, on the other hand, is the difference between the price at which a producer is willing to sell a product and the actual selling price. The paragraph explains these concepts with examples and uses supply and demand curves to illustrate equilibrium price, where the quantity supplied equals the quantity demanded. The importance of understanding these surpluses in economics and business decision-making is highlighted.

🧮 Determining Equilibrium Points and Surpluses

This paragraph focuses on finding equilibrium points where supply and demand intersect and calculating the associated consumer and producer surpluses. The equilibrium point is identified by setting the supply and demand functions equal to each other and solving for the quantity. Once the equilibrium quantity and price are established, the consumer surplus is calculated by integrating the demand function from zero to the equilibrium quantity and subtracting the total revenue (equilibrium price times quantity). An example is provided where the demand function is given, and the equilibrium price is $20, resulting in an equilibrium quantity of 50 units. The consumer surplus is then calculated to be $3,010.46. The process is also explained for finding the producer surplus, which involves integrating the supply function from zero to the equilibrium quantity and subtracting this value from the total revenue.

📉 Calculating Producer Surplus with a Quadratic Supply Function

The final paragraph presents a problem involving a supply function where the price is a quadratic function of the number of units. Given a supply function and an equilibrium price of $20 per unit, the task is to find the producer surplus. The equilibrium point is determined by setting the supply function equal to the equilibrium price and solving for the quantity. After establishing that the equilibrium quantity is 4 million units, the producer surplus is calculated by subtracting the integral of the supply function from the total revenue at the equilibrium point. The integral of the supply function from 0 to 4 million units is evaluated, and the result is used to find the producer surplus, which is given in million dollars, resulting in a surplus of $50.67 million.

Mindmap

Keywords

💡Definite Integrals

💡Continuous Income Stream

💡Integration

💡Total Income Function

💡Present Value

💡Future Value

💡Consumer Surplus

💡Producer Surplus

💡Equilibrium Price

💡Supply and Demand

💡Substitution

Highlights

Introduction to applications of definite integrals in the context of business and social sciences.

Exploration of continuous income stream problems, such as profits from an oil company's well.

Use of integration to find the total income from a rate of income over a period of time.

Example calculation for Bailey Oil's total income from a well over ten years.

Common mistake correction regarding the evaluation of limits in integrals, specifically when plugging in zero.

Importance of considering units when expressing answers in financial calculations.

Discussion on the present value of a continuous income stream and its relevance in decision-making.

Integration used to calculate the present value of an income stream with a given interest rate.

Bailey Oil example to find the present value of a well over the next ten years with a 10% interest rate.

Explanation of the future value of an income stream and its calculation using continuous compounding.

Problem-solving approach to find the future value of an asset with a given income rate and interest rate.

Concept of producer and consumer surplus in the context of market equilibrium.

Graphical representation of supply and demand curves to illustrate equilibrium price.

Calculation of consumer surplus using the area between the demand curve and the total revenue rectangle.

Determination of producer surplus by integrating the supply function and subtracting from total revenue.

Problem-solving steps to find the equilibrium point where supply and demand intersect.

Use of definite integrals to calculate the area representing consumer and producer surplus.

Example calculation of consumer surplus for a product with a given demand function and equilibrium price.

Final calculation of producer surplus for a given supply function and equilibrium price.

Transcripts

Browse More Related Video

Continuous Money Flow: Future Value with increasing rate of growth

Continuous Money Flow: Finding Revenue Stream when Future Value is Known

Continuous Money Flow: Present Value Problems

Managerial Economics 2.5: More Elasticity

Calculus Chapter 4 Lecture 30 Simple Areas

consumer surplus and producer surplus

5.0 / 5 (0 votes)

Thanks for rating: