Simulating Supply and Demand

TLDRThis video script explores the concept of markets from a basic level, simulating the interaction between buyers and sellers with varying price limits. It demonstrates how surplus is created when a transaction occurs and how market dynamics change with the addition of more buyers and sellers. The script delves into the self-organizing nature of markets, the concept of surplus, and the equilibrium price where supply meets demand. It also touches on the efficiency of markets and the arguments for and against market regulation. The discussion highlights the importance of understanding markets as tools that can be beneficial when used thoughtfully.

Takeaways

- 🚀 The video discusses the concept of markets starting with a simple scenario of one buyer and one seller and building up to a complex market simulation with multiple participants.

- 💰 The script introduces the idea of 'surplus' as a measure of the value gained from a transaction, where both the buyer and seller benefit from the price agreed upon.

- 📊 The video uses a simulation to demonstrate how the introduction of additional buyers and sellers affects market dynamics, including price changes and surplus distribution.

- 📈 The concept of supply and demand curves is introduced to illustrate how equilibrium price and quantity are determined in a market.

- 🤔 The video raises the question of market efficiency and the conditions under which a market operates ideally, such as the presence of many buyers and sellers with full information and voluntary transactions.

- 🛡️ It also addresses potential arguments for market regulation, questioning whether the idealized market model accurately represents real-world scenarios and whether maximizing surplus is always the right goal.

- 🌐 The script touches on the broader implications of market organization, suggesting that markets can be efficient in generating maximum surplus and determining the right number of participants.

- 👥 The video highlights the importance of understanding markets as tools, emphasizing the need for thoughtful consideration of how and when to use them effectively.

- 🏛️ The discussion includes the role of the 'invisible hand' of the market, referring to the automatic organization and optimization that occurs without central direction.

- 💡 The video script concludes with a real-world example of educational videos on the internet, suggesting that viewer engagement can influence supply and demand in this unique market.

- 🔄 The script encourages viewers to think critically about the role of markets in society and the balance between self-organization and intervention.

Q & A

What is the purpose of the video script?

-The purpose of the video script is to explain the concept of markets, starting from a basic scenario with one buyer and one seller, and gradually building up to a simulation of a market with many buyers and sellers. It also aims to discuss the arguments for and against market intervention.

What are 'blue blobs' and 'orange blobs' in the context of the script?

-In the script, 'blue blobs' represent sellers who offer to sell rockets, while 'orange blobs' represent buyers who are willing to purchase rockets at the right price.

What does the vertical bar represent for the seller in the script?

-The vertical bar represents the minimum price a seller is willing to accept for a rocket. It is determined by the cost of obtaining the rocket and the seller's personal value of keeping it.

What is the significance of the buyer's maximum price in the script?

-The buyer's maximum price is the highest amount they are willing to pay for a rocket. It sets a limit beyond which the buyer deems the purchase not worth it.

What is meant by 'surplus' in the context of the script?

-Surplus refers to the additional value gained by both the buyer and the seller from a transaction. It is calculated as the difference between what the buyer values the rocket at and what they actually paid for it.

How does the introduction of a second buyer affect the market dynamics in the script?

-The introduction of a second buyer creates competition, which can lead to an increase in the price of rockets as both buyers are willing to pay more to secure a purchase.

What is the role of 'expected prices' in the simulation described in the script?

-Expected prices are the prices that buyers and sellers have in mind for each transaction. They adjust these expectations based on their daily experiences in the market, becoming more or less aggressive with their pricing accordingly.

What happens when the number of sellers exceeds the number of buyers in the script's market simulation?

-When there are more sellers than buyers, some sellers will not be able to make a sale, leading them to lower their asking price in order to compete and secure a transaction.

What is the economic term for the stable price and quantity that the market settles on in the script?

-The economic term for the stable price and quantity where the quantity supplied equals the quantity demanded is 'equilibrium price and quantity'.

What does the script suggest about the efficiency of markets at equilibrium?

-The script suggests that at equilibrium, markets are efficient as they generate the maximum possible surplus and determine the right number of participants, which is often referred to as the 'invisible hand' of the market.

What are some arguments for market regulation mentioned in the script?

-The script mentions that market regulation might be necessary when the ideal conditions for a free market are not met, such as when there are not many buyers and sellers, or when participants do not have full information. Additionally, regulation might be considered if maximizing surplus is not the society's primary goal, such as in markets for food, labor, and healthcare.

How does the script relate the concept of markets to the real-world industry of educational videos on the internet?

-The script suggests that the principles of supply and demand can apply to the distribution of educational videos on the internet. User engagement through likes, subscriptions, shares, and direct support can influence the quantity supplied of such content in the long run.

Outlines

🚀 Introduction to Market Dynamics

This paragraph introduces the concept of a market simulation starting with a single buyer and seller and building up to a complex market with multiple participants. The instructor uses the analogy of blue blobs as sellers and orange blobs as buyers, with rockets as the product. The seller has a minimum value for the rocket, and the buyer has a maximum price they are willing to pay. A transaction occurs when the agreed price falls between these two values, creating a surplus for both parties. The example given is a transaction at $30, with the buyer valuing the rocket at $40 and the seller's minimum at $20, resulting in a $10 surplus for each. The paragraph also discusses the impact of adding a second buyer with a lower price limit and the simulation rules that govern the market interactions.

📈 Market Equilibrium and Surplus Distribution

The second paragraph explores the effects of increasing the number of sellers and buyers in the market. It discusses the introduction of two additional sellers with varying price limits and the resulting market dynamics. With three sellers and two buyers, at least one seller cannot make a sale, leading to a price decrease. The surplus generated from transactions is now mostly captured by the buyers, as sellers compete with each other. The paragraph then considers the scenario of having an equal number of buyers and sellers and how this leads to a market equilibrium where the quantity supplied equals the quantity demanded. The concept of supply and demand curves is introduced to illustrate this equilibrium, and the market's efficiency in generating maximum surplus is highlighted.

🛡️ Arguments for and Against Market Regulation

The final paragraph delves into the arguments for and against market regulation. It starts by questioning the applicability of the idealized market model to real-world scenarios, noting that for markets to be efficient, there must be many informed participants who can freely choose to engage in transactions. The paragraph then challenges the goal of maximizing surplus, suggesting that society might value other outcomes, such as ensuring access to basic needs for all, even if it results in less total surplus. The instructor emphasizes that markets are tools that should be used thoughtfully, understanding their strengths and limitations. The video concludes with a brief mention of the free distribution of educational content online, like this video, and how viewer engagement can influence the supply of such content.

Mindmap

Keywords

💡Markets

💡Surplus

💡Supply and Demand

💡Equilibrium Price

💡Quantity Supplied

💡Quantity Demanded

💡Price Limits

💡Economic Efficiency

💡Intervention

💡Invisible Hand

💡Blobs

Highlights

Introduction to market dynamics starting with a single buyer and seller scenario.

Building up to a market simulation with multiple buyers and sellers.

Exploration of the political implications of market efficiency and intervention.

Use of blue and orange blobs to represent sellers and buyers respectively.

Explanation of the minimum and maximum price values for sellers and buyers.

Concept of surplus as a measure of trade worthiness.

Introduction of a second buyer with a different price limit.

Simulation rules involving daily price setting and random buyer-seller interactions.

Behavior of buyers and sellers adjusting prices based on transaction outcomes.

Impact of adding a second buyer on rocket prices and surplus distribution.

Introduction of two additional sellers with varying price limits.

Effect of increased seller competition on market prices and surplus.

Equilibrium concept where quantity supplied equals quantity demanded.

Use of supply and demand curves to illustrate equilibrium price and quantity.

Discussion on the efficiency of markets in generating maximum surplus.

Critique of the idealized market model and its applicability to real-world scenarios.

Arguments for market regulation beyond surplus maximization.

The role of markets as a tool and the importance of thoughtful application.

Real-world application of market dynamics in the industry of free educational videos.

Transcripts

Browse More Related Video

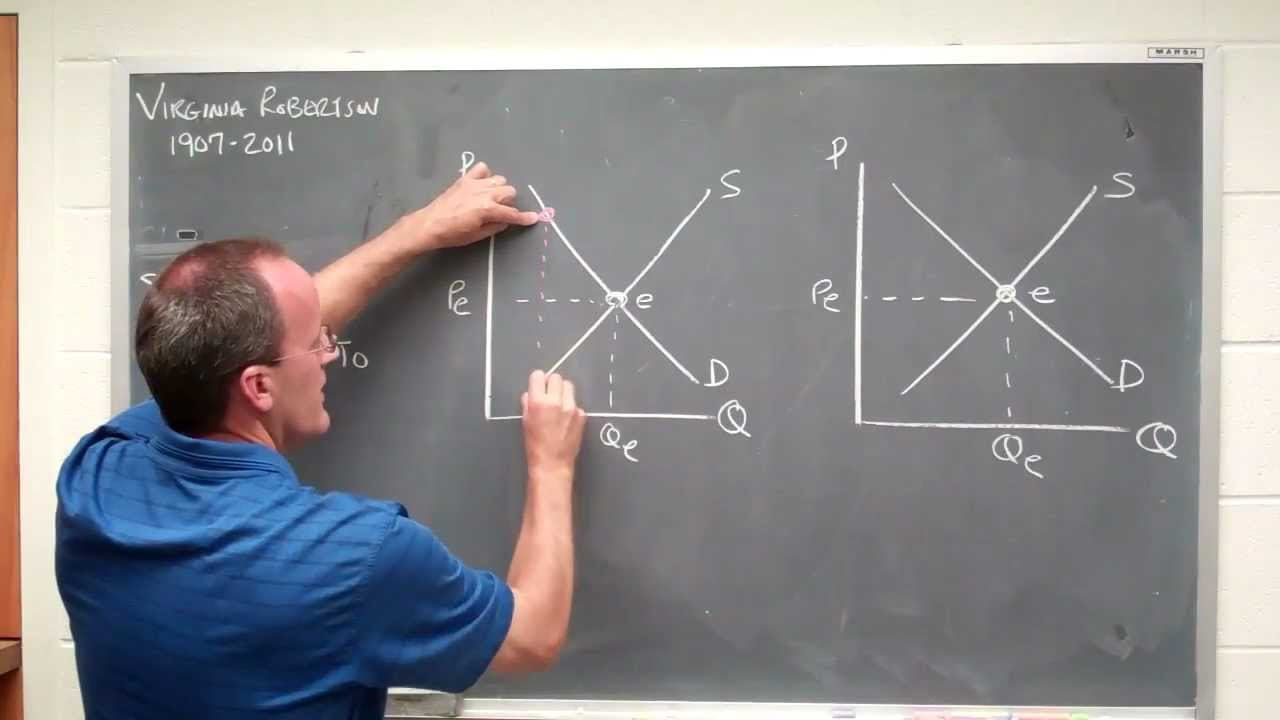

supply demand in equilibrium

Supply and Demand: Crash Course Economics #4

Chapter 7: Consumer Surplus, Producer Surplus and the Efficiency of Markets - Part 1

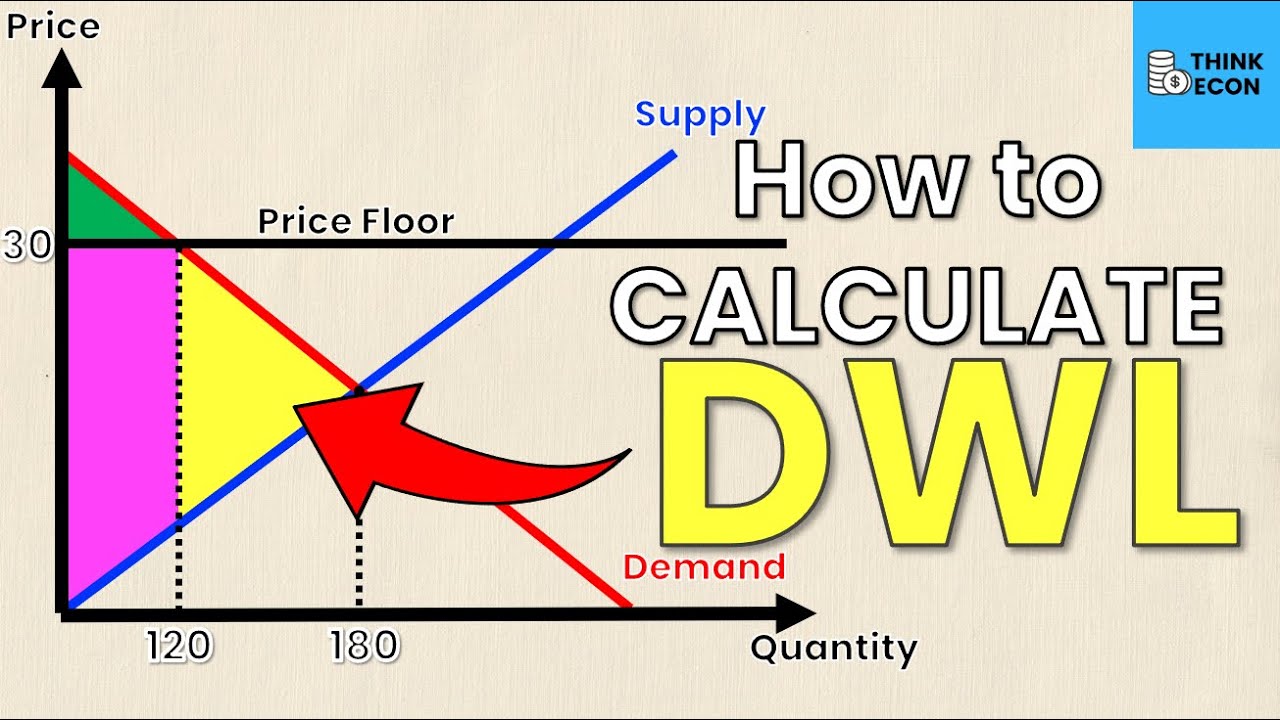

How to Calculate Deadweight Loss (with a Price Floor) | Think Econ

Intermediate Microeconomics: Consumer surplus, producer surplus, price controls, and taxes, Part 1

Animation on How to Price Floors and Price Ceilings

5.0 / 5 (0 votes)

Thanks for rating: