Managerial Economics 2.5: More Elasticity

TLDRIn this video, Sebastian Y dives into the concepts of cross price and income elasticity in managerial economics. He explains that the demand for a product can be influenced by the prices of other goods, using the example of how wine's price affects beer's demand. Cross price elasticity is calculated by the percentage change in the quantity demanded of one good (X) divided by the percentage change in the price of another good (Y). If the elasticity is positive, goods are substitutes; if negative, they are complements. Income elasticity measures the responsiveness of quantity demanded to changes in consumer income, with positive values indicating normal goods and negative values suggesting inferior goods. The video also includes examples of calculating these elasticities using a beer demand function and discusses how to apply elasticity in scenarios such as increasing quantity demanded by adjusting price or understanding the impact of income changes on sales.

Takeaways

- 📈 **Cross Price Elasticity**: The demand for a product can be influenced by the prices of other goods, not just its own price. It's calculated as the percentage change in quantity demanded of one good (X) divided by the percentage change in price of another good (Y).

- 🔄 **Substitutes and Complements**: If goods are substitutes, the cross price elasticity is positive; if they are complements, it's negative.

- 📉 **Law of Demand**: Unlike own price elasticity, there is no law of demand for cross price elasticity, meaning the sign of the derivative is not predetermined.

- 🍺 **Beer and Wine Example**: Beer and wine are substitutes, as shown by a positive cross price elasticity calculated using a beer demand function.

- 💰 **Income Elasticity**: It measures the responsiveness of quantity demanded to a change in consumer income and is calculated as the percentage change in quantity demanded divided by the percentage change in income.

- 📌 **Normal and Inferior Goods**: If income elasticity is positive, the good is normal; if negative, it's inferior.

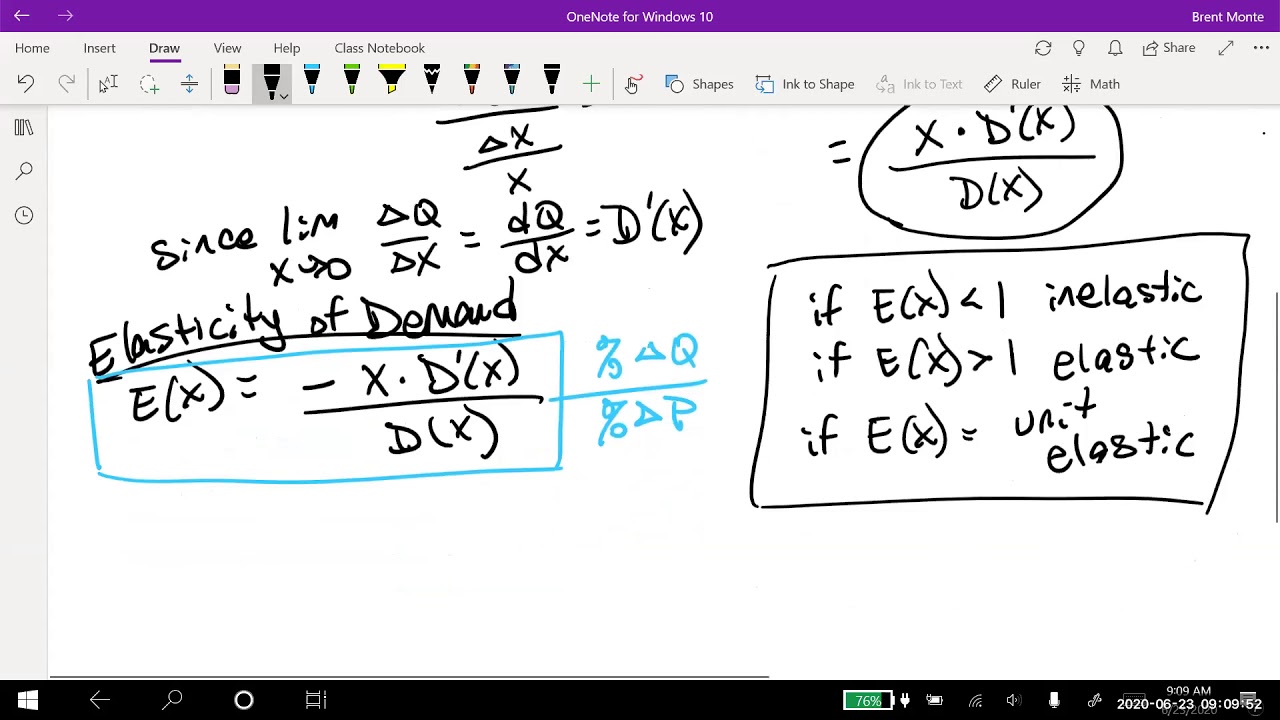

- 📊 **Elasticity Calculation Methods**: There are two ways to calculate elasticity: using percentage changes or through a demand function, depending on the situation.

- 🔢 **Partial Derivatives**: The partial derivative of the demand function with respect to the price of another good (Y) or income (m) is key to calculating cross price and income elasticity.

- 📚 **Algebra Omitted**: The algebraic steps for calculating elasticity are not shown in detail but are implied to be similar to own price elasticity calculations.

- 🤔 **Managerial Application**: Price elasticity can guide managers on how much to change prices to achieve a desired change in quantity demanded.

- 📈 **Quantity Increase Strategy**: To increase quantity demanded by 10%, a manager would need to decrease the price by 5% if the price elasticity of demand is negative 2.

- 💼 **Income Change Impact**: If income is expected to rise by 10% and the income elasticity of demand is 0.2, the quantity demanded is expected to rise by 2%.

Q & A

What is the main topic discussed in the video?

-The main topic discussed in the video is cross price and income elasticity, including their definitions, calculations, and applications.

How does the demand for a good relate to the prices of other goods?

-The demand for a good can depend on the prices of other goods, not just the price of the good itself. For example, the price of wine can impact the demand for beer.

What is the formula for calculating cross price elasticity?

-The formula for calculating cross price elasticity is the percent change in the quantity of one good demanded (good X) divided by the percent change in a different good's price (good Y).

What is the key difference between cross price elasticity and own price elasticity?

-The key difference is that there is no law of demand for cross price elasticity, meaning the sign of the derivative is not guaranteed to be negative as it is with own price elasticity.

How can you tell if two goods are substitutes based on cross price elasticity?

-If the cross price elasticity is positive or greater than zero, the goods are substitutes.

How can you tell if two goods are complements based on cross price elasticity?

-If the cross price elasticity is less than zero, the goods are complements.

What is the formula for calculating income elasticity?

-The formula for calculating income elasticity is the percent change in the quantity demanded divided by the percent change in income.

How does income elasticity help determine if a good is normal or inferior?

-If the income elasticity is positive, the good is considered normal. If it is negative, the good is considered inferior.

What is the significance of the sign of the partial derivative in the income elasticity formula?

-The sign of the partial derivative determines whether the good is a normal or inferior good, which affects the direction of the change in quantity demanded relative to a change in income.

How can a manager use price elasticity to increase quantity demanded by a certain percentage?

-A manager can use the price elasticity equation to calculate the necessary percentage change in price that would result in the desired percentage change in quantity demanded.

What is the expected change in quantity demanded when income increases by 10 percent if the income elasticity of demand is 0.2?

-If the income elasticity of demand is 0.2 and income is expected to increase by 10 percent, the quantity demanded is expected to increase by 2 percent.

How does the video script enhance the understanding of elasticity concepts?

-The video script enhances the understanding of elasticity concepts by providing clear definitions, mathematical formulas, and step-by-step examples that illustrate how to calculate cross price and income elasticity, as well as their practical applications.

Outlines

📚 Introduction to Cross Price and Income Elasticity

Sebastian Y introduces the concept of cross price and income elasticity in managerial economics. He explains that demand for a product can be influenced by the prices of other goods. The cross price elasticity is calculated as the percentage change in the quantity demanded of one good (X) divided by the percentage change in the price of another good (Y). This is different from own price elasticity as there's no law of demand certainty for cross price elasticity. If the goods are substitutes, the elasticity is positive; if they're complements, it's negative. An example using a beer demand function is given to illustrate the calculation, showing that beer and wine are substitutes with a positive elasticity. Income elasticity is also discussed, defined as the percentage change in quantity demanded divided by the percentage change in income. It helps to determine if a good is normal or inferior based on the sign of the elasticity.

📈 Elasticity Calculations and Applications

The video continues with an example of calculating income elasticity using a beer demand function. It's shown that beer is a normal good with a positive income elasticity. The application of elasticity in managerial decision-making is then explored. Two scenarios are presented: one where a manager aims to increase quantity demanded by 10% with a known price elasticity of demand, and another where the income elasticity of demand is 0.2 and income is expected to increase by 10%. For the first scenario, using the price elasticity equation, it's calculated that to achieve a 10% increase in quantity demanded, the price must be decreased by 5%. In the second scenario, it's determined that a 10% increase in income would lead to a 2% increase in quantity demanded for the product. The video concludes with an invitation for viewers to ask questions and a thank you for watching.

Mindmap

Keywords

💡Cross Price Elasticity

💡Income Elasticity

💡Partial Derivative

💡Law of Demand

💡Substitutes

💡Complements

💡Normal Good

💡Inferior Good

💡Price Elasticity of Demand

💡Managerial Economics

💡Elasticity Calculations

Highlights

The demand for a good can depend on the prices of other goods, not just the price of the good itself.

Cross price elasticity is defined as the percent change in the quantity of one good demanded divided by the percent change in a different good's price.

There are two ways to calculate cross price elasticity: using percentage changes or a demand function.

The sign of the cross price elasticity derivative determines if goods are substitutes (positive) or complements (negative).

An example is given using a beer demand function to calculate cross price elasticity with respect to the price of wine.

Income elasticity is defined as the percent change in the quantity demanded divided by the percent change in income.

The sign of income elasticity indicates whether a good is normal (positive) or inferior (negative).

An example calculates income elasticity using a beer demand function, showing beer as a normal good.

Elasticity can be applied to perform calculations, such as determining price changes needed to achieve a target quantity demanded.

If the price elasticity of demand is negative, and a manager wants to increase quantity demanded by 10%, the price must be decreased by 5%.

Income elasticity of demand can predict changes in quantity demanded based on expected changes in income.

An example predicts a 2% increase in quantity demanded when income is expected to rise by 10%.

The importance of understanding the positive or negative nature of cross price and income elasticity for strategic decision-making.

The absence of the law of demand in cross price elasticity calculations.

The algebraic steps for calculating own price elasticity are omitted, emphasizing the focus on cross price and income elasticity.

The use of partial derivatives in calculating cross price and income elasticity, highlighting the mathematical approach.

The practical application of elasticity in managerial economics for decision-making regarding price and income changes.

The video provides a comprehensive understanding of how to apply elasticity in various economic scenarios.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: