Y1 16) Indirect Tax - Full Market Impact

TLDRThis video script delves into indirect taxes as a government intervention tool, highlighting their role in revenue generation and addressing market failures. It distinguishes between specific and ad valorem taxes, demonstrating their impact on supply curves. The script explores the effects of indirect taxes on market equilibrium, consumer and producer burdens, and government revenue. It also touches on the negative implications for consumers and producers, the potential for black markets, and the importance of considering elasticity in future discussions.

Takeaways

- 💼 Indirect taxes are a form of government intervention used to raise revenue and address market failures by discouraging the consumption and production of harmful goods and services.

- 💰 Indirect taxes can be categorized into specific taxes, which are per unit charges like wine duty, and ad valorem taxes, which are a percentage of the price, such as VAT at 20%.

- 📈 Specific indirect taxes shift the supply curve parallelly, reflecting a consistent tax per unit, while ad valorem taxes cause a pivoted shift, with the tax revenue varying proportionally with the price.

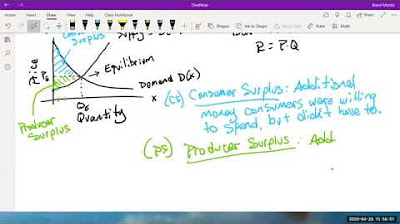

- 📊 The impact of an indirect tax on a market can be analyzed graphically by observing the shift in the supply curve and the new equilibrium point, which results in higher prices and lower quantities.

- 💡 The government revenue from indirect taxes can be calculated by multiplying the tax per unit by the quantity of goods sold at the new equilibrium.

- 🔍 The script explains how to determine the consumer and producer burden of a tax, showing who bears more of the tax impact through price changes and quantity adjustments.

- 📉 Indirect taxes lead to a decrease in producer revenue as some of the revenue generated goes to the government as tax, reducing the income that producers can retain.

- 🚫 Indirect taxes can cause a deadweight loss, a reduction in overall welfare, due to the decrease in quantity traded below the efficient market level.

- 🛑 Consumers generally dislike indirect taxes due to the increased prices and reduced consumer surplus, and these taxes are regressive, impacting low-income households more significantly.

- 🏭 Producers and workers may also be negatively affected by indirect taxes, facing lower revenues and potential job losses as a result of reduced demand and production.

- 🏦 While governments may favor indirect taxes for revenue generation and addressing market failures, they must consider the unintended consequences, including harm to consumers and producers and the potential for creating black markets.

Q & A

What is the primary purpose of indirect taxes?

-Indirect taxes serve two core purposes: to raise government revenue and to address market failures by reducing the consumption and production of goods and services that are harmful to society.

How do indirect taxes differ from direct taxes?

-Indirect taxes are expenditure taxes that can be transferred to consumers through higher prices, whereas direct taxes, such as income tax, cannot be transferred and are levied directly on income.

What are the two types of indirect taxes mentioned in the script?

-The two types of indirect taxes are specific indirect taxes, which are taxes per unit, and ad valorem taxes, which are a percentage of the price being charged.

How does a specific indirect tax affect the supply curve in a market?

-A specific indirect tax shifts the supply curve parallel to itself, with the vertical distance between the original and new supply curve representing the value of the tax per unit.

How does an ad valorem tax impact the supply curve differently from a specific tax?

-An ad valorem tax shifts the supply curve pivoted from its original position, reflecting that the tax is a percentage of the price, meaning the tax revenue varies with the price level.

What is the formula to calculate government revenue from an indirect tax?

-Government revenue can be calculated by taking the vertical distance between the two supply curves (which is the tax per unit) and multiplying it by the quantity of goods produced and sold up to the new equilibrium point.

How can you determine the consumer and producer burden of an indirect tax?

-The consumer burden is the difference in price portion of the government revenue box, representing how much of the tax is passed on to consumers. The producer burden is the remaining area of the box, indicating the portion of the tax borne by producers.

What is the impact of an indirect tax on producer revenue?

-Indirect taxes reduce producer revenue because the revenue calculation must account for the government's tax revenue, which is a portion of the price paid by consumers.

What is the potential consequence of an indirect tax for workers in an industry?

-Workers may face job losses due to the reduced quantity of goods produced as a result of the indirect tax, as labor demand decreases with the reduction in production.

How does an indirect tax create a deadweight loss in a market?

-A deadweight loss occurs when the quantity of goods traded falls due to the tax, leading to a reduction in overall welfare, represented by the area of the triangle formed by the new equilibrium point, the original supply curve, and the tax-induced price increase.

What are the potential unintended consequences of indirect taxes mentioned in the script?

-Unintended consequences of indirect taxes include harm to consumers due to higher prices, potential shutdown or relocation of producers, and the creation of black markets.

Outlines

💼 Indirect Taxes: Purpose and Types

This paragraph introduces the concept of indirect taxes as a form of government intervention in microeconomics, primarily for raising revenue and addressing market failures. It distinguishes between indirect and direct taxes, with the latter being taxes on income that cannot be transferred. The focus is on indirect taxes, which are expenditure taxes levied on the sale of goods and services, potentially increasing production costs and consumer prices. The paragraph further explains two types of indirect taxes: specific taxes, which are a fixed amount per unit sold, and ad valorem taxes, which are a percentage of the price. The summary also illustrates how specific taxes shift the supply curve vertically, while ad valorem taxes pivot the supply curve, reflecting the percentage impact on different price levels.

📊 Impact of Indirect Taxes on Market Equilibrium

The second paragraph delves into the effects of indirect taxes on market equilibrium. It explains how an indirect tax, specifically a specific tax, increases production costs, causing the supply curve to shift upwards. This shift results in a new equilibrium with higher prices and reduced quantities. The paragraph provides a method to calculate government revenue from the tax by measuring the vertical distance between the original and new supply curves and multiplying it by the quantity sold. Additionally, it explores the distribution of the tax burden between consumers and producers, highlighting the consumer burden as the difference in price portions due to the tax and the producer burden as the remaining area. The summary also touches on the decrease in producer revenue and the potential deadweight welfare loss caused by the reduction in market quantity, concluding with the negative implications for consumers, producers, and workers due to the regressive nature of indirect taxes and potential job losses.

👋 Conclusion and Preview of Further Analysis

The final paragraph serves as a conclusion to the video script, summarizing the key impacts of indirect taxes on various stakeholders, including consumers, producers, workers, and the government. It emphasizes the negative perceptions of indirect taxes by consumers and producers due to increased prices, reduced surplus, and potential job losses. The government, while potentially achieving revenue and market failure solutions, must consider the unintended consequences, such as harm to consumers and producers, aggressive tax nature, and the possibility of creating black markets. The paragraph ends with a teaser for the next video, which will explore how the impacts of indirect taxes can vary depending on elasticity, inviting viewers to stay tuned for more detailed analysis.

Mindmap

Keywords

💡Indirect Taxes

💡Government Revenue

💡Market Failure

💡Direct Taxes

💡Specific Indirect Tax

💡Ad Valorem Tax

💡Supply Curve

💡Equilibrium

💡Government Revenue Calculation

💡Consumer Burden

💡Producer Burden

💡Deadweight Loss

Highlights

Indirect taxes are a form of government intervention used to raise revenue and address market failures.

Indirect taxes like VAT are used to increase government revenue, while others like cigarette and alcohol duties aim to reduce consumption of harmful goods and services.

There are two types of taxes: indirect and direct, with the video focusing on the former.

Indirect taxes are expenditure taxes that can be transferred to consumers through higher prices, hence their name.

Indirect taxes can be specific, such as a tax per unit, or ad valorem, which is a percentage of the price.

Specific indirect taxes shift the supply curve parallel, reflecting a consistent tax per unit.

Ad valorem taxes shift the supply curve pivoted, with the tax value varying based on the price level.

The impact of an indirect tax on a market can be analyzed by observing shifts in the supply curve and changes in equilibrium.

Government revenue from indirect taxes can be calculated by multiplying the tax per unit by the quantity sold.

The consumer and producer burdens of an indirect tax can be determined by analyzing the price difference and revenue distribution.

Indirect taxes can lead to a decrease in producer revenue and potentially job losses due to reduced demand for labor.

Governments may favor indirect taxes for revenue generation and addressing market failures, but must consider unintended consequences.

Indirect taxes can create deadweight loss, which has implications for market efficiency.

Consumers generally dislike indirect taxes due to increased prices and reduced consumer surplus.

Indirect taxes are regressive, disproportionately affecting low-income households.

Producers may also be negatively impacted by indirect taxes, with potential business closures and market exits.

The video will explore how elasticity affects the impact of indirect taxes in future content.

Transcripts

Browse More Related Video

Intermediate Microeconomics: Consumer surplus, producer surplus, price controls, and taxes, Part 1

Micro: Unit 1.6 -- Consumer Surplus, Producer Surplus, and Deadweight Loss

Math 11 - Section 5.1

Animation on How to Price Floors and Price Ceilings

Consumer/Producer Surplus

Consumer Surplus and Producer Surplus

5.0 / 5 (0 votes)

Thanks for rating: