Micro: Unit 1.6 -- Consumer Surplus, Producer Surplus, and Deadweight Loss

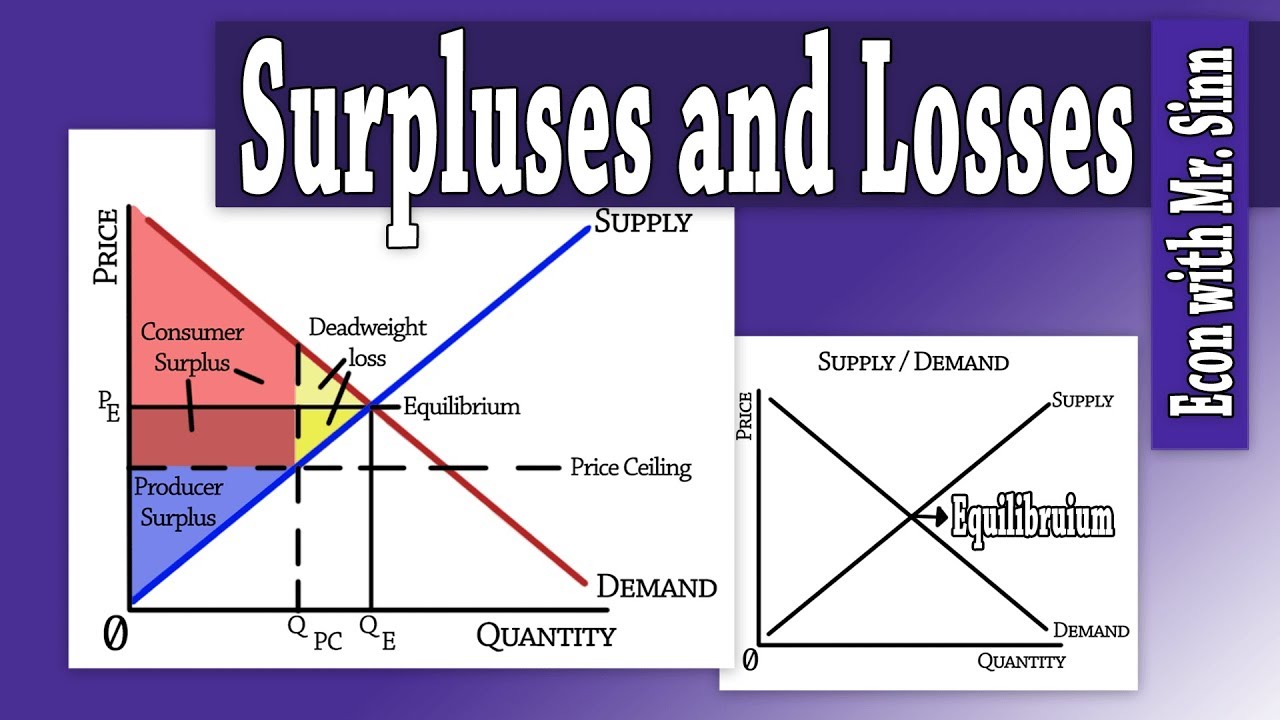

TLDRThis script from 'Your Love Economics' explains the concept of market equilibrium and its benefits, focusing on consumer and producer surplus. It illustrates how voluntary exchanges maximize utility and profits, leading to allocative efficiency. The video uses the car purchase example to clarify surplus calculations and their geometric representation. It further explores the impact of government interventions, such as price controls and taxes, on surpluses and introduces deadweight loss as a consequence of market inefficiency.

Takeaways

- 😀 Economics is about mutual benefit through voluntary exchange where both consumers and firms maximize their utility and profits at market equilibrium.

- 📈 Consumer surplus is the difference between what consumers are willing to pay and what they actually pay for a good or service.

- 🏭 Producer surplus is the difference between what firms are willing to sell a good or service for and what they actually receive from the sale.

- 🚗 An example of consumer and producer surplus is given through the negotiation of a car purchase, illustrating the benefits for both buyer and seller.

- 📊 The concept of consumer and producer surplus can be visualized graphically as the areas under the demand and supply curves, respectively.

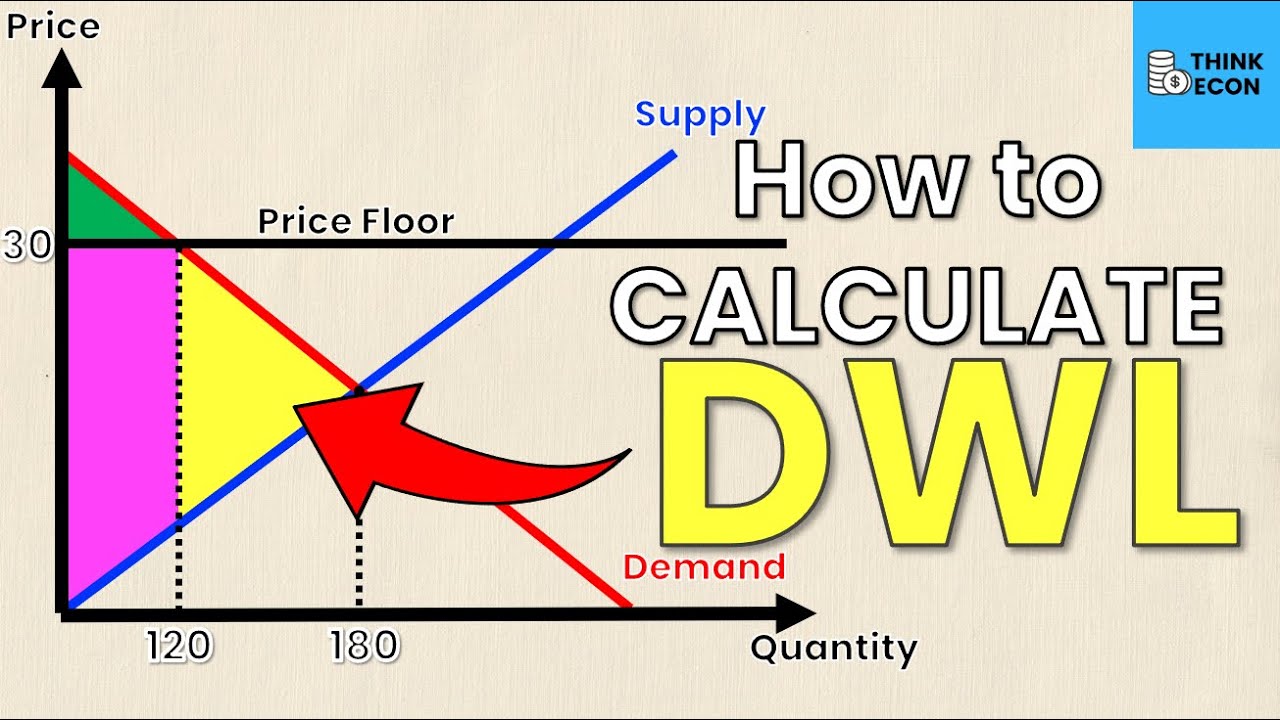

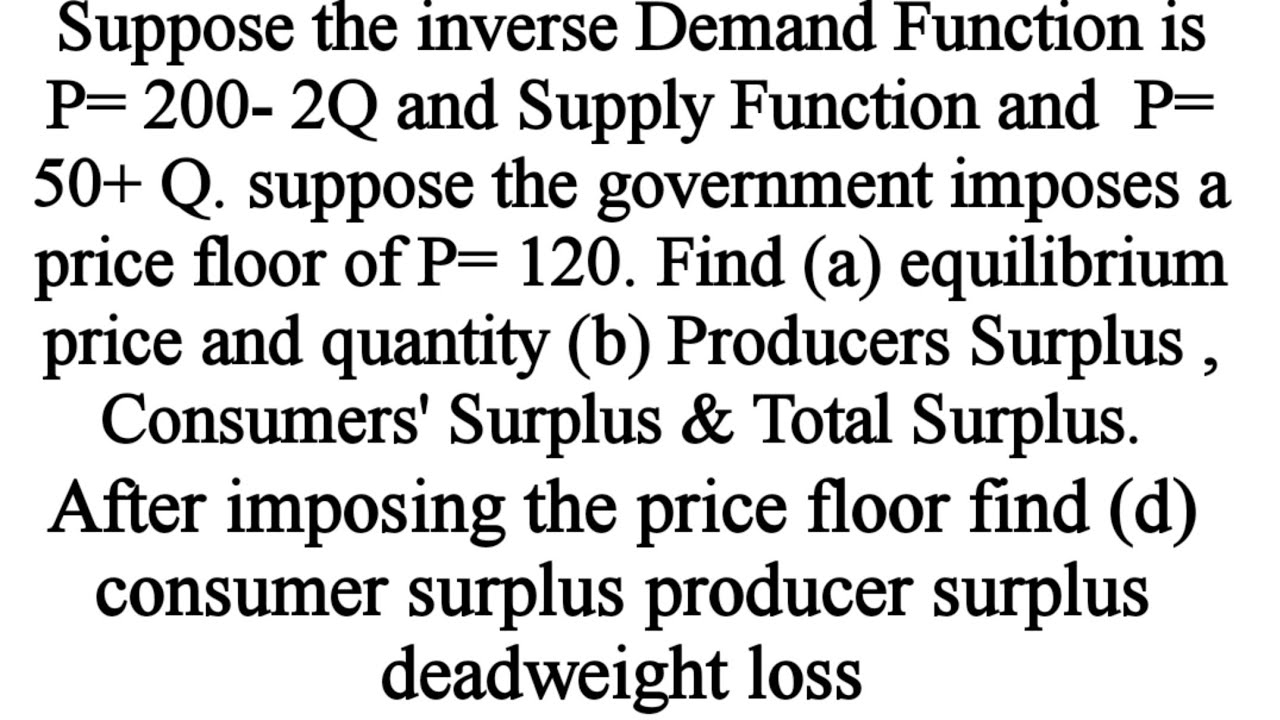

- 🔢 Calculating consumer and producer surplus involves geometric calculations, typically the area of triangles formed under the curves, using the formula (base * height) / 2.

- 🛍️ Consumer surplus represents the total benefit gained by all consumers in an industry through voluntary exchange at the market equilibrium price.

- 💼 Producer surplus represents the total benefit gained by all firms in an industry through voluntary exchange at the market equilibrium price.

- 📉 Changes in supply and demand can shift the equilibrium, affecting the levels of consumer and producer surplus, but the market remains allocatively efficient at equilibrium.

- 🚫 Government interventions, such as price controls, production quotas, and excise taxes, can create market disequilibrium, reducing allocative efficiency and causing deadweight loss.

- 💔 Deadweight loss occurs when market inefficiencies, due to interventions, result in a loss of potential surplus that could have been gained at market equilibrium.

Q & A

What is the concept of equilibrium in the context of economics?

-Equilibrium in economics refers to a state where the quantity supplied of a good or service equals the quantity demanded by consumers. It is a point where both consumers and firms mutually benefit, with prices being optimal and allocative efficiency achieved.

What are consumer surplus and producer surplus, and how are they related to market equilibrium?

-Consumer surplus is the difference between what consumers are willing to pay and what they actually pay at the market equilibrium price. Producer surplus is the difference between what firms are willing to accept and the equilibrium price they receive. Both are maximized at market equilibrium, indicating a state where total benefit for consumers and firms is optimized.

Can you explain the example of buying a new car that was given in the script?

-The car buying example illustrates the concept of consumer surplus and producer surplus in a negotiation scenario. The consumer had a maximum price of $40,000 and the dealer had a minimum price of $20,000. They agreed on an equilibrium price of $30,000, resulting in a consumer surplus of $10,000 (the difference between their maximum willingness to pay and the actual price) and a producer surplus of $10,000 (the difference between the actual price and the dealer's minimum price).

How is consumer surplus calculated in a market?

-Consumer surplus is calculated by determining the difference between the maximum price consumers are willing to pay and the equilibrium price, then multiplying this difference by the quantity of goods sold, and finally dividing by two to find the area of the triangle formed on a graph.

What is the formula for calculating producer surplus in a market?

-Producer surplus is calculated by finding the difference between the equilibrium price and the minimum price firms are willing to accept, then multiplying this difference by the quantity of goods sold, and dividing by two to get the area of the triangle representing producer surplus.

What happens to consumer and producer surplus when there is a change in supply and demand?

-When there are changes in supply and demand, the equilibrium price and quantity will adjust accordingly. This can result in an increase or decrease in both consumer and producer surplus, depending on the direction of the price change.

How does government intervention in the form of price controls affect consumer and producer surplus?

-Price controls, such as a price ceiling, can lead to a decrease in consumer surplus and an increase in producer surplus if the price is set above the equilibrium level. Conversely, if the price is set below the equilibrium level, consumer surplus increases and producer surplus decreases, but this can also lead to allocative inefficiency and deadweight loss.

What is deadweight loss and how does it occur in a market?

-Deadweight loss is the reduction in total surplus (the sum of consumer and producer surplus) that occurs when a market is not operating at equilibrium due to inefficiencies, such as those caused by government interventions like price controls, production quotas, or taxes.

Can you provide an example of how a production quota affects the market?

-A production quota restricts the quantity of a good that can be produced and sold. In the script's example, a quota on good x reduced the output to 600 units, causing the price to increase to $7. This intervention decreased consumer surplus and increased producer surplus, but also created deadweight loss due to allocative inefficiency.

How do excise taxes impact consumer and producer surplus?

-Excise taxes imposed on firms increase their cost of production. To minimize tax burden, firms may reduce production, leading to a decrease in supply. This results in higher prices for consumers, reducing consumer surplus, and lower net revenue for firms after tax payments, reducing producer surplus. The overall effect is a decrease in both surpluses and potential deadweight loss.

What are the implications of allocative efficiency for consumer and producer surplus?

-Allocative efficiency occurs when the quantity of goods produced and consumed is at the level that maximizes total welfare. At this point, consumer and producer surplus are maximized, and any deviation from this point, such as through government intervention, can lead to a reduction in total surplus and potential deadweight loss.

Outlines

📈 Market Equilibrium and Surpluses

This paragraph introduces the concept of market equilibrium, where the quantity supplied equals the quantity demanded, maximizing both consumer utility and firm profits. It explains consumer surplus as the difference between what consumers are willing to pay and what they actually pay, and producer surplus as the difference between what firms are willing to accept and what they actually receive. An example of buying a car illustrates these surpluses, showing how both the buyer and the seller can benefit from reaching an agreement at the market equilibrium price. The paragraph also describes how these surpluses can be visualized graphically and calculated geometrically, emphasizing the importance of voluntary exchange in achieving allocative efficiency.

📉 Impact of Government Intervention on Surpluses

This section discusses the effects of government intervention on market equilibrium, focusing on price controls, production quotas, and excise taxes. It explains how price ceilings can lead to shortages and increased consumer surplus at the expense of producer surplus, while price floors can cause surpluses and decrease consumer surplus in favor of producer surplus. The paragraph also covers how production quotas can restrict output, leading to allocative inefficiency and deadweight loss, and how excise taxes can reduce both consumer and producer surplus by increasing the product price and decreasing output. The concept of deadweight loss is introduced as the loss of total surplus due to market inefficiency caused by government interventions.

🚀 Conclusion on Economic Surpluses and Interventions

The final paragraph wraps up the discussion on consumer surplus, producer surplus, and deadweight loss, highlighting the importance of understanding these economic concepts. It also touches on the consequences of government interventions, such as price controls and production quotas, on market efficiency. The paragraph encourages viewers to subscribe to the channel for more economic insights and provides links to related videos on elasticity and calculating surpluses. The author thanks the viewers for watching and invites them to engage with the content through likes and comments.

Mindmap

Keywords

💡Equilibrium

💡Consumer Surplus

💡Producer Surplus

💡Allocative Efficiency

💡Price Controls

💡Deadweight Loss

💡Production Quotas

💡Excise Tax

💡Voluntary Exchange

💡Price Ceiling

💡Price Elasticity

Highlights

Market equilibrium is a state where both consumers and firms mutually benefit through voluntary exchange.

Allocative efficiency is achieved when the quantity supplied equals the quantity demanded at optimal prices.

Consumer surplus is the difference between what consumers are willing to pay and what they actually pay.

Producer surplus is the difference between the price firms receive for selling a good and what they are willing to accept.

An example of consumer and producer surplus is given through a car purchase negotiation scenario.

Visualizing consumer and producer surplus can be done using a graph to represent the total benefit for both parties.

The areas of consumer and producer surplus represent the benefits gained by all consumers and firms in the market.

Calculating consumer and producer surplus involves geometric methods, specifically the area of triangles.

The formula for calculating consumer surplus involves multiplying the price difference by the quantity and dividing by two.

Producer surplus is calculated similarly, using the difference between the equilibrium price and the seller's minimum price.

Government intervention, such as price controls, can lead to market disequilibrium and affect consumer and producer surplus.

A price ceiling can increase consumer surplus but decrease producer surplus, leading to allocative inefficiency.

Deadweight loss is the loss of consumer and producer surplus due to market inefficiency caused by government intervention.

Production quotas can restrict output, leading to increased prices and changes in consumer and producer surplus.

Excise taxes imposed on firms can decrease both consumer and producer surplus and create deadweight loss.

The impact of government intervention on markets is discussed with examples of price controls, production quotas, and excise taxes.

The video concludes with an invitation to subscribe for more economics content and a summary of the topics covered.

Transcripts

Browse More Related Video

Consumer/Producer Surplus & Deadweight Loss

Consumer Surplus, Producer Surplus,& Deadweight Loss before and after imposing the price ceiling?

Rent control and deadweight loss | Microeconomics | Khan Academy

How to Calculate Deadweight Loss (with a Price Floor) | Think Econ

How to calculate changes in consumer and producer surplus with price and floor ceilings.

Consumers 'surplus Producers' Surplus , Total surplus, deadweight loss with price floor

5.0 / 5 (0 votes)

Thanks for rating: