Calculating the Elasticity of Demand

TLDRThis lecture on the elasticity of demand explains how to measure responsiveness of quantity demanded to price changes. It covers the formula for calculating elasticity, provides examples, and highlights the importance of the midpoint formula to avoid calculation inconsistencies. The relationship between elasticity and total revenue is explored, with graphical illustrations demonstrating inelastic and elastic demand curves. Applications like the war on drugs and effects of drought on crop revenues are discussed, emphasizing the practical implications of demand elasticity in various scenarios.

Takeaways

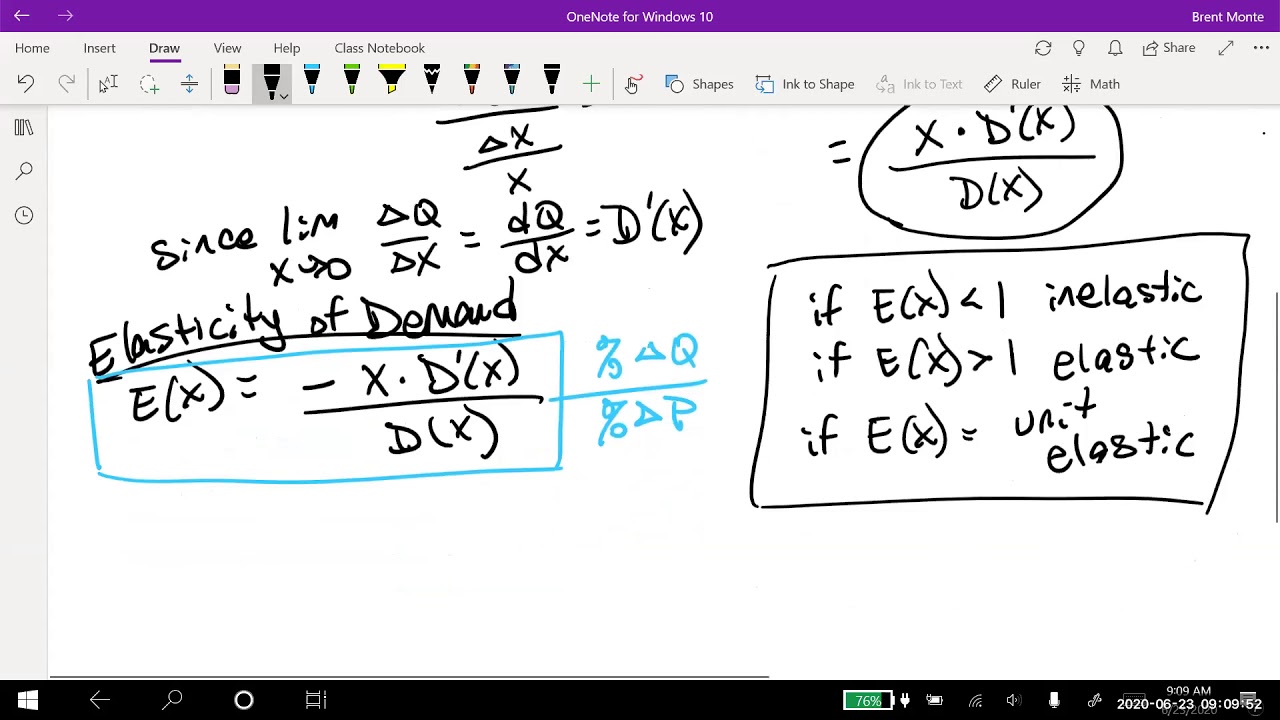

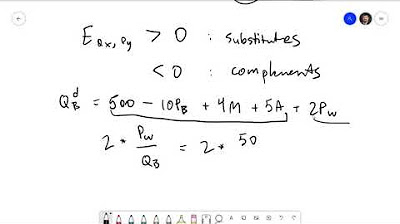

- 📊 Elasticity of demand is a measure of how responsive the quantity demanded is to a change in price, with more responsive demand being more elastic.

- 🔢 The numeric measure of elasticity is calculated by dividing the percentage change in quantity demanded by the percentage change in price.

- ⚖️ Elasticity values are always negative, but the negative sign is often dropped for simplicity, with values less than one indicating inelastic demand, greater than one indicating elastic demand, and equal to one indicating unit elastic demand.

- 📉 An example given is that if the price of oil increases by 10% and the quantity demanded falls by 5%, the elasticity of demand for oil is -0.5, which is inelastic.

- 🔄 The Midpoint Formula is used to calculate elasticity to avoid inconsistencies that arise from changing the base of percentage changes.

- 📐 The formula for elasticity using the Midpoint Formula is (change in quantity / average quantity) / (change in price / average price).

- 💡 Understanding the calculation of percentage change is crucial, as it can be tricky due to changes in the base value, hence the use of the Midpoint Formula.

- 📚 A specific example is provided where an initial price of $10 with a quantity demanded of 100, and a subsequent price rise to $20 with a quantity demanded falling to 90, results in an elasticity of 0.158, indicating inelastic demand.

- 💰 The relationship between elasticity of demand and total revenue is significant; inelastic demand leads to revenue increasing when prices rise, while elastic demand leads to revenue decreasing when prices rise.

- 📉 Graphical representations of demand curves help illustrate the relationship between price changes, quantity demanded, and total revenue, with steeper curves indicating inelastic demand and flatter curves indicating elastic demand.

- 🧑🏫 The script uses real-world examples, such as the war on drugs and the impact of drought on corn growers, to demonstrate the practical applications of understanding elasticity of demand.

Q & A

What is the basic concept of elasticity of demand?

-Elasticity of demand measures the responsiveness of the quantity demanded to a change in price. It indicates how much the quantity demanded changes for a given percentage change in price.

How is the elasticity of demand calculated?

-The elasticity of demand is calculated as the percentage change in quantity demanded divided by the percentage change in price, often using the Midpoint Formula to ensure consistency in calculations.

What does a negative elasticity of demand signify?

-A negative elasticity of demand signifies the inverse relationship between price and quantity demanded; as price increases, quantity demanded decreases, and vice versa.

What are the three categories of demand elasticity, and how are they determined?

-The three categories are inelastic, elastic, and unit elastic. Demand is inelastic if the absolute value of elasticity is less than one, elastic if it's greater than one, and unit elastic if it's exactly one.

Why is the Midpoint Formula used to calculate elasticity?

-The Midpoint Formula is used to avoid inconsistencies that arise from calculating percentage changes from different bases. It ensures the same elasticity value whether calculated from a lower or higher base.

Can you provide an example of calculating elasticity of demand from the script?

-Yes, an example given in the script is when the price of oil increases by 10% and the quantity demanded falls by 5%. The elasticity of demand is calculated as -5% / 10%, which equals -0.5, and is often reported as 0.5 after dropping the negative sign.

How does the elasticity of demand relate to total revenue?

-The relationship between elasticity of demand and total revenue depends on whether the demand is inelastic, elastic, or unit elastic. With inelastic demand, an increase in price leads to an increase in revenue, while with elastic demand, an increase in price leads to a decrease in revenue. Unit elastic demand means a change in price does not affect total revenue.

Outlines

📊 Elasticity of Demand Basics

This paragraph introduces the concept of elasticity of demand, which is a measure of how responsive the quantity demanded is to changes in price. It explains that a higher elasticity indicates a more responsive demand. The paragraph also outlines how to calculate elasticity using the formula: elasticity of demand = (% change in quantity demanded) / (% change in price). An example is given where a 10% increase in the price of oil leads to a 5% decrease in quantity demanded, resulting in an elasticity of -0.5, which is typically expressed as 0.5 due to the inverse relationship between price and quantity. The paragraph concludes by defining different types of demand curves based on elasticity: inelastic (elasticity < 1), elastic (elasticity > 1), and unit elastic (elasticity = 1).

📈 Calculating Elasticity and Its Implications

This section delves deeper into calculating elasticity, emphasizing the importance of using the Midpoint Formula to avoid inconsistencies when calculating percentage changes. An example calculation is provided, where an initial price of $10 and a quantity demanded of 100 change to a price of $20 and a quantity of 90, resulting in an elasticity of 0.158, indicating inelastic demand. The paragraph further explains the relationship between elasticity and total revenue, showing that with inelastic demand, an increase in price leads to an increase in revenue, whereas with elastic demand, an increase in price leads to a decrease in revenue. This relationship is illustrated with graphs and a thought experiment.

🌾 Applications of Elasticity in Real Life

The paragraph discusses the real-world applications of elasticity of demand, using the war on drugs and its impact on drug dealers' revenues as an example. It explains that because drugs typically have inelastic demand, enforcement actions that raise prices also increase total revenues for sellers, potentially exacerbating issues related to drug prohibition. Another application is presented through a quote from NPR's food blog about the Midwest drought and its counterintuitive effect on corn growers' revenues due to likely inelastic demand for corn, which could explain why revenues increased despite reduced yields.

📚 Conclusion and Preview of Elasticity of Supply

In conclusion, the paragraph summarizes the key points about elasticity of demand and encourages students to practice these concepts, perhaps through sketching graphs to solidify their understanding. It also previews the next topic, which will be the elasticity of supply, suggesting that the concepts covered in this lecture will provide a solid foundation for understanding supply elasticity. The paragraph ends with a prompt for students to engage with practice questions or proceed to the next video.

Mindmap

Keywords

💡Elasticity of Demand

💡Percentage Change

💡Inelastic Demand

💡Elastic Demand

💡Unit Elastic

💡Midpoint Formula

💡Total Revenue

💡Revenue Rectangles

💡Practice Question

💡Application of Elasticity

Highlights

Elasticity of demand measures the responsiveness of quantity demanded to a change in price.

Elastic demand means a higher responsiveness to price changes.

The numeric measure of elasticity is calculated using the formula: elasticity = (% change in quantity demanded) / (% change in price).

Elasticity of demand is always negative due to the inverse relationship between price and quantity demanded.

Demand is considered inelastic if the absolute value of elasticity is less than one.

Elastic demand is indicated when the elasticity is greater than one.

Unit elastic demand occurs when elasticity equals one.

Percentage change in quantity is calculated using the Midpoint Formula to avoid inconsistencies.

An example calculation shows how to determine elasticity using price and quantity changes.

Inelastic demand results in increased revenue when prices rise due to the small change in quantity demanded.

Elastic demand leads to decreased revenue when prices rise due to a significant drop in quantity demanded.

The relationship between elasticity and total revenue can be visualized through graphical analysis.

A practice question illustrates the impact of a 10% price increase on total revenues for a product with an elasticity of 0.1.

The war on drugs is difficult due to the inelastic demand for drugs, leading to increased seller revenues despite enforcement actions.

The paradoxical effect of drought on corn growers' revenues can be explained by understanding elasticity of demand.

Elasticity of demand has practical applications in understanding market behaviors and policy impacts.

Upcoming lectures will cover the elasticity of supply, which shares similar concepts with demand elasticity.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: