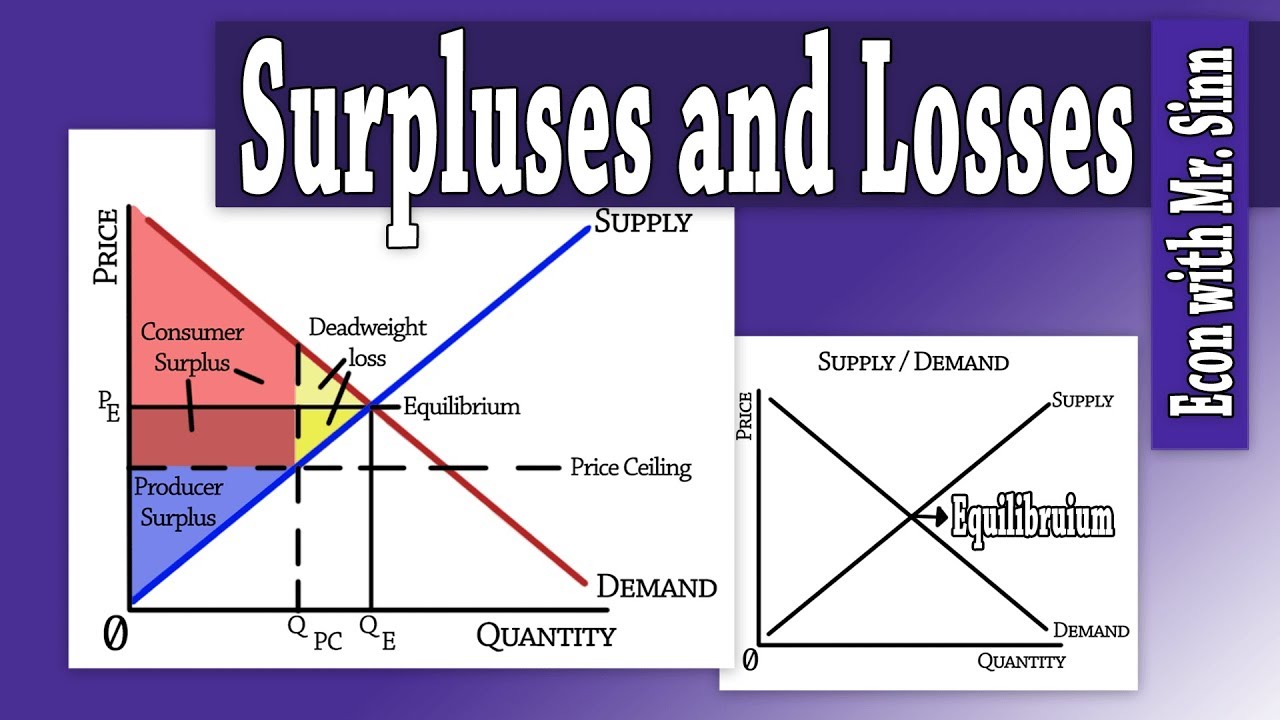

Price Ceiling: Consumer Surplus, Producer Surplus, & Deadweight loss

TLDRThis video explores the effects of price ceilings on the market for batteries, illustrating the calculation of consumer and producer surplus and deadweight loss. Starting with a market equilibrium at $12 and 40 units, the video introduces a binding price ceiling of $8, leading to a 40-unit shortage. Graphical analysis and extensions consider scenarios with random consumer selection and black markets, showing how price ceilings can reduce surplus and lead to inefficiencies.

Takeaways

- 📉 Price ceilings can create shortages by setting prices below the market clearing level.

- 🔍 The benchmark market outcome without a price ceiling shows equilibrium at $12 and 40 units.

- 📊 A price ceiling set at $8 leads to consumers wanting 60 units but sellers only supplying 20, causing a shortage of 40 units.

- 📐 Consumer surplus without a price ceiling is $160, calculated as the area between the demand curve and the market price.

- 🏭 Producer surplus without a price ceiling is also $160, calculated as the area between the market price and the supply curve.

- 💡 Total surplus without a price ceiling is $320, the sum of consumer and producer surplus.

- 🔻 With a price ceiling of $8, consumer surplus increases to $200 due to the combination of a triangle and rectangle area under the demand curve.

- 🔵 Producer surplus with a price ceiling drops to $40, represented by a small triangle between the price ceiling and supply curve.

- ⚖️ Deadweight loss from the price ceiling is $80, the lost surplus from the market outcome to the price ceiling outcome.

- 🔄 Realistic scenarios like queueing or black markets can further reduce consumer surplus or create different dynamics under a price ceiling.

Q & A

What is the purpose of the video?

-The purpose of the video is to explain the concept of price ceilings, specifically how they affect consumer surplus, producer surplus, and create deadweight loss in the context of a battery market.

What is the market equilibrium price and quantity for batteries without a price ceiling?

-The market equilibrium price without a price ceiling is $12, and the equilibrium quantity is 40 units.

How is the price ceiling set in the video?

-The price ceiling is set at $8, which is below the market clearing price to ensure it is binding and creates a shortage.

What is the shortage of batteries when the price ceiling is in effect?

-The shortage of batteries when the price ceiling is in effect is 40 units, as consumers want to buy 60 units but sellers only bring 20 units to the market.

How is consumer surplus calculated in the video?

-Consumer surplus is calculated by finding the area between the demand curve and the market price up to the last unit purchased, using the formula for the area of a triangle (1/2 base times height).

What is the total consumer surplus when there is no price ceiling?

-The total consumer surplus when there is no price ceiling is $160.

How is producer surplus calculated in the video?

-Producer surplus is calculated by finding the area between the market price and the supply curve up to the last unit sold, also using the formula for the area of a triangle.

What is the total producer surplus when there is no price ceiling?

-The total producer surplus when there is no price ceiling is $160.

How does the video calculate the deadweight loss under a price ceiling?

-The deadweight loss is calculated by finding the area of the triangle formed between the demand curve and the quantity supplied at the price ceiling, using the same triangle area formula.

What is the deadweight loss when the price ceiling is in effect?

-The deadweight loss when the price ceiling is in effect is $80.

What are some of the extensions discussed in the video regarding the price ceiling?

-The extensions discussed in the video include the assumption of random selection of consumers for purchasing batteries, the potential for a black market to arise, and the calculation of consumer surplus and producer surplus under these scenarios.

Outlines

📈 Market Equilibrium and Price Ceiling Basics

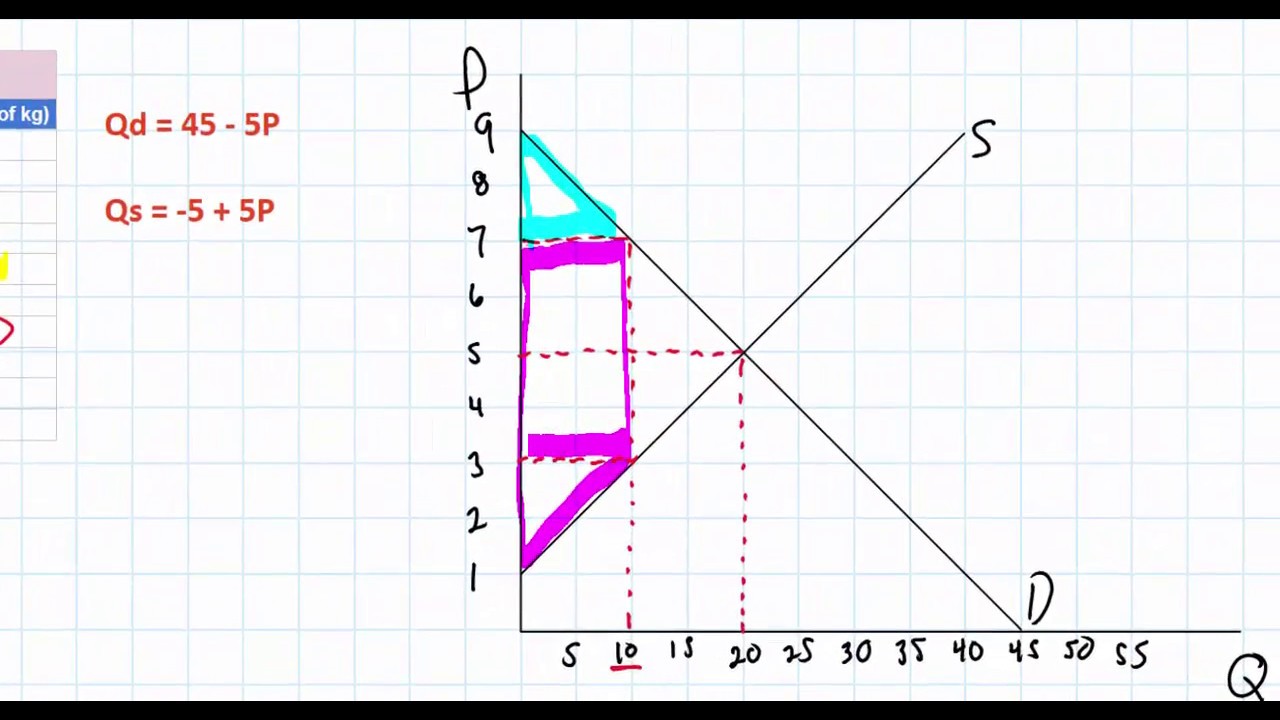

This paragraph introduces the concept of price ceilings and their impact on consumer and producer surplus, as well as deadweight loss. The example of the battery market is used to illustrate the point, where the demand and supply equations are given. The equilibrium price and quantity are calculated without a price ceiling, resulting in a price of $12 and a quantity of 40 units. The paragraph then discusses the binding condition for a price ceiling to create a shortage, which is when it is set below the market clearing price—in this case, $8. The resulting consumer demand and supplier supply at this price ceiling are compared, revealing a shortage of 40 units. The paragraph concludes with a transition to a graphical analysis of the market outcome.

📉 Impact of Price Ceiling on Surplus and Shortage

The second paragraph delves into the effects of the price ceiling on consumer and producer surplus and introduces the concept of deadweight loss. It starts by referencing the market outcome under no price ceiling, with an equilibrium price of $12 and quantity of 40. The price ceiling of $8 is then applied, leading to a consumer desire to purchase 60 units and a supplier willingness to bring only 20 units to the market, resulting in a shortage. Graphical representation is used to calculate consumer and producer surplus under the market outcome and the price ceiling, revealing a reduction in total surplus from $320 to $240. The deadweight loss is identified as the area of the triangle representing the loss in total surplus, calculated to be $80. The paragraph also touches on extensions to the price ceiling scenario, such as the assumption that batteries are bought by those with the highest willingness to pay and the potential for a black market to arise.

🤔 Extensions of Price Ceiling Effects

The final paragraph explores further extensions of the price ceiling scenario. It challenges the assumption that batteries are bought by those with the highest willingness to pay, suggesting instead that buyers may be a random selection of consumers with varying willingness to pay. The average value of consumers' willingness to pay is calculated to be $14, leading to a lower consumer surplus of $120 compared to the market outcome. The paragraph also considers the emergence of a black market, where producers could potentially charge an additional amount under the table, resulting in a maximum willingness to pay of $16 per unit. This scenario significantly reduces consumer surplus to a small triangle area, calculated to be $40. The video concludes with the hope that the content was helpful for understanding the complex dynamics of price ceilings.

Mindmap

Keywords

💡Price Ceiling

💡Consumer Surplus

💡Producer Surplus

💡Deadweight Loss

💡Equilibrium Price

💡Quantity Demanded

💡Quantity Supplied

💡Shortage

💡Demand Curve

💡Supply Curve

💡Market Outcome

Highlights

Introduction to the concept of price ceilings and their impact on consumer and producer surplus, as well as deadweight loss.

Market analysis begins with a battery market example, establishing demand and supply equations.

Calculation of the equilibrium price and quantity in a free market, resulting in $12 and 40 units respectively.

Explanation of the binding condition for a price ceiling to create a shortage, set below the market clearing price.

Impact of a price ceiling of $8 on consumer demand and seller supply, leading to a 40-unit shortage.

Graphical representation of market outcomes, including equilibrium points and demand/supply curves.

Method for finding vertical and horizontal intercepts of demand and supply curves for graphical analysis.

Calculation of consumer surplus and producer surplus in an unregulated market, totaling $160 each.

Introduction of a price ceiling and its effect on consumer and producer surplus, leading to a new market outcome.

Graphical illustration of the price ceiling impact, showing the gap between quantity demanded and supplied.

Revised calculation of consumer surplus under the price ceiling, incorporating a new demand curve height of $16.

New calculation of producer surplus under the price ceiling, resulting in a reduced surplus of $40.

Introduction of deadweight loss as a result of price ceiling implementation, quantified as $80.

Exploration of extensions to the price ceiling scenario, including non-price rationing and black markets.

Analysis of consumer surplus under random selection of buyers and the impact on surplus value.

Consideration of a black market scenario where producers can charge additional under-the-table payments.

Final calculation of consumer surplus in a black market, showing a significant reduction to $40.

Summary of the video's findings, emphasizing the economic implications of price ceilings and market distortions.

Transcripts

Browse More Related Video

Animation on How to Price Ceilings with Calculations

How to calculate changes in consumer and producer surplus with price and floor ceilings.

Animation on How to Price Floors and Price Ceilings

Consumer Surplus, Producer Surplus,& Deadweight Loss before and after imposing the price ceiling?

Consumer/Producer Surplus & Deadweight Loss

Calculating the area of Deadweight Loss (welfare loss) in a Linear Demand and Supply model

5.0 / 5 (0 votes)

Thanks for rating: