Rent Control and Deadweight Loss

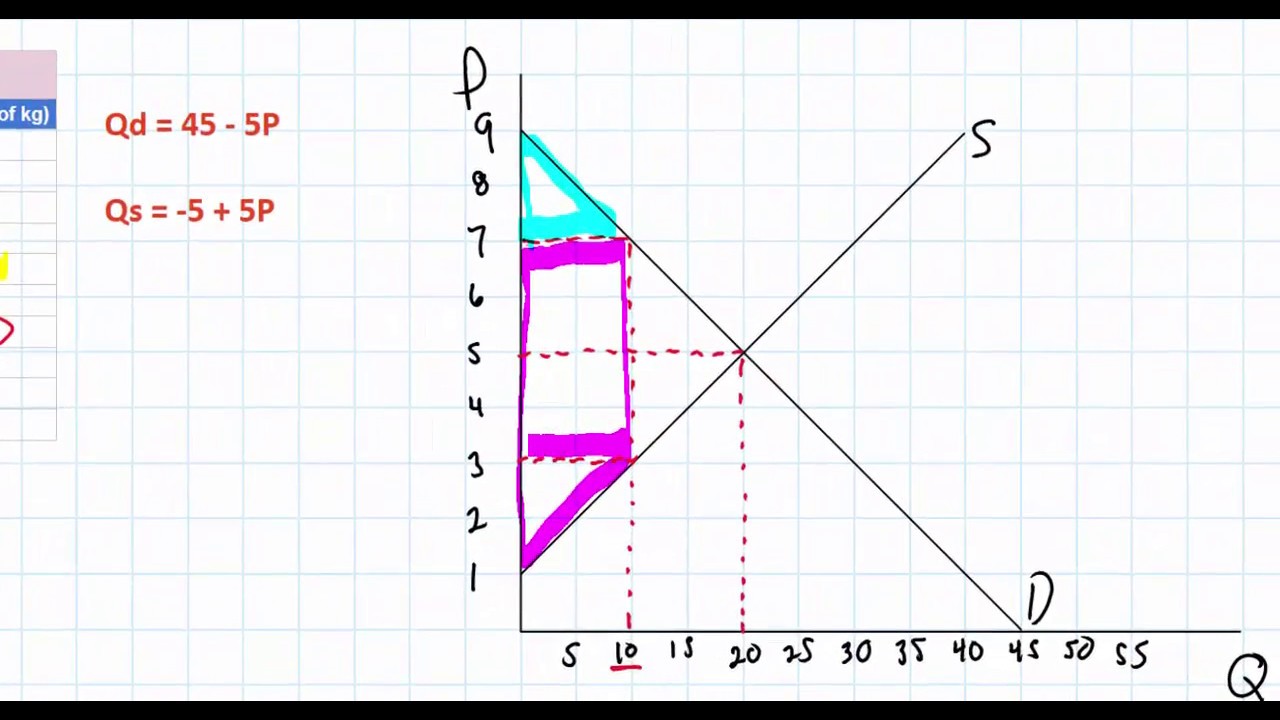

TLDRThis script explores the economic concepts of consumer and producer surplus, marginal benefit, and marginal cost through the lens of real estate. It illustrates how an equilibrium price of $3 per square foot is established, reflecting the balance between these benefits and costs. The introduction of rent control, set at $2 per square foot, leads to a decrease in supply and a reduction in total surplus, resulting in a deadweight loss of $750,000. The script effectively demonstrates the impact of price ceilings on market efficiency and surplus distribution.

Takeaways

- 📏 The script discusses the concept of marginal benefit and marginal cost in the context of square footage in real estate, using it to explain consumer and producer surplus.

- 🏢 The demand curve is viewed as a marginal benefit curve, indicating the value of each additional square foot to consumers.

- 📈 The supply curve is portrayed as a marginal cost curve, showing the cost to suppliers for producing additional square footage.

- 💰 The equilibrium price is set where the marginal benefit equals the marginal cost, resulting in a price of $3 per square foot per month in the given example.

- 🏘️ The equilibrium price and quantity are reached when producers continue to produce as long as the marginal benefit exceeds the marginal cost.

- 💔 The introduction of rent control, acting as a price ceiling, disrupts the market equilibrium by setting a maximum price that can be charged for rent.

- 🚫 At the rent control price of $2 per square foot, the quantity supplied decreases, as it's no longer profitable for some suppliers to offer their units for rent.

- 📉 The consumer surplus increases for those who can rent at the controlled price, but the producer surplus decreases, leading to a reduction in total surplus.

- 🔍 The script calculates the consumer and producer surplus before and after the introduction of rent control to illustrate the impact on total surplus.

- 📊 The script uses the area under the curves to quantify the surpluses and the resulting deadweight loss due to rent control.

- 💔 The deadweight loss represents the benefit to the market that is lost due to the inefficiency caused by the price ceiling, amounting to $750,000 in the example.

- 🛑 The total surplus of the market decreases due to rent control, indicating a reduction in the overall benefit to society from the real estate market.

Q & A

What is the significance of the demand curve in the context of the video?

-The demand curve is viewed as a marginal benefit curve, representing the benefit to consumers for each additional square foot of rented space.

How is the supply curve interpreted in the video?

-The supply curve is interpreted as a marginal cost curve, indicating the opportunity cost for producers to supply additional square feet of rented space.

Why is there a large consumer surplus at the beginning of the market?

-There is a large consumer surplus initially because the benefit to consumers for the first few square feet is very high, while the cost to producers is very low.

What happens to the producer and consumer surplus as the market quantity increases?

-As the market quantity increases, the surplus for both producers and consumers is divided between them depending on the price, until the point where the marginal benefit equals the marginal cost.

Why does the market stop producing additional square feet beyond a certain point?

-The market stops producing additional square feet beyond the point where the marginal cost exceeds the marginal benefit, as no surplus can be gained from further production.

What is the equilibrium price and quantity in the described market?

-The equilibrium price is $3 per square foot per month, and the equilibrium quantity is 3 million square feet per month.

How does rent control affect the market according to the video?

-Rent control, acting as a price ceiling, reduces the quantity of rental space supplied and lowers the total market surplus by causing a deadweight loss.

What is deadweight loss, and how is it calculated in the context of rent control?

-Deadweight loss is the lost benefit to society due to market inefficiency caused by rent control. It is calculated as the area of the triangle formed by the difference in marginal benefit and marginal cost at the controlled price.

What are the new producer and consumer surpluses after rent control is instituted?

-The new producer surplus is reduced to the area below the $2 price level, and the consumer surplus for those who can still rent increases, but the overall total surplus decreases.

What is the total surplus loss due to rent control, and how does it affect the market?

-The total surplus loss due to rent control is $750,000, reducing the total market surplus from $6 million to $5.25 million. This results in a less efficient market with fewer rental units available.

Outlines

🏢 Understanding Consumer and Producer Surplus in Real Estate

The first paragraph delves into the concept of consumer and producer surplus in the context of real estate. It introduces the idea of viewing the demand curve as a marginal benefit curve and the supply curve as a marginal cost curve. The script explains how the benefit to consumers is high for the initial square footage, while the cost to suppliers is low, leading to a surplus that can be divided between consumers and producers. The equilibrium quantity and price are reached when the marginal benefit equals the marginal cost, set at three million square feet per month and three dollars per square foot, respectively. The paragraph also touches on the implications of rent control, which sets a price ceiling and can affect the total surplus in the market.

📉 Impact of Rent Control on Market Surplus and Efficiency

The second paragraph explores the effects of rent control, specifically a price ceiling set at two dollars per square foot. It discusses how this intervention leads to a decrease in the total quantity supplied to two million square feet per month. The script highlights the inefficiency caused by rent control, as the marginal benefit exceeds the marginal cost, yet no additional units are supplied due to the price ceiling. This results in a reduction of both consumer and producer surplus, with the total surplus shrinking and a deadweight loss of 750,000 dollars, representing the unattainable benefit to society that could have been distributed between consumers and producers in an efficient market.

📉 Further Analysis of Deadweight Loss Due to Rent Control

The third paragraph continues the discussion on the impact of rent control, focusing on the calculation of the deadweight loss caused by the price ceiling. It explains how the loss is measured by the area of a triangle formed by the difference between the marginal benefit and the price ceiling. The script provides a numerical example, calculating the deadweight loss to be 750,000 dollars, which signifies the reduction in total surplus from the original six million dollars to five point two five million dollars. This reduction in surplus illustrates the inefficiency and loss of potential benefit to both consumers and producers due to the rent control policy.

Mindmap

Keywords

💡Square feet

💡Consumer surplus

💡Producer surplus

💡Demand curve

💡Supply curve

💡Marginal benefit

💡Marginal cost

💡Equilibrium quantity

💡Rent control

💡Price ceiling

💡Deadweight loss

Highlights

The concept of viewing the demand curve as a marginal benefit curve and the supply curve as a marginal cost curve is introduced.

The initial benefit to consumers for the first square feet is valued at over $4 per square foot.

The opportunity cost for suppliers of the first few square feet is very low due to availability of cheap land.

Market equilibrium is reached when the marginal benefit equals the marginal cost, resulting in consumer and producer surplus.

The equilibrium price is set at three dollars per square foot per month, reflecting a high rent scenario like in San Francisco.

Rent control is introduced as a price ceiling, potentially limiting rent to $2 per square foot per month.

The impact of rent control on total surplus is discussed, including the reduction in consumer and producer surplus.

Calculation of consumer surplus at equilibrium before rent control is detailed, amounting to $2.25 million.

Producer surplus at equilibrium is calculated to be $3.75 million, indicating the value producers gain above their costs.

The total surplus in an unfettered market is $6 million, representing the combined benefit to consumers and producers.

The imposition of a price ceiling reduces the quantity supplied to 2 million square feet per month.

A price ceiling leads to a deadweight loss, which is the benefit to the market that is lost due to inefficiency.

The deadweight loss is quantified as $750,000, representing the reduction in total market benefit.

The total surplus post-rent control decreases to $5.25 million, indicating a loss in market efficiency.

Rent control may benefit some renters but can lead to a shortage of available housing and a reduction in producer surplus.

The economic concept of deadweight loss is explained in the context of rent control and its impact on market efficiency.

Transcripts

Browse More Related Video

Rent control and deadweight loss | Microeconomics | Khan Academy

Calculating the area of Deadweight Loss (welfare loss) in a Linear Demand and Supply model

Consumer Surplus, Producer Surplus,& Deadweight Loss before and after imposing the price ceiling?

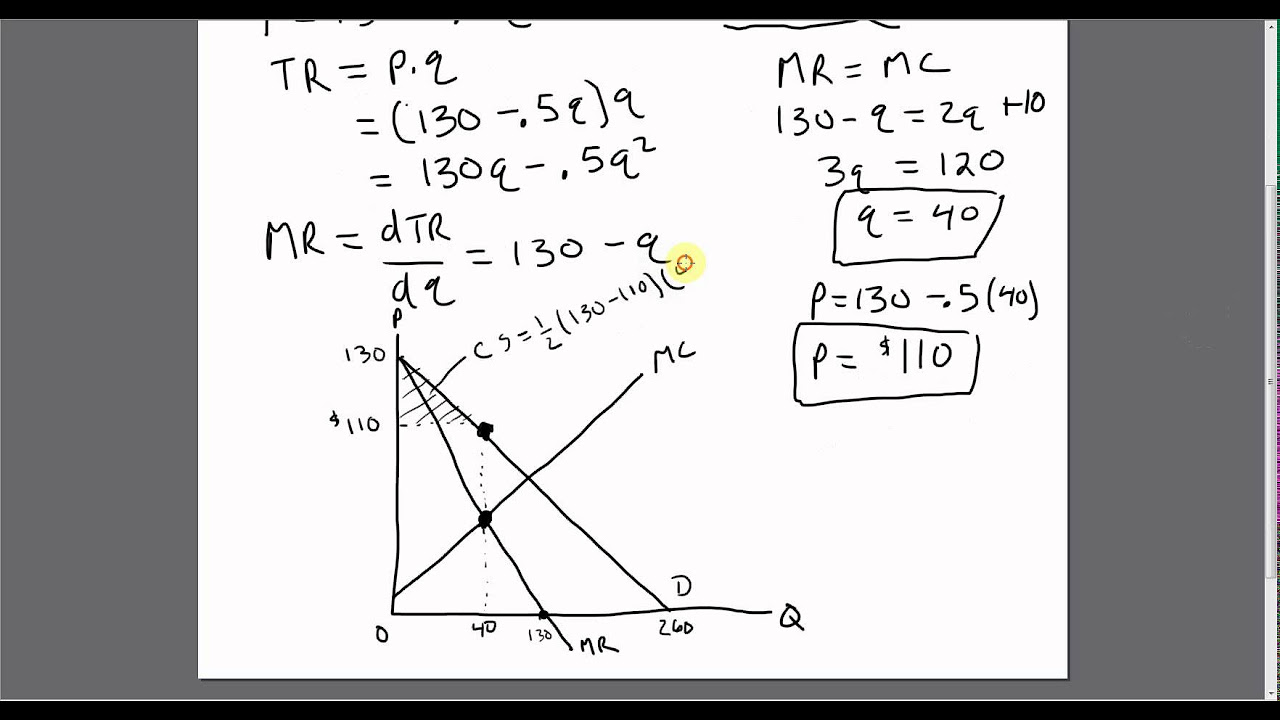

Monopoly: Consumer Surplus, Producer Surplus, Deadweight Loss

Consumer Surplus and Producer Surplus

Price floors and surplus

5.0 / 5 (0 votes)

Thanks for rating: