An Application to Ito Integrals I

TLDRThe video script delves into the application of Ito calculus in understanding interest rate models, specifically the Vasicek model. It explains how Ito calculus can verify solutions to stochastic differential equations and compute important parameters like mean and variance, even when a closed-form solution isn't available. The lecture also touches on the limitations of the Vasicek model, such as allowing negative interest rates, and introduces the Cox-Ingersoll-Ross (CIR) model as an improvement. The speaker emphasizes the importance of understanding the mathematical techniques of Ito calculus rather than focusing solely on the financial implications.

Takeaways

- 📚 The lecture discusses the application of Ito calculus in understanding interest rate models, specifically focusing on the Vasicek model.

- 🔍 Ito calculus is used to analyze the stochastic differential equation that defines the Vasicek model, highlighting its ability to provide closed-form solutions under certain conditions.

- 📉 The Vasicek model's stochastic differential equation includes parameters alpha, beta, and gamma, which are assumed to be positive for the model's validity.

- 🧩 Ito calculus is not only useful for verifying solutions to stochastic differential equations but also for computing important parameters like mean and variance when closed-form solutions are not available.

- 📈 The closed-form solution of the Vasicek model reveals that the interest rate Rt follows a normal distribution, which theoretically allows for negative interest rates, an undesirable feature in financial models.

- 🔑 The concept of choosing the appropriate function f(t, x) is fundamental in applying Ito calculus, as it helps in extracting the form of the function from a given Ito process.

- 📝 The importance of understanding the derivatives involved in Ito calculus is emphasized, including partial derivatives with respect to x and t, and the second derivative with respect to x.

- 📉 The script explains the process of applying Ito's formula to derive the dynamics of a function of the Ito process, illustrating its application with the Vasicek model.

- 💡 Ito's calculus is shown to be instrumental in verifying that a given process is a solution to a stochastic differential equation and in deriving the process's properties.

- 🔄 The script introduces the Cox-Ingersoll-Ross (CIR) model as an alternative to the Vasicek model, which avoids the issue of negative interest rates and does not have a closed-form solution.

- 📚 The CIR model is highlighted as an example where Ito calculus can be used to understand the behavior of a stochastic process, even in the absence of a closed-form solution, by focusing on computing its mean and variance.

Q & A

What is the main topic of the talk?

-The main topic is the use of Ito calculus to understand interest rate models, specifically focusing on the Vasicek model.

What is the Vasicek model?

-The Vasicek model is a mathematical model used to describe the evolution of interest rates. It is characterized by a stochastic differential equation.

Why is it important to not focus on why the model was built in a certain way?

-The focus of the talk is on the application of Ito calculus rather than the historical or financial reasons behind the construction of the model.

What are the key parameters in the Vasicek model?

-The key parameters are alpha, beta, and gamma, which are assumed to be positive.

What is the significance of having a closed form solution for the Vasicek model?

-A closed form solution allows for explicit expressions for the interest rates, making it easier to analyze and understand the model.

What is the challenge with stochastic differential equations in financial models?

-Many stochastic differential equations do not have closed form solutions, which makes them harder to solve and analyze.

How does the Vasicek model handle the distribution of interest rates?

-The Vasicek model shows that the interest rate, Rt, follows a normal distribution with mean 0, which implies it can take negative values.

Why are negative interest rates considered unfavorable?

-Negative interest rates are not practical in real financial markets as interest rates are generally expected to be positive or zero.

What model was introduced to address the issue of negative interest rates in the Vasicek model?

-The Cox-Ingersoll-Ross (CIR) model was introduced to ensure that interest rates remain non-negative.

What is the key difference between the Vasicek model and the CIR model?

-The CIR model modifies the drift term to prevent interest rates from becoming negative, unlike the Vasicek model.

Can the CIR model be solved in a closed form?

-No, the CIR model does not have a closed form solution, but Ito calculus can still help compute its mean and variance.

What is the role of Ito calculus in the context of these models?

-Ito calculus is used to verify solutions of stochastic differential equations and to compute important parameters like mean and variance even when a closed form solution is not available.

What is the importance of choosing the right function f(tx) in Ito calculus?

-Choosing the right function f(tx) is crucial for applying Ito calculus correctly and obtaining useful results from the calculations.

What is an 'almost everywhere' equality in stochastic processes?

-An 'almost everywhere' equality means the equality holds for all cases except possibly for a set of events with probability zero.

Why are the equalities in Ito calculus considered to hold 'almost surely'?

-Because they hold with probability one, which means they are true in all cases except for a negligible set of events.

What is the expectation of Rt in the Vasicek model?

-The expectation of Rt is given by the mean of the normal distribution it follows, which is computed using Ito calculus.

What are the steps to compute the mean of Rt in the CIR model?

-To compute the mean of Rt in the CIR model, one must choose an appropriate function f(tx), apply Ito's formula, and integrate both sides of the resulting differential equation.

How does the talk suggest verifying the calculations presented?

-The speaker encourages listeners to independently verify the calculations to ensure understanding and accuracy.

What is the significance of the quadratic variation term in Ito's formula?

-The quadratic variation term accounts for the variance introduced by the stochastic component of the process.

What practical advice does the speaker give for applying Ito calculus?

-The speaker advises understanding the importance of choosing the right function and verifying calculations independently to grasp the concepts better.

Outlines

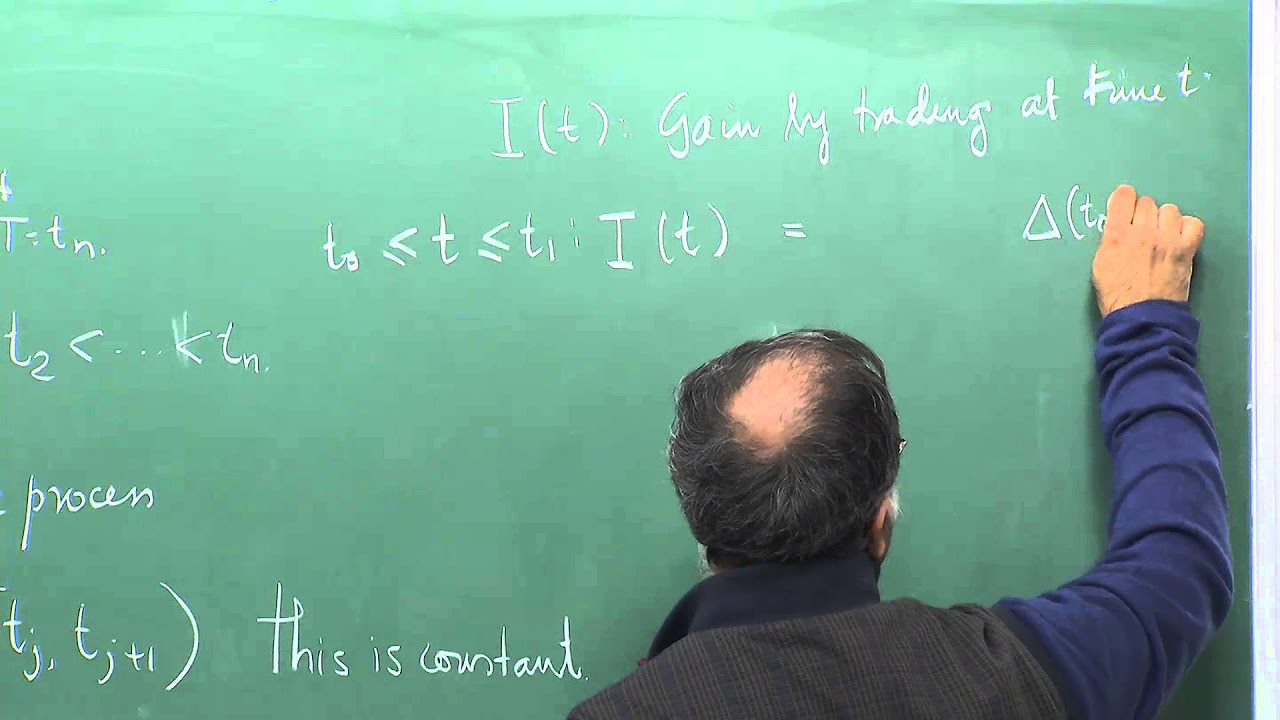

📚 Introduction to Ito Calculus in Interest Rate Models

This paragraph introduces the application of Ito calculus in understanding interest rate models, specifically focusing on the Vasicek model. It emphasizes not to question the model's structure but to understand its formulation using stochastic differential equations. The Vasicek model defines Rt as an Ito process with a given equation, and it is highlighted that not all such equations have closed-form solutions, but the Vasicek model does. The paragraph also discusses the importance of Ito calculus in solving or understanding the properties of these models, even when a closed-form solution is not available.

🔍 Vasicek Model's Limitations and the Role of Ito Calculus

The speaker discusses the limitations of the Vasicek model, which allows for the possibility of negative interest rates, an undesirable feature in financial models. The paragraph delves into the use of Ito calculus to understand the behavior of Rt, including its mean and variance, despite the model's inability to provide a closed-form solution for all cases. The importance of choosing the right function for Ito calculus is stressed, and the process of applying Ito's formula to derive the properties of the model is outlined, including the use of partial derivatives and the concept of an Ito process within another process.

📘 Ito's Formula Application and Stochastic Differential Equations

This section explains the application of Ito's formula to the Vasicek model, detailing the steps to verify the closed-form solution of the stochastic differential equation. It discusses the components of Ito's formula, including the drift term, the diffusion term, and the quadratic variation term. The paragraph clarifies the concept of 'almost everywhere' in the context of stochastic processes and the importance of understanding the equality in a probabilistic sense. The summary also involves simplifying the formula to show that the model's solution adheres to Ito's calculus rules.

📉 Exploring the Nature of the Ito Process and Its Implications

The speaker explores the nature of the Ito process, specifically the xt process, which is derived from the Vasicek model. The paragraph discusses the expectation and variance of xt and Rt, highlighting that xt follows a normal distribution with a mean of 0. It also touches on the implications of the normal distribution for Rt, which theoretically could take negative values, and sets the stage for the discussion of modifications made in the Cox-Ingersoll-Ross (CIR) model to address this issue.

🛠 Modifications in the CIR Model and Ito Calculus' Utility

This paragraph discusses the modifications made in the CIR model to prevent Rt from taking negative values, a limitation of the Vasicek model. It emphasizes that even without a closed-form solution, Ito calculus can be instrumental in determining important parameters like the mean and variance of Rt. The speaker provides a hint on how to compute the mean of Rt using Ito calculus, suggesting the use of exponential functions to maintain non-negativity and guiding through the process of applying Ito's formula to the CIR model.

📝 Conclusion and Assignment on Ito Calculus Application

The speaker concludes the discussion by emphasizing the importance of applying Ito calculus to understand and manipulate stochastic processes in finance. The paragraph leaves the audience with an assignment to compute the mean of Rt using Ito's integral and encourages self-practice to solidify understanding. It highlights the practical use of Ito calculus beyond verifying solutions and stresses the importance of personal engagement with the material.

Mindmap

Keywords

💡Ito Calculus

💡Vasicek's Model

💡Stochastic Differential Equation (SDE)

💡Closed-Form Solution

💡Normal Distribution

💡Mean and Variance

💡Ito's Formula

💡Quadratic Variation

💡Almost Everywhere

💡Cox-Ingersoll-Ross (CIR) Model

Highlights

Introduction to Ito calculus and its application in understanding interest rate models.

Discussion of Vasicek's model and its representation as an Ito process governed by a stochastic differential equation.

Explanation of the absence of a drift term when setting Rt equal to alpha by beta in the model.

Assumption that parameters alpha, beta, and gamma are positive in the model.

Clarification that not all stochastic differential equations have closed-form solutions, but Vasicek's does.

Presentation of the closed-form solution for Vasicek's model using Ito calculus.

Demonstration of how to apply Ito's formula to verify the solution of a stochastic differential equation.

Discussion on the limitations of the normal distribution in modeling interest rates, which cannot be negative.

Introduction of the Cox-Rand-Ingersoll model as an alternative to address the limitations of Vasicek's model.

Highlight of the importance of choosing the right function f(t, x) when applying Ito calculus.

Explanation of the process of defining f(t, x) and its role in bringing a smaller Ito process within a larger one.

Importance of understanding the derivatives required for applying Ito's calculus correctly.

Illustration of the simplification process in Ito's calculus to derive the mean and variance of Rt.

Introduction of the Cox-Ingersoll-Ross (CIR) model and its modification to prevent negative interest rates.

Emphasis on the practical applications of Ito calculus beyond verifying solutions, such as computing mean and variance.

Guidance on using Ito's integral to compute the mean of Rt in the context of the CIR model.

Encouragement for students to perform their own calculations as part of the learning process.

Conclusion and emphasis on the importance of understanding the mathematical principles behind financial models.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: