Causes of Inflation

TLDRThis video script delves into the primary cause of inflation through the lens of the quantity theory of money. It explains that changes in prices can be attributed to variations in money supply (M), velocity of money (V), or real GDP (Y). The script argues that while prices can fluctuate significantly, real GDP and velocity of money remain relatively stable. Consequently, it concludes that increases in the money supply are the main driver of inflation. The theory is illustrated with data from Peru's hyperinflation period, showing a direct correlation between the growth rate of money supply and inflation. The video emphasizes three key principles: money's neutrality in the long run, inflation as a monetary phenomenon, and central banks' significant control over a nation's inflation rate.

Takeaways

- 📚 The video explains the primary cause of inflation using the quantity theory of money.

- 🔍 The equation is simplified by dividing both sides by Y, which leads to the insight that changes in prices can be caused by changes in M (money supply), V (velocity of money), or Y (real GDP).

- 💡 Prices can fluctuate significantly in a short period, unlike real GDP (Y), which tends to be stable and doesn't vary much within a year.

- 🌐 The velocity of money (V) is relatively stable, averaging around seven in the U.S. and influenced by factors similar to personal financial habits.

- 🚫 Since both Y and V are stable, the video concludes that changes in the money supply (M) are the primary driver of price changes.

- 💰 The quantity theory of money posits that an increase in the money supply leads to an increase in prices, encapsulated in the equation MV = PY.

- 📈 The video provides empirical evidence from Peru's hyperinflation, showing a direct correlation between the increase in money supply and price level.

- 📊 Growth rates of money supply and prices are directly proportional, as illustrated by the data from Peru and other countries.

- 🌍 The relationship between money supply growth and inflation rate is nearly linear across 110 countries from 1960 to 1990.

- 🏦 Central banks, which often control a nation's money supply, also have significant influence over the country's inflation rate.

- 📚 Three key principles are highlighted: money is neutral in the long run, inflation is a monetary phenomenon, and central banks have control over inflation.

Q & A

What is the primary cause of inflation according to the video?

-The primary cause of inflation, as explained in the video, is an increase in the money supply.

What theory is used to explain the relationship between money supply and inflation in the video?

-The video uses the Quantity Theory of Money to explain the relationship between money supply and inflation.

How does the video define the equation for the Quantity Theory of Money?

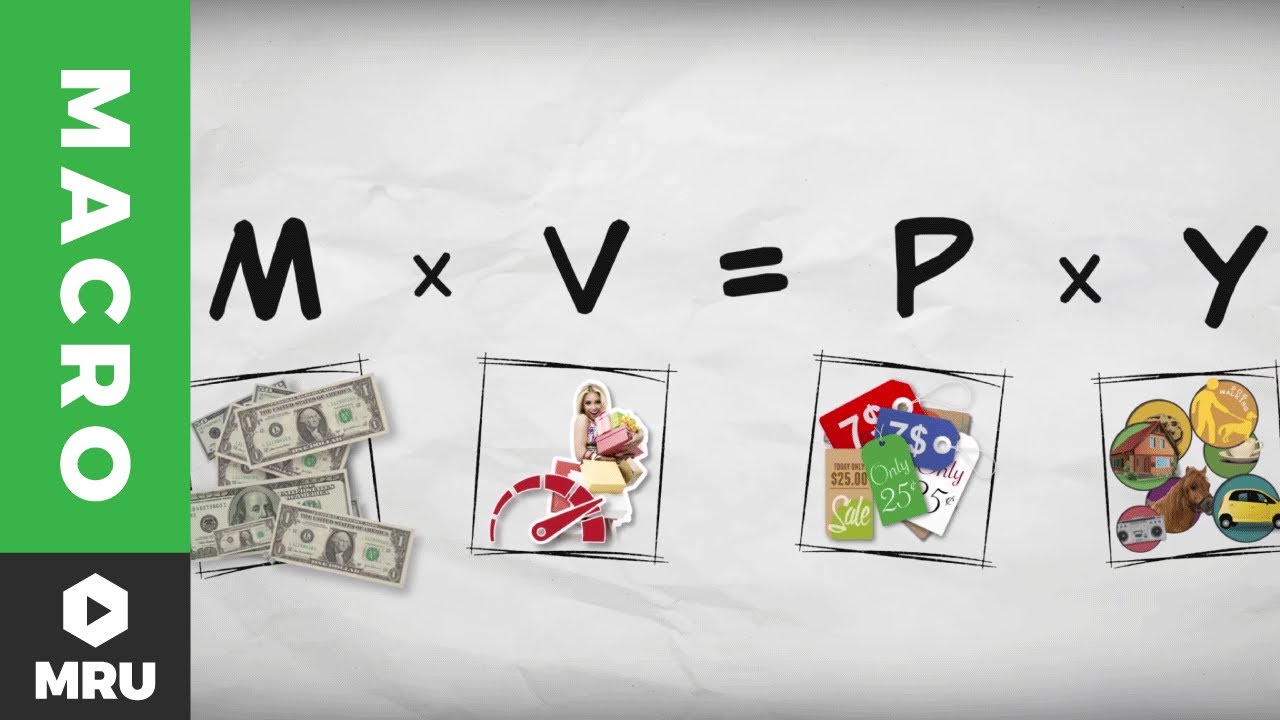

-The video defines the equation for the Quantity Theory of Money as MV = PY, where M is the money supply, V is the velocity of money, P is the price level, and Y is the real GDP.

What does the video suggest are the three possible causes for changes in prices?

-The video suggests that the three possible causes for changes in prices are changes in the money supply (M), the velocity of money (V), or real GDP (Y).

Why is the change in real GDP (Y) not considered a plausible candidate for explaining large and sustained changes in prices?

-The change in real GDP (Y) is not considered a plausible candidate because it is relatively stable and doesn't vary much within a year, making it unlikely to cause large and sustained changes in prices.

How does the video describe the velocity of money (V)?

-The velocity of money (V) is described in the video as the average number of times a dollar is used to purchase final goods and services in a year.

According to the video, what is the typical range of change for the velocity of money (V) in the short run?

-In the short run, the velocity of money (V) can change but typically doesn't vary much more than going up to eight or down to six times a year.

What does the video conclude about the relationship between the growth rate of money supply and the inflation rate?

-The video concludes that if the velocity of money (V) and real GDP (Y) are not growing too much, then the growth rate of the money supply should be equal to the inflation rate.

What historical example does the video provide to illustrate the Quantity Theory of Money?

-The video provides the example of Peru during its hyperinflation, where a massive increase in the money supply led to a corresponding massive increase in prices.

What are the three important principles about money and inflation that the video suggests we keep in mind?

-The three important principles are: 1) In the long run, money is neutral and a doubling of the money supply will lead to a doubling of prices; 2) Inflation is always and everywhere a monetary phenomenon; 3) Central banks often have significant control over a nation's money supply and, by extension, its inflation rate.

Outlines

💰 The Quantity Theory of Money and Inflation

This paragraph introduces the concept of inflation and its primary cause using the quantity theory of money. It explains how changes in prices can be attributed to changes in money supply (M), velocity of money (V), or real GDP (Y). The script argues that prices can fluctuate significantly in a short time, while V and Y remain relatively stable. Real GDP doesn't change drastically within a year, and velocity of money, determined by factors like payment frequency and check-clearing times, also doesn't vary much. The paragraph concludes that since Y and V are stable, any increase in prices (P) must be due to an increase in M. This is supported by the example of Peru's hyperinflation, where a massive increase in the money supply led to a corresponding increase in prices. The theory is further validated by plotting the price level and money supply, showing a direct correlation between the two.

📈 The Relationship Between Money Growth and Inflation

This paragraph delves into the empirical evidence supporting the quantity theory of money. It presents a graph showing the relationship between inflation rates and money growth rates across approximately 110 countries from 1960 to 1990. The data indicates a near-linear relationship, suggesting that a one percentage point increase in the money supply growth rate results in a similar increase in the inflation rate. Three key principles are highlighted: in the long run, money is neutral and a doubling of the money supply will lead to a doubling of prices; significant and sustained inflation is a monetary phenomenon; and central banks, which often control a nation's money supply, also have significant control over its inflation rate. The paragraph encourages viewers to remember these principles for future discussions on economics.

Mindmap

Keywords

💡Inflation

💡Quantity Theory of Money

💡Money Supply (M)

💡Real GDP (Y)

💡Velocity of Money (V)

💡Price Level (P)

💡Hyperinflation

💡Growth Rates

💡Inflation Rate

💡Central Banks

💡Milton Friedman

Highlights

The primary cause of inflation is explained using the quantity theory of money.

Equation is rewritten by dividing both sides by Y to show the relationship between prices, money supply, velocity, and real GDP.

Prices can change significantly in a short period, unlike real GDP and velocity, which are relatively stable.

Real GDP (Y) does not vary much within a year, making it an unlikely candidate for explaining large price changes.

Velocity of money (V) is the average number of times money is used to purchase goods and services annually.

Velocity of money is relatively stable and does not fluctuate enough to explain large price changes.

An increase in the money supply (M) is identified as the primary driver of price increases.

The quantity theory of money suggests that when more money chases the same goods and services, prices must rise.

The theory is tested using data from Peru during hyperinflation, where a massive increase in money supply corresponded with a massive increase in prices.

Growth rates of the quantity theory indicate that if velocity and real GDP are stable, the growth rate of money supply should equal the inflation rate.

Data from 110 countries between 1960 and 1990 shows a close linear relationship between money supply growth and inflation rate.

Three key principles are highlighted: long-term money neutrality, inflation as a monetary phenomenon, and central banks' control over inflation.

The video concludes with the importance of understanding these principles for future economic analysis.

Practice questions and further macroeconomics resources are suggested for viewers to deepen their understanding.

Marginal Revolution University's other popular videos are recommended for additional learning.

Transcripts

Browse More Related Video

5.0 / 5 (0 votes)

Thanks for rating: