Minimum wage and price floors | Microeconomics | Khan Academy

TLDRThis video script explores the dynamics of the unskilled labor market, illustrating the effects of a government-imposed minimum wage of $7 per hour. The natural equilibrium at $6 is disrupted, creating a price floor that leads to oversupply and unemployment. The script explains how this regulation redistributes surplus between employers and workers, resulting in job loss and a deadweight loss of $1 million per month, while benefiting those who retain employment at the higher wage.

Takeaways

- 📚 The script discusses the labor market, particularly focusing on unskilled labor, and uses basic microeconomic principles to understand real-world scenarios.

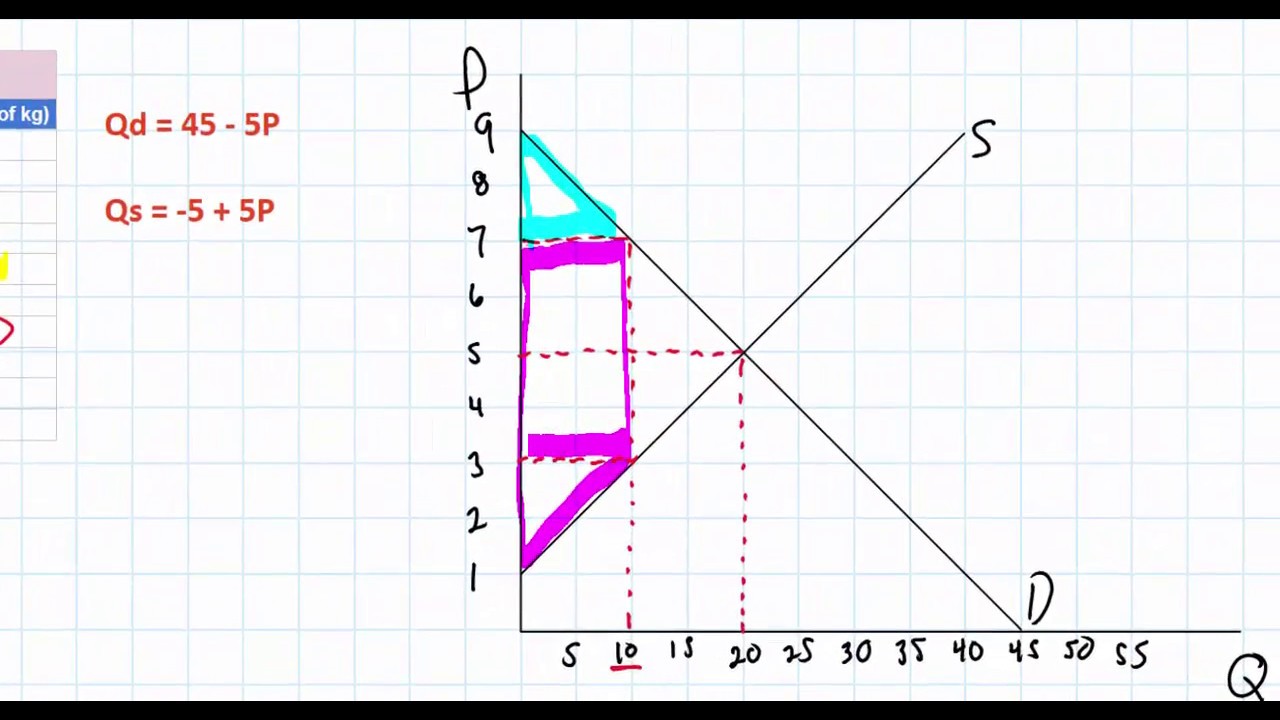

- 📈 The vertical axis in the labor market graph represents wage rates per hour, which is the price of labor, while the horizontal axis represents the quantity of labor in millions of hours per month.

- 🔄 The natural equilibrium in the unregulated labor market is established at a wage of $6 per hour and a quantity of 22 million hours per month.

- 🤔 The government's intervention in the form of a minimum wage of $7 per hour is intended to address the perceived inadequacy of the $6 wage for a good standard of living.

- 🚫 The introduction of a minimum wage creates a price floor in the labor market, which is higher than the equilibrium wage and leads to market distortion.

- 📉 Employers, now facing higher labor costs, reduce their demand for labor to 21 million hours per month, reflecting the cost sensitivity of labor demand.

- 📈 The supply of labor increases as more people are willing to work at the higher wage rate of $7 per hour, leading to an oversupply of labor.

- 👥 This oversupply results in unemployment, as there are more people seeking work (23 million) than there are jobs available (21 million), creating a surplus of 2 million workers.

- 🧩 The script acknowledges the oversimplification of the model, noting that even in an unregulated market, some unemployment exists due to market frictions.

- 💰 The minimum wage regulation leads to a redistribution of surplus between employers and workers, with workers gaining more producer surplus and employers experiencing a reduction in consumer surplus.

- 📊 The script calculates a deadweight loss of $1 million per month due to the minimum wage, representing the loss of total benefit in the market caused by the regulation.

Q & A

What is the primary purpose of simplifying concepts in microeconomics videos?

-The primary purpose is to apply basic ideas from microeconomics to real-world situations, making complex concepts easier to understand and relate to.

What does the vertical axis in the unskilled labor market graph represent?

-The vertical axis represents the wage rate per hour, which is essentially the price of labor.

How is the quantity of labor measured in the script's example?

-The quantity of labor is measured in terms of millions of hours per month.

Who are the primary demanders in the labor market according to the script?

-The primary demanders in the labor market are employers who are essentially buying labor.

What is the difference between supply in the labor market and supply in other markets mentioned in the script?

-In the labor market, the supply comes from individual workers who provide labor, unlike in other markets where supply might come from corporations.

What is the natural equilibrium wage and quantity of labor in the script's hypothetical scenario?

-In the hypothetical scenario, the natural equilibrium wage is $6 an hour, with an equilibrium quantity of labor supplied at 22 million hours per month.

Why does the government in the script's example decide to implement a minimum wage?

-The government decides to implement a minimum wage because they believe that $6 an hour is too low for people to live well on and they want to support their voters who are making that wage.

What is the effect of a minimum wage set at $7 an hour on the labor market according to the script?

-The effect is a distortion in the market, causing an oversupply of labor as more people are willing to work at the higher wage, but employers can only afford to hire 21 million hours of labor.

How does the script describe the impact of a minimum wage on the quantity of labor supplied?

-The script describes an increase in the quantity of labor supplied as more people are willing to work at the higher wage, including those who were previously not working or retired.

What is the term used in the script to describe the surplus that is lost due to the minimum wage regulation?

-The term used is 'dead weight loss,' which in this scenario amounts to $1 million per month of surplus lost to the market.

How does the minimum wage affect the surplus for workers and employers in the script's example?

-For workers who are employed, their producer surplus increases because they are earning more than their opportunity cost. However, for employers, their consumer surplus decreases due to the higher wage costs, leading to job destruction.

Outlines

📊 Unskilled Labor Market Dynamics and Minimum Wage Impact

The script introduces the concept of the unskilled labor market, where individuals without specific training or experience are considered. It explains the labor market's basic structure with wage rates on the vertical axis and labor quantity in millions of hours on the horizontal axis. The natural equilibrium is established at a wage of $6 per hour with 22 million hours of labor supplied monthly. The government's intervention by imposing a minimum wage of $7 per hour creates a price floor above the market's clearing price, leading to an oversupply of labor. This results in 2 million people wanting to work but with only 21 million jobs available, thus increasing unemployment. The script acknowledges the oversimplification of the model and the existence of frictional unemployment even in an unregulated market.

📉 Consequences of Minimum Wage Legislation on Labor Market Surplus

This paragraph delves into the effects of the minimum wage legislation on the labor market's surplus. It discusses how the increase in wage leads to a higher quantity of labor supplied but a reduced demand from employers, resulting in a loss of 1 million jobs. The surplus before the minimum wage was the area between the demand and supply curves, divided into consumer and producer surpluses. After the minimum wage implementation, the surplus is reduced, leading to a $1 million per month deadweight loss. However, the workers who retain their jobs experience an increase in producer surplus, while employers face a decrease in consumer surplus. The paragraph concludes by highlighting the redistribution of surplus between workers and employers and the potential job destruction caused by the higher wage floor.

Mindmap

Keywords

💡Labor Market

💡Wage Rate

💡Quantity of Labor

💡Demand

💡Supply

💡Equilibrium

💡Minimum Wage

💡Price Floor

💡Oversupply

💡Unemployment

💡Surplus

💡Dead Weight Loss

Highlights

The labor market is simplified for the application of microeconomics concepts to real-world scenarios.

Unskilled labor market is characterized by individuals without specific training or experience for a job.

Wage rate per hour is the price of labor, with a natural equilibrium at $6 per hour in the unskilled market.

Employers represent the demand side, while individual workers represent the supply side in the labor market.

Government intervention can lead to a minimum wage regulation, setting a price floor in the labor market.

A minimum wage of $7 per hour is introduced as a price floor, distorting the natural equilibrium of the labor market.

Employers reduce labor demand to 21 million hours per month at the new minimum wage rate.

Workers increase labor supply as higher wages incentivize more individuals to seek employment.

An oversupply of labor occurs as 2 million more people seek jobs than the available demand.

Unemployment rises due to the excess of labor supply over demand post-minimum wage implementation.

The oversimplified model suggests a classical definition of unemployment resulting from wage regulation.

A minimum wage creates a redistribution of surplus between employers and workers.

Employers experience a decrease in surplus due to the higher wage costs.

Workers who secure jobs under the new wage enjoy an increased producer surplus.

A $1 million per month deadweight loss occurs due to the minimum wage regulation.

Job destruction is implied as higher wages lead to a reduced overall demand for labor.

The model's assumptions lead to the conclusion of fewer jobs and increased unemployment due to minimum wage laws.

The labor market model demonstrates the impact of government intervention on employment and wages.

Transcripts

Browse More Related Video

How to calculate changes in consumer and producer surplus with price and floor ceilings.

Labor Markets and Minimum Wage: Crash Course Economics #28

Price floors and surplus

Rent Control and Deadweight Loss

Animation on How to Price Floors and Price Ceilings

Calculating the area of Deadweight Loss (welfare loss) in a Linear Demand and Supply model

5.0 / 5 (0 votes)

Thanks for rating: