Inflation and Deflation

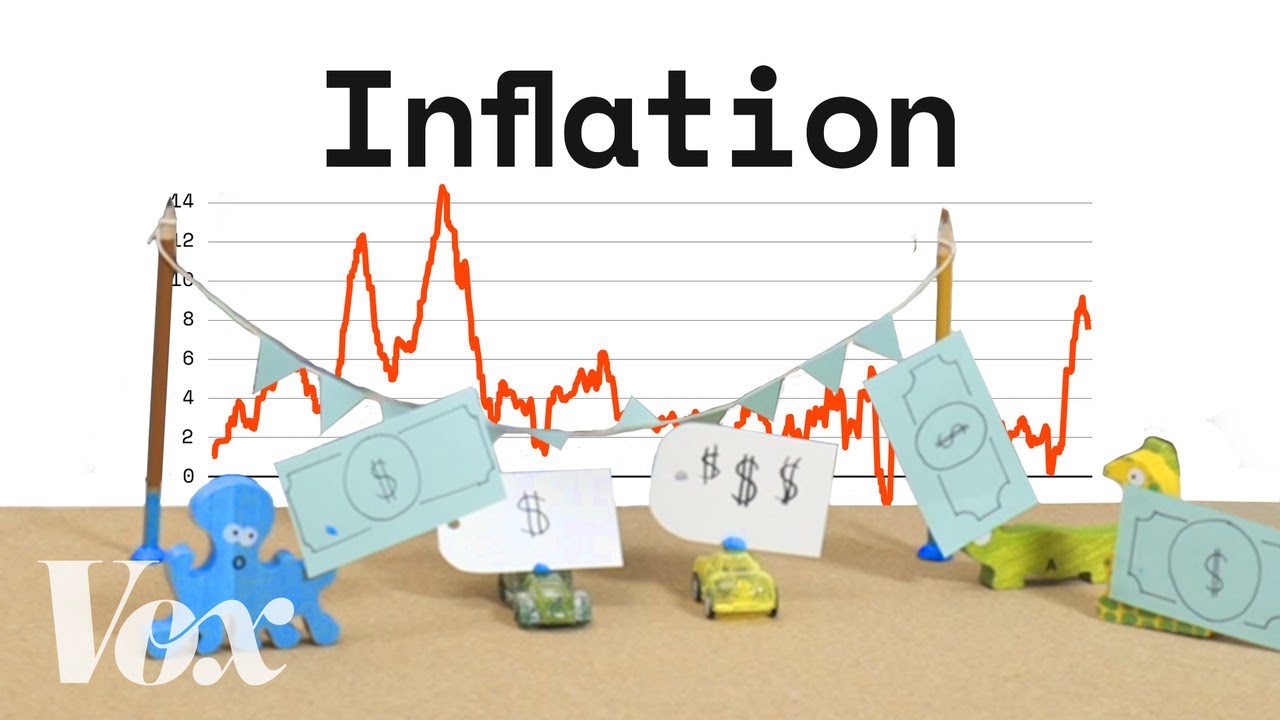

TLDRThis script explores the concept of inflation, explaining how it leads to a general rise in prices and a decrease in purchasing power over time. It uses the example of Jane and Bob's house to illustrate the impact of inflation, which increased the value of their home from $15,000 to $150,000. The script delves into causes of inflation, such as an excess of currency, increased aggregate demand, and rising production costs. It also contrasts inflation with deflation, noting the economic challenges each presents. The Consumer Price Index (CPI) is highlighted as a tool to measure inflation, with an ideal rate of 2-3% promoting economic growth. The video aims to educate viewers on the inevitability of inflation and its importance for a healthy economy.

Takeaways

- 💰 Inflation is a general increase in prices and a decrease in the purchasing value of money over time.

- 🏠 The example of Jane and Bob's house illustrates how inflation can significantly increase the value of assets like real estate.

- 📈 Hyperinflation is a dramatic and rapid form of inflation that can lead to an economic crisis and is considered unsustainable.

- 🛒 Purchasing power is the amount of goods or services one can buy with a unit of currency, and it decreases as prices rise due to inflation.

- 📊 Price indexes, such as the Consumer Price Index (CPI), measure the average price changes of a standard group of goods and services over time.

- 📈 The CPI in the U.S. is updated every 10 years to reflect changes in consumer spending habits and includes eight major categories of goods and services.

- 📉 Moderate inflation, around 2-3%, is considered healthy as it encourages investment and economic growth.

- 💡 Causes of inflation include the quantity theory (too much currency), increased aggregate demand, and higher production costs for producers.

- 📉 The Zimbabwean hyperinflation example shows the extreme consequences of unchecked money printing and inflation.

- 👴 Inflation is particularly concerning for those on fixed incomes, such as retirees relying on government assistance, as their income does not increase with rising prices.

- 📉 Deflation, the opposite of inflation, is generally viewed negatively by economists because it can lead to reduced production, layoffs, and economic stagnation.

Q & A

What is inflation and why does it cause prices to rise over time?

-Inflation is a general increase in prices and a fall in the purchasing value of money. It causes prices to rise over time because it reflects an overall increase in the cost of goods and services in an economy.

Can you provide an example from the script that illustrates the impact of inflation on property values?

-Jane and Bob bought their house in 1970 for $15,000, and by the time they wanted to retire and downsize, their home was worth $150,000. This significant increase in value was partly due to inflation.

What is the difference between normal inflation and hyperinflation?

-Normal inflation is a gradual and controlled increase in prices, which is often considered healthy for an economy. Hyperinflation, on the other hand, is when inflation becomes rapid and dramatic, leading to an unsustainable economic situation and a severe drop in the value of money.

How does inflation affect the purchasing power of money?

-Inflation leads to a drop in purchasing power because as prices increase, the amount of goods or services one can buy with a unit of currency decreases.

What is the Consumer Price Index (CPI) and how is it used to measure inflation?

-The Consumer Price Index (CPI) is a measure that shows how the average price of a standard group of goods and services changes over time. It is used to calculate the inflation rate, which is the percentage rate of change in price level, typically from one year to the next.

How often are the categories of goods and services in the CPI updated, and why?

-The categories of goods and services in the CPI are updated every 10 years to adjust for changes in consumer spending habits and to ensure the index accurately reflects the current market basket of goods.

Why is a certain level of inflation considered beneficial for an economy?

-A moderate inflation rate, such as around 2-3%, is considered beneficial because it encourages investment and economic growth. People are more likely to invest if they expect prices to rise, as it can potentially lead to higher returns on their investments.

What are the three main causes of inflation as discussed in the script?

-The three main causes of inflation are: 1) The quantity theory of inflation, which suggests that an excess of currency can lead to higher prices and reduced purchasing power. 2) An increase in aggregate demand, which can occur due to higher income levels and increased consumer spending. 3) Higher production costs for producers, which may lead them to raise prices to maintain profits.

How does inflation impact those who are on a fixed income?

-Inflation is particularly concerning for those on a fixed income because their income does not increase even when prices go up consistently. This can erode their purchasing power and make it more difficult to maintain their standard of living.

What is deflation, and why is it generally viewed negatively by economists?

-Deflation is a reduction in the overall level of prices in an economy. It is generally viewed negatively because it can lead to producers slowing down production in response to falling prices, which may result in layoffs, salary reductions, and a halt in economic growth.

Why is some level of inflation considered inevitable and potentially beneficial for the economy?

-Some level of inflation is considered inevitable due to the natural progression of an economy and the constant changes in supply and demand. It is potentially beneficial because it can stimulate investment and economic growth, provided that it is controlled and not excessive.

Outlines

📈 Understanding Inflation and Its Impact

The first paragraph introduces the concept of inflation, which is the general rise in prices and decrease in purchasing power over time. It uses the example of Jane and Bob's house, which appreciated significantly in value due to inflation, not just supply and demand. The paragraph explains that inflation affects almost all commonly purchased items and can lead to economic crises if it becomes rapid and dramatic, as seen in hyperinflation scenarios. The purchasing power of money diminishes as prices rise, making it difficult to find items like a house at the same price as decades ago. Economists use price indexes, such as the Consumer Price Index (CPI) in the United States, to measure the average price changes over time for a standard group of goods and services. The CPI includes eight categories of goods and services, which are updated every 10 years to reflect changes in consumer spending habits. The paragraph concludes by discussing the ideal inflation rate for promoting investment and economic growth, which is around 2-3%, and the three main causes of inflation: the quantity theory (too much currency), increased aggregate demand (higher income leading to more spending), and increased production costs (like higher wages for workers).

💰 Inflation's Effects on Fixed Incomes and Deflation

The second paragraph delves into the specific challenges that inflation poses for individuals on fixed incomes, such as those receiving government assistance like Social Security payments. It highlights that governments may not adjust these payments quickly enough to keep pace with inflation, which can erode the purchasing power of these fixed incomes. The paragraph also contrasts inflation with deflation, which is a decrease in the overall price level in an economy. Deflation is generally viewed negatively by economists because it can lead to reduced production, layoffs, and salary cuts, ultimately stalling economic growth. The paragraph emphasizes the inevitability of inflation and the necessity of adapting to it for the health of the economy in the long term. It concludes by suggesting that while inflation and deflation are important concepts, there are other economic concepts worth exploring.

Mindmap

Keywords

💡Inflation

💡Hyperinflation

💡Purchasing Power

💡Price Indexes

💡Consumer Price Index (CPI)

💡Inflation Rate

💡Quantity Theory of Inflation

💡Aggregate Demand

💡Producer Costs

💡Fixed Income

💡Deflation

Highlights

Inflation causes prices of goods like milk, candy, and hot dogs to increase over time.

Example of Jane and Bob's house appreciating in value from $15,000 to $150,000 due to inflation.

Inflation is a general increase in prices and a fall in the purchasing value of money.

Hyperinflation is an unsustainable and dramatic form of inflation leading to economic crisis.

Inflation results in a drop in purchasing power as prices rise.

Economists use price indexes like the Consumer Price Index (CPI) to measure inflation.

CPI measures a standard group of goods and services representing an average consumer's market basket.

CPI categories are updated every 10 years to reflect changes in spending habits.

A moderate inflation rate of 2-3% is considered healthy for promoting investment and economic growth.

Inflation is caused by an excess of currency, leading to higher prices and reduced purchasing power.

Zimbabwe experienced extreme hyperinflation with an 89.7 sextillion percent rate between 2007 and 2008.

Increased aggregate demand due to higher income can cause inflation as more people buy goods.

Producers may raise prices to cover increased costs, such as higher wages, contributing to inflation.

Inflation is concerning for those on fixed incomes, like Social Security recipients, as their income does not increase with prices.

Deflation, the opposite of inflation, is generally viewed negatively as it can lead to economic stagnation.

Inflation is inevitable and some level is necessary for a healthy economy in the long run.

Transcripts

5.0 / 5 (0 votes)

Thanks for rating: