How The Economic Machine Works by Ray Dalio

TLDRThe economy functions like a simple machine, driven by human nature and comprised of transactions, three key forces, and cycles of growth and recession. Though complex, the economy can be understood by examining productivity, debt cycles, and the interplay between inflationary and deflationary pressures. Following three basic rules can lead to stability: don't let debt outpace income, don't let income outpace productivity, and maximize productivity growth above all, as this is crucial for long-term prosperity.

Takeaways

- 😀 The economy works like a simple machine driven by productivity growth, short term debt cycles, and long term debt cycles.

- 😊 Transactions between buyers and sellers are the basic building blocks of the economy.

- 🧐 Credit is extremely important because it allows spending to increase faster than income and productivity.

- 😯Short term debt cycles cause alternating periods of economic expansion and recession every 5-8 years.

- 😲Long term debt cycles with excessive debt accumulation end with painful deleveragings lasting about 10-15 years.

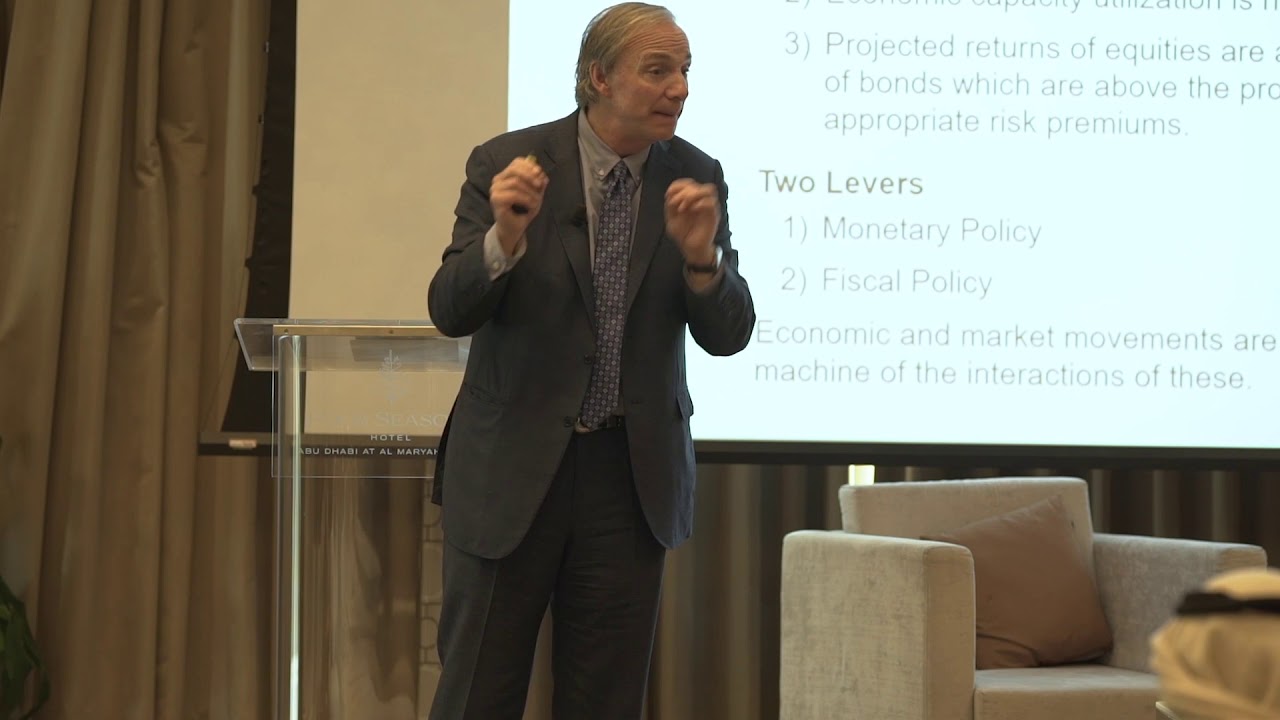

- 🤔Central banks use monetary policy like interest rates to manage the short term debt cycle.

- 🤨Central governments use fiscal policy like taxation and spending to redistribute wealth and income.

- 😀Productivity matters most in the long run, while credit matters most in the short run.

- ☹️Don't let income rise faster than productivity or debt rise faster than income.

- 🙂Do all you can to increase productivity because it drives long term economic growth.

Q & A

What are the three main forces that drive the economy?

-The three main forces that drive the economy are: 1) Productivity growth, 2) The Short term debt cycle, and 3) The Long term debt cycle.

Why is credit the most important part of the economy?

-Credit is the most important part of the economy because it is the biggest and most volatile part. Credit allows people to spend more than they produce, driving economic expansions, but also leads to economic contractions when debt burdens get too high.

How do short term debt cycles work?

-In the short term debt cycle, increased availability of credit leads to economic expansion and inflation. Central banks raise rates to reduce inflation, making borrowing more expensive. This causes spending and incomes to drop, leading to recession. Central banks then lower rates to stimulate borrowing and restart the cycle.

What happens during a deleveraging?

-In a deleveraging, debt burdens have become too large relative to incomes. People cut spending to pay debts, but incomes fall faster. Defaults rise, lending dries up, asset prices drop, and the economy contracts. Deleveragings reverse long term debt cycles.

What are the four ways debt burdens can come down?

-The four ways debt burdens can come down are: 1) Cutting spending, 2) Debt defaults and restructurings, 3) Wealth redistribution from rich to poor, and 4) Printing money (inflationary).

How can central banks and governments stimulate a depressed economy?

-Central banks can print money to buy financial assets and government bonds, while governments can run deficits to fund increased spending on goods, services and benefits. This increases incomes and creditworthiness.

What is a 'beautiful deleveraging'?

-A beautiful deleveraging is when debts decline relative to income, economic growth is positive, and inflation is low, due to the right balance of cutting spending, reducing debts, transferring wealth and printing money.

Why can printing money be risky?

-Printing money can easily be abused because it is easy to do and people prefer it over cutting spending or reducing debts. However, printing too much money leads to unacceptably high inflation.

How can income growth help reduce debt burdens?

-If income grows faster than the interest rate on debt, the debt burden (debt-to-income ratio) will decline over time. Printing money may raise income growth enough to achieve this.

What are the key lessons for policymakers and individuals?

-The key lessons are: 1) Don't let debt grow faster than income, 2) Don't let income grow faster than productivity, and 3) Focus on raising productivity over the long run.

Outlines

😀 How the Economy Works

This introductory paragraph explains that the economy works like a simple machine made up of transactions, but many people don't understand how it works, leading to economic suffering. The narrator feels a responsibility to share a practical economic template that has helped anticipate financial crises.

😊 Transactions Drive the Economy

This paragraph explains that the economy is made up of transactions between buyers and sellers exchanging money, credit, goods, services and assets. The total spending amount drives the economy. Prices are determined by dividing amount spent by quantity sold.

😲 Credit Allows Faster Growth

This paragraph explains that credit allows spending to increase faster than income and productivity in the short run, creating economic cycles, because borrowing pulls future spending forward. But income and productivity determine long run growth.

📈 The Short Term Debt Cycle

This paragraph explains the short term debt cycle of expansion and recession over 5-8 years caused by fluctuating availability of credit. Central banks influence this cycle by adjusting interest rates.

📉 The Long Term Debt Cycle

This paragraph explains the long term debt cycle of debt accumulation over decades leading to a deleveraging. This happens when debts grow faster than incomes for too long, eventually reducing creditworthiness.

😣 The Painful Deleveraging Process

This paragraph details the deflationary, depressing deleveraging process of cutting spending, defaulting on debts, redistributing wealth and printing money to bring down excessive debt burdens.

😌 Achieving a Beautiful Deleveraging

This concluding paragraph suggests balancing the deleveraging methods to maintain stability and positive growth while reducing debt can produce an optimal, beautiful deleveraging over a decade.

Mindmap

Keywords

💡Productivity Growth

💡Credit

💡Short Term Debt Cycle

💡Long Term Debt Cycle

💡Central Bank

💡Inflation

💡Deflation

💡Budget Deficits

💡Printing Money

💡Beautiful Deleveraging

Highlights

The study found a significant increase in life satisfaction for participants after 6 months of meditation practice.

MRI scans showed changes in brain structure and activity in regions related to awareness, empathy, and stress.

Participants reported feeling more connected, less anxious, and better able to regulate emotions after learning meditation.

Meditation was linked to improved cardiovascular health, including lower blood pressure and heart rate.

The research indicates meditation can be beneficial for mental health, physical health, and personal growth.

Meditation may reduce age-related memory loss and decrease the risk of Alzheimer's disease.

Mindfulness meditation increased empathy, compassion, and altruistic behavior in study participants.

Experienced meditators were better able to regulate emotional reactions and recover from negative stimuli.

Meditation groups had fewer doctor visits and lower health care utilization rates than non-meditators.

The research provides biological and psychological evidence for the benefits of meditation.

Study limitations include potential sample bias and the challenge of isolating meditation as the sole causal factor.

More randomized controlled trials with diverse, non-self-selecting participants are needed.

Wider implementation of meditation-based interventions could improve population health and well-being.

The findings support the value of meditation and mindfulness practices for health and personal development.

Further research on optimal meditation techniques, duration, and implementation is warranted.

Transcripts

Browse More Related Video

5.0 / 5 (0 votes)

Thanks for rating: