WEEK 2 | MARCH 2024 | UK CASH STUFFING | LOW INCOME | BISCUIT UPDATE 😂

TLDRIn this video, the host provides a detailed account of their weekly budget review and updates on various financial challenges they're participating in. They discuss expenses, including groceries, household items, and petrol, as well as their Etsy purchase and the results of a biscuit purchase. The host also shares their experience with the 'Post Code Challenge', their progress on saving for their son's birthday, and their efforts to manage debt and build savings for future expenses like Christmas.

Takeaways

- 📅 The video is a weekly financial update for the second week of March, discussing budgeting and spending.

- 💰 The creator has a specific budget for groceries, spending, and other categories, with some funds allocated for special purchases.

- 🛍️ An Etsy purchase was made, and the creator is awaiting its arrival to share more details.

- 🐱 Expenses for cats are mentioned, but no spending was reported in this category for the week.

- 🏠 The creator discusses a dilemma about splitting the household budget into separate envelopes for toiletries but decides against it for now.

- 💸 The creator has a 'cocktail' envelope for miscellaneous spending and shares an update on its status.

- 🍪 A box of biscuits was purchased from a hotel, but the creator was disappointed with the texture, despite enjoying the flavor.

- 👖 The creator confesses to spending some cashback on jeans and toiletries, but emphasizes not adding to debt.

- 📈 The 'post code challenge' is ongoing, with the creator collecting post codes from viewers and saving money accordingly.

- 🎁 The creator has spent a significant amount on Easter gifts and is preparing for upcoming holidays like Mother's Day and a birthday.

- 🎄 The creator is actively saving for Christmas and other future expenses, aiming to stay out of debt.

Q & A

What is the main topic of the video?

-The main topic of the video is the host's personal finance update, including expenses, budgeting, and savings challenges.

How much was spent on groceries during the week documented in the video?

-31 pounds were spent on groceries during the week.

What is the purpose of the 'cocktail envelope' mentioned in the video?

-The 'cocktail envelope' is part of the host's budgeting system, where money is set aside for social activities such as buying cocktails.

What was the host's experience with the biscuits purchased from the hotel?

-The host found the biscuits to be tasty but had an unusual consistency, comparing it to hard stale bread, and decided they were not to their liking.

How much cashback did the host receive from Topcashback?

-The host received 54 pounds in cashback from Topcashback.

What did the host do with the 54 pounds received from Topcashback?

-The host used the 54 pounds to buy jeans and toiletries, and was left with 20 pounds, which they stuffed into their purse.

What is the 'postcode challenge' mentioned in the video?

-The 'postcode challenge' is a savings goal where the host collects money from viewers based on their postcodes, with the aim of reaching 50 pounds.

How much money did the host allocate for their son's birthday from the cash on hand?

-The host allocated 10 pounds for their son's birthday from the cash on hand.

What is the 'planner challenge' mentioned in the video?

-The 'planner challenge' is a savings goal where the host sets aside money each week towards purchasing a planner, with specific themes and amounts for each week.

What is the total amount of money the host has saved for Christmas so far?

-The host has saved 100 pounds for Christmas so far.

What is the host's overall financial goal?

-The host's overall financial goal is to get out of debt, stay out of debt, and build up savings to prevent returning to debt.

Outlines

💰 Budget Review and Expenses Tracking

The paragraph discusses the speaker's financial tracking for the second week of March. They review their spending across various categories such as groceries, spending, household, and petrol. The speaker mentions an Etsy purchase, a dilemma about splitting household and toiletries expenses, and their petrol expenditure. They also provide an update on a box of biscuits they bought, which turned out to be disappointing due to texture, despite the pleasant taste.

🎁 Easter and Gift Budgeting

This section focuses on the speaker's budgeting for Easter and gifts. They discuss taking money from their Easter budget to buy eggs and the amount spent on gifts, including for a one-year-old and a 95-year-old. The speaker also talks about their strategy for managing the gift budget and their excitement about an upcoming visit to see their daughter.

💼 Financial Goals and Challenges

The speaker shares their progress on various financial goals and challenges, such as the pound coin challenge, the post code challenge, and the planner challenge. They update the progress on these challenges, adding money to their son's birthday fund and the year of savings. The speaker emphasizes the importance of staying out of debt and building up savings to prevent future financial setbacks.

🎈 Upcoming Financial Plans and Savings

In this part, the speaker outlines their financial plans for the upcoming week, including allocating money for groceries and spending. They also mention participating in the neon challenge for groceries and the rock-paper-scissors challenge for spending money. The speaker expresses satisfaction with their savings progress and plans for the rest of the month.

👋 Signing Off and Well Wishes

The speaker concludes the video by wishing the viewers a lovely week and day. They encourage viewers to like, comment, and subscribe to their channel if they enjoyed the content. The speaker also expresses hope for everyone's well-being.

Mindmap

Keywords

💡Budgeting

💡Etsy Purchase

💡Envelope System

💡Postcode Challenge

💡Spending Habits

💡Financial Goals

💡Debt Management

💡Year of Savings

💡Planner Challenge

💡Financial Tracking

💡Gift Purchasing

Highlights

The video is an update on the second week of March budgeting and expenses.

The total amount spent on groceries for the week is £31, with no additional spending.

An Etsy purchase was made, the item is yet to arrive and will be accounted for in the miscellaneous category.

The spending category has a balance of £15, with an actual spending of £5.

The cats category had a budget of £10, with no spending reported.

Household expenses had a budget of £15, with £20 spent, mainly on toiletries.

The dilemma of splitting the household budget into toiletries and household is discussed, with a decision to keep them combined for now.

Petrol expenses for half a tank cost £53.91.

A box of biscuits from Hotel Chocolat was purchased for £10, but the consistency was not to the liking.

The total amount spent for the week is £69, with £5391 remaining.

A cashback of £54 from Top Cashback was received after waiting nearly four months.

The post code challenge is ongoing, with £49 collected so far.

Easter and gifts budget adjustments are made, with £10 left for Easter and £650 for gifts after recent purchases.

The son's birthday fund now has £110, after adding £10 from the leftover cash.

Christmas savings have been started, with £1 added weekly.

A year of savings challenge is being participated in, with £5 saved for March.

The video concludes with a reminder to like, comment, and subscribe for updates on budgeting and saving challenges.

Transcripts

Browse More Related Video

How to invest as a beginner (and everything to do BEFORE that!)

Learning to Crochet (Woobles kits)

How Do I Tackle My $13,000 Credit Card Debt?

I Have A $27,000 Credit Card Debt Mess!

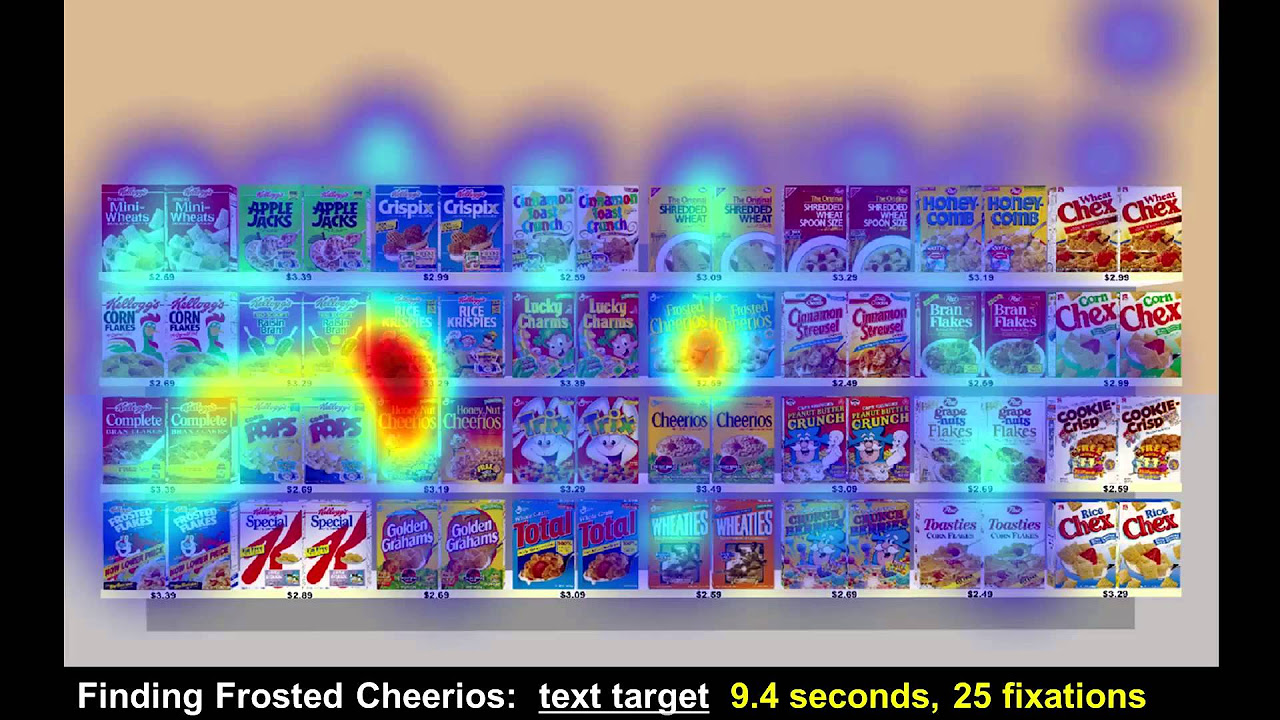

How stores track your shopping behavior | Ray Burke | TEDxIndianapolis

Americans are feeling the financial sting as credit card debt reaches record highs

5.0 / 5 (0 votes)

Thanks for rating: